- United States

- /

- Professional Services

- /

- NasdaqCM:VCIG

VCI Global (NASDAQ:VCIG) Shareholders Should Be Cautious Despite Solid Earnings

VCI Global Limited's (NASDAQ:VCIG) solid earnings report last week was underwhelming to investors. We think that they may be worried about something else, so we did some analysis and found that investors have noticed some soft numbers underlying the profit.

See our latest analysis for VCI Global

Zooming In On VCI Global's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

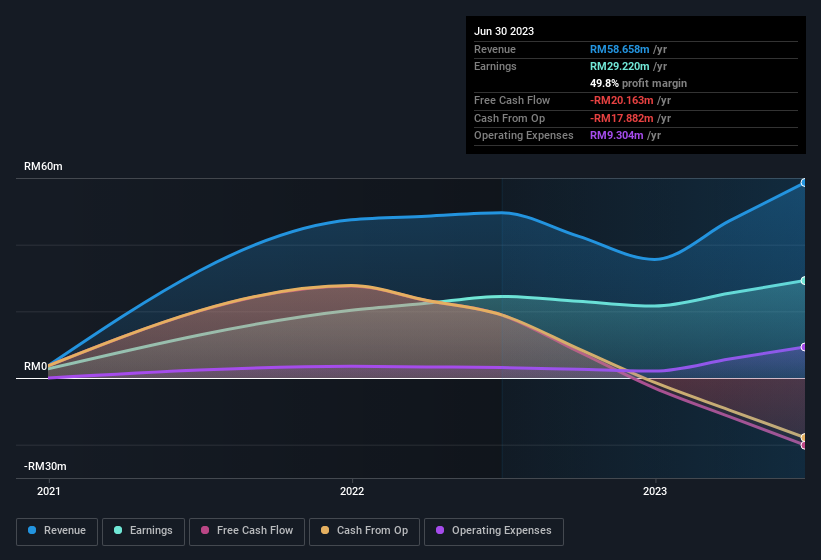

Over the twelve months to June 2023, VCI Global recorded an accrual ratio of 1.16. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of RM29.2m, a look at free cash flow indicates it actually burnt through RM20m in the last year. It's worth noting that VCI Global generated positive FCF of RM19m a year ago, so at least they've done it in the past. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio. This would certainly have contributed to the weak cash conversion.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of VCI Global.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that VCI Global profited from a tax benefit which contributed RM6.2m to profit. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On VCI Global's Profit Performance

This year, VCI Global couldn't match its profit with cashflow. If the tax benefit is not repeated, then profit would drop next year, all else being equal. For the reasons mentioned above, we think that a perfunctory glance at VCI Global's statutory profits might make it look better than it really is on an underlying level. If you want to do dive deeper into VCI Global, you'd also look into what risks it is currently facing. At Simply Wall St, we found 2 warning signs for VCI Global and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VCIG

VCI Global

Provides business and technology consulting services in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.