- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

Does Verra Mobility’s Valuation Reflect Its New Tolling Partnerships and Recent Price Swings?

Reviewed by Bailey Pemberton

If you are eyeing Verra Mobility’s stock right now, you are not alone. Investors are weighing what to do as the company hovers near $24 a share, with recent weeks bringing some modest dips but plenty of underlying intrigue. In the past month, the stock slipped by 2.2%, a move that might make you wonder if negative sentiment is building. But zoom out, and a longer-term view tells a very different story. Verra Mobility’s shares have soared by a whopping 149.2% over the past five years, and they are still up 38.8% over three. Clearly, something is powering this resilient trend.

Lately, news around Verra Mobility has centered on strategic partnerships and expansion into new tolling markets. For instance, its recent collaborations with city governments and transportation agencies have kept the spotlight on the company’s smart mobility solutions, reminding the market that Verra Mobility is more than just a toll operator. While these headlines have not always resulted in immediate price pops, they do help shift how investors perceive the company’s risk and future growth.

So, is the current valuation attractive, given the recent moves and growing ambitions? According to a widely used valuation score, Verra Mobility passes 2 out of 6 checks for being undervalued. This is a sign that it is not exactly a bargain basement play, but there may still be opportunities hiding beneath the surface. Next, let’s break down these valuation approaches one by one and reveal, at the end of this article, a smarter, more complete way to judge whether Verra Mobility deserves a spot in your portfolio.

Verra Mobility scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Verra Mobility Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future free cash flows and discounting them back to present-day dollars. This approach is popular for growth companies because it reveals what the business could be worth if current trends continue.

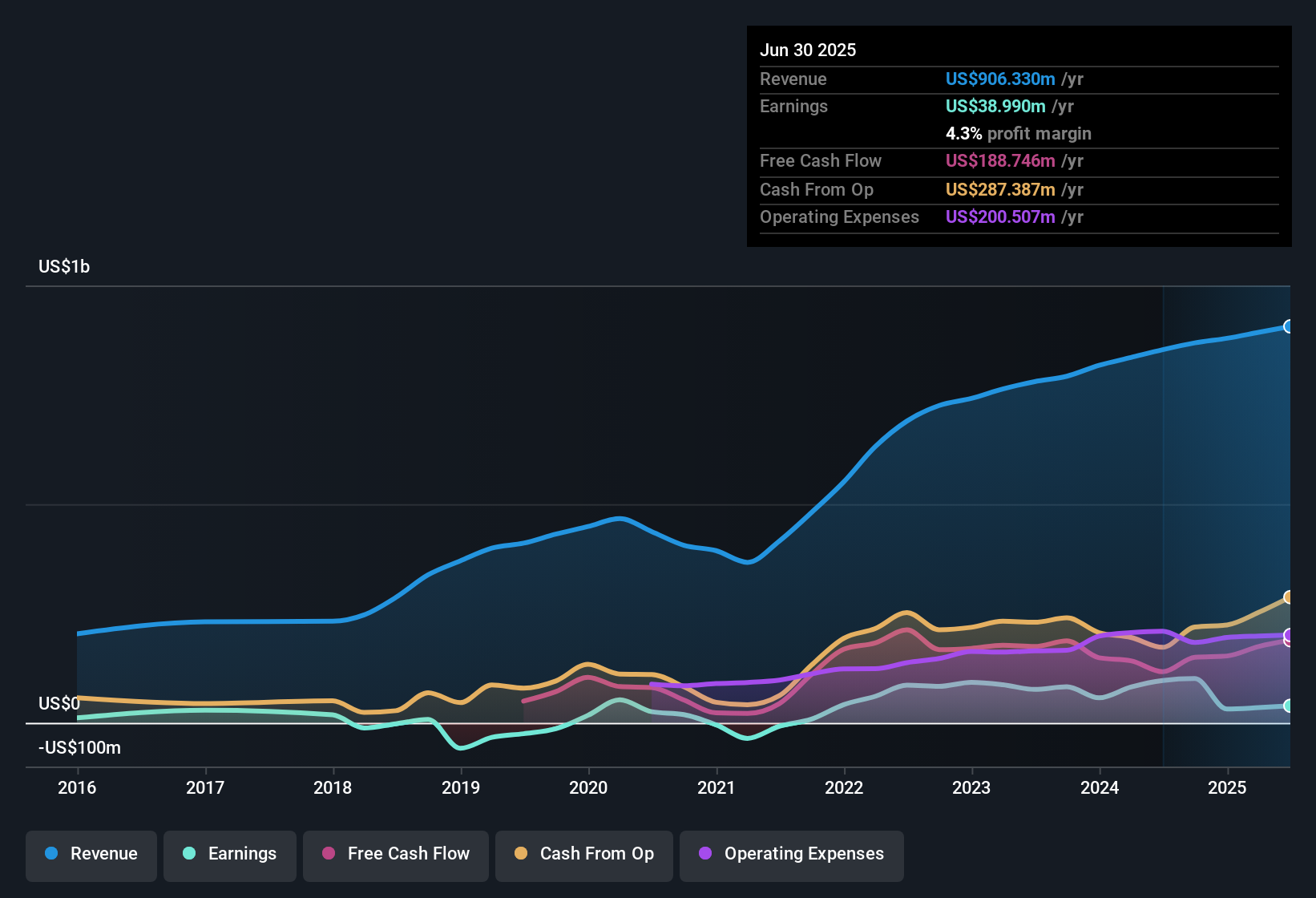

For Verra Mobility, the most recent twelve-month free cash flow sits at $212.6 million. While analysts offer formal estimates for up to five years, long-term cash flows are extended using conservative growth assumptions. For example, Simply Wall St projections suggest annual free cash flow could reach $251.99 million by 2035, based on incremental increases of roughly 0.8% to 3% per year.

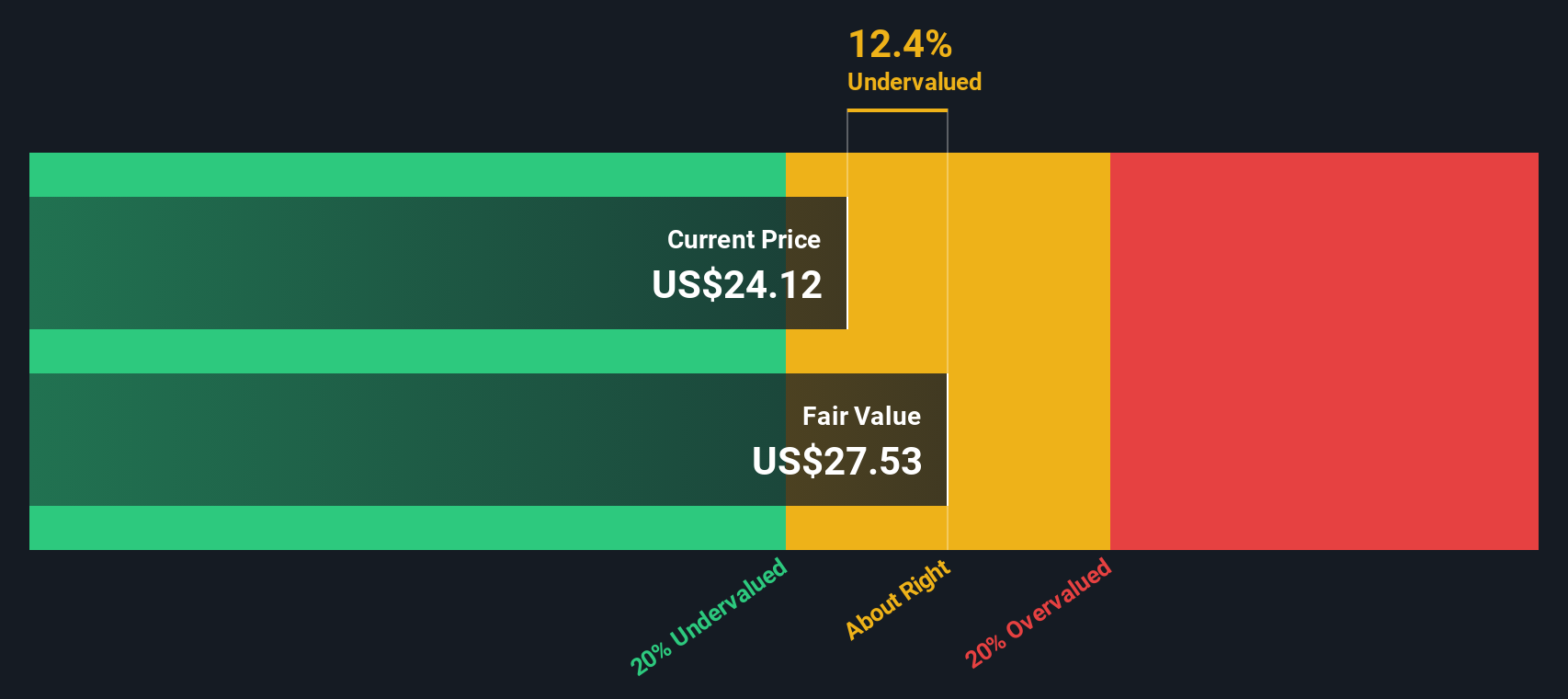

By discounting these future cash flows, the DCF model calculates an intrinsic fair value of $27.53 per share. This is about 13% above today’s share price and may indicate the stock is undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verra Mobility is undervalued by 13.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Verra Mobility Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it directly relates a company’s market value to its current annual earnings. It is especially useful for established businesses like Verra Mobility, as it quickly shows how much investors are willing to pay for each dollar of profit.

Interpreting PE ratios, however, is not always straightforward. A high PE ratio can sometimes be justified by strong growth expectations or lower risk. Conversely, a low PE may signal concerns over future earnings. What is considered “normal” depends on both industry trends and specific company outlooks.

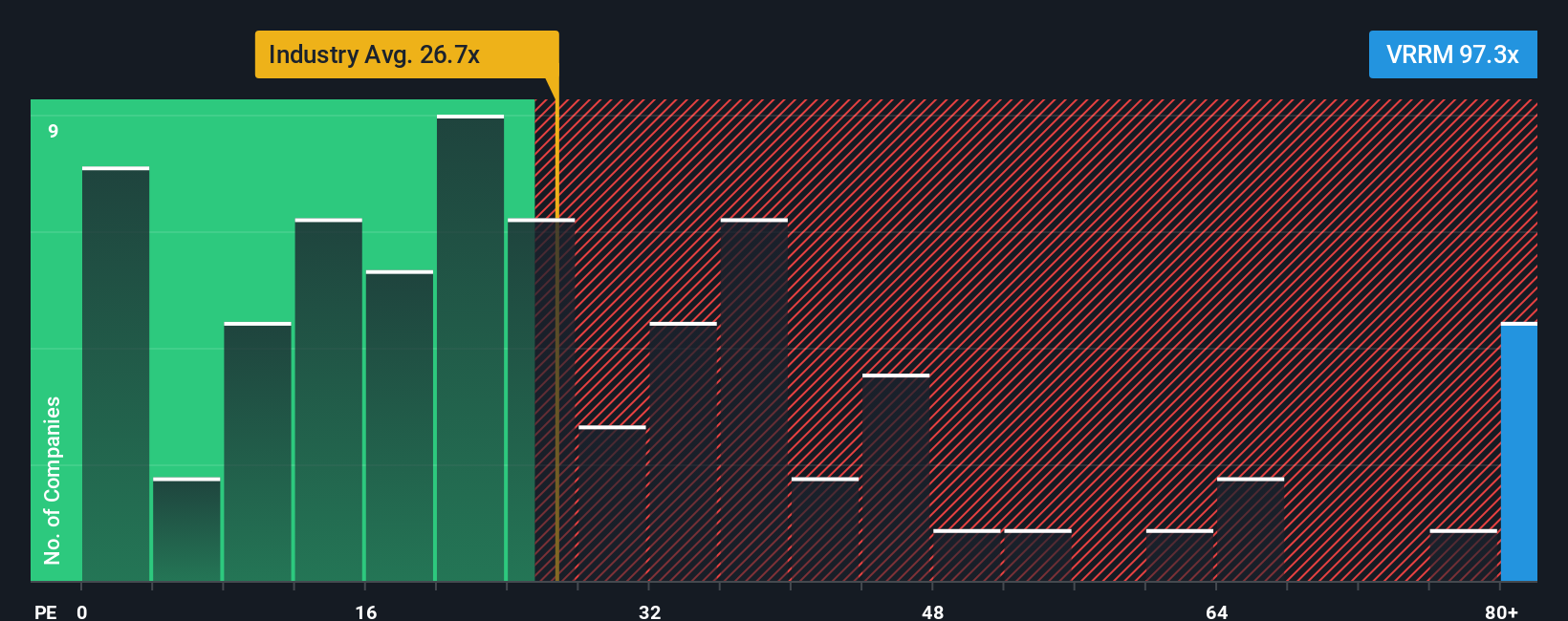

Currently, Verra Mobility trades at a steep 98x PE ratio. For context, the average PE ratio for the Professional Services industry is 26.5x, and its closest peers average around 16.6x. This suggests the market is pricing in exceptional growth or other factors setting Verra Mobility apart.

To offer a more nuanced view, Simply Wall St calculates a proprietary “Fair Ratio,” which estimates what an appropriate PE should be based on factors like earnings growth, sector outlook, profitability, size, and unique risks. This approach goes deeper than the usual industry or peer comparisons by reflecting the company’s specific fundamentals and future prospects.

Verra Mobility’s Fair Ratio stands at 41.5x. Since its actual PE of 98x is well above this level, the stock appears substantially overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verra Mobility Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, approachable way to put your story or outlook behind the numbers, linking your assumptions about Verra Mobility’s future revenue growth, earnings, margins, and what you believe is fair value to the company’s real-world developments.

With Narratives, you connect the company’s story, such as legislation, contracts, or expansions, to a full financial forecast and a price target. This makes it easy to justify your buy or sell decisions. These Narratives are available on Simply Wall St’s Community page, a platform trusted by millions of investors. They are dynamic and update automatically as new news or earnings come to light.

By comparing your Narrative’s fair value to the current share price, you can quickly see whether you think Verra Mobility is a buy, hold, or sell based on your personal interpretation of what will drive the company forward. For example, one Narrative sees international expansion and U.S. legislation powering double-digit growth and a fair value of $32, while a more cautious Narrative highlights contract risks and assigns a fair value of $23, showing that your perspective truly determines your investing strategy.

Do you think there's more to the story for Verra Mobility? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives