- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

Will Upwork (UPWK) Unlock Sustainable Growth Through International Expansion and AI Ambitions?

Reviewed by Sasha Jovanovic

- Upwork Inc. recently announced plans to open its first international operational hub in Lisbon, Portugal, with the office set to become fully operational in late 2026 and focused on product development and technical hiring.

- This move signals Upwork’s push to expand its footprint and capabilities outside the U.S., coinciding with new analyst optimism around its AI-driven growth strategy and increased market visibility due to upcoming index inclusion.

- We’ll now explore how Upwork’s international expansion and AI investment may shape its long-term investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Upwork Investment Narrative Recap

To own Upwork shares, investors need confidence in the company's ability to translate AI-powered innovation, international scale, and enterprise expansion into higher client activity and sustained top-line growth. The Lisbon hub announcement aligns with Upwork’s broader international and technical strategy, but it does not materially alter the most important near-term catalyst: a rebound in client acquisition and transaction volume as macro conditions stabilize. Risks tied to slow new client growth and ongoing macroeconomic uncertainty remain central to the investment story.

Among recent announcements, the launch of Lifted, Upwork’s new enterprise-focused platform, connects directly to growth catalysts by broadening enterprise offerings and serving clients who require more integrated workforce management solutions. This is relevant to the company's push for diversification and higher transaction values, and closely complements the technical hiring ambitions underway in Lisbon.

Yet, despite promising expansion, investors should also keep in mind the challenge of persistent macroeconomic unpredictability and its impact on Upwork’s ability to grow its…

Read the full narrative on Upwork (it's free!)

Upwork's narrative projects $906.3 million revenue and $147.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $97.6 million decrease in earnings from $245.4 million currently.

Uncover how Upwork's forecasts yield a $22.60 fair value, a 15% upside to its current price.

Exploring Other Perspectives

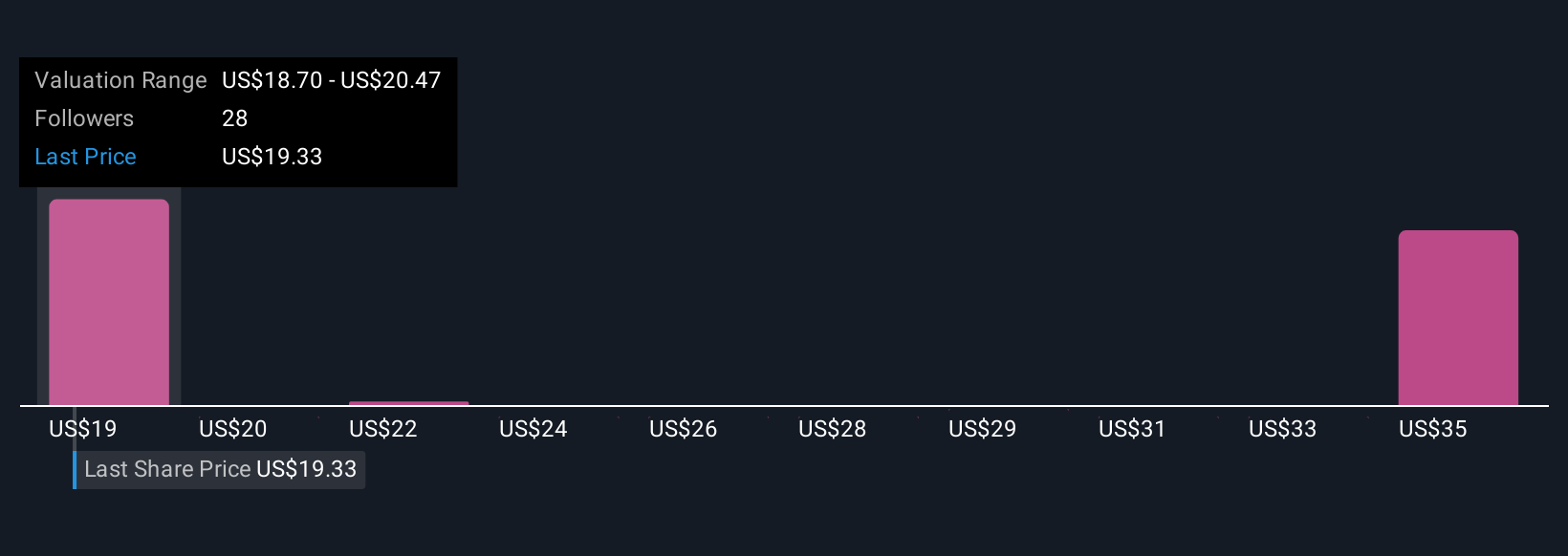

The Simply Wall St Community’s fair value estimates for Upwork range from US$22.60 to US$30.81, based on 4 unique perspectives. While opinions vary widely, many are focused on how AI investments and client demand trends could shape future revenue expansion.

Explore 4 other fair value estimates on Upwork - why the stock might be worth as much as 56% more than the current price!

Build Your Own Upwork Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upwork research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Upwork research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upwork's overall financial health at a glance.

No Opportunity In Upwork?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success