- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Tetra Tech (TTEK): Evaluating Valuation as Sales Growth and Backlog Fuel Investor Interest

Reviewed by Kshitija Bhandaru

Tetra Tech (TTEK) continues to capture investor attention as its sales growth streak stands out in the sector. The company’s project backlog has now reached $4.28 billion, which supports a compelling outlook for future revenue.

See our latest analysis for Tetra Tech.

Tetra Tech’s share price has held fairly steady this year, with recent moves reflecting investor optimism about its expanding project backlog and sales pipeline. Looking at the bigger picture, the company’s five-year total shareholder return of 69.6% highlights its long-term growth story, even as near-term share price performance has leveled out.

If you’re scanning for other companies with robust growth and healthy insider buying trends, now is the perfect time to discover fast growing stocks with high insider ownership

With Tetra Tech posting rapid sales growth, but earnings per share slipping and shares trading below analyst targets, the real question is whether there is still hidden value for buyers or if the market already reflects future gains.

Most Popular Narrative: 22.6% Undervalued

With Tetra Tech shares last closing at $33.74 and the consensus narrative projecting a fair value of $43.60, the most widely followed outlook sees strong long-term potential that has yet to be recognized by the market. This sets up a key debate over what is powering that higher price target.

Ongoing expansion of advanced digital automation and analytics offerings, catalyzed by rising adoption of AI and recent strategic acquisitions, positions Tetra Tech for higher-margin, tech-driven consulting services and recurring revenue streams. This supports long-term net margin and earnings growth.

Curious what aggressive financial assumptions are fueling this optimistic view? The headline narrative counts on a margin leap and recurring revenues transforming the profit model. The full story unpacks these bold projections, AI bets, and the numbers you will not want to miss.

Result: Fair Value of $43.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the loss of major government contracts and reliance on non-recurring disaster response work could weaken the positive long-term outlook for Tetra Tech.

Find out about the key risks to this Tetra Tech narrative.

Another View: Market Multiples Raise a Flag

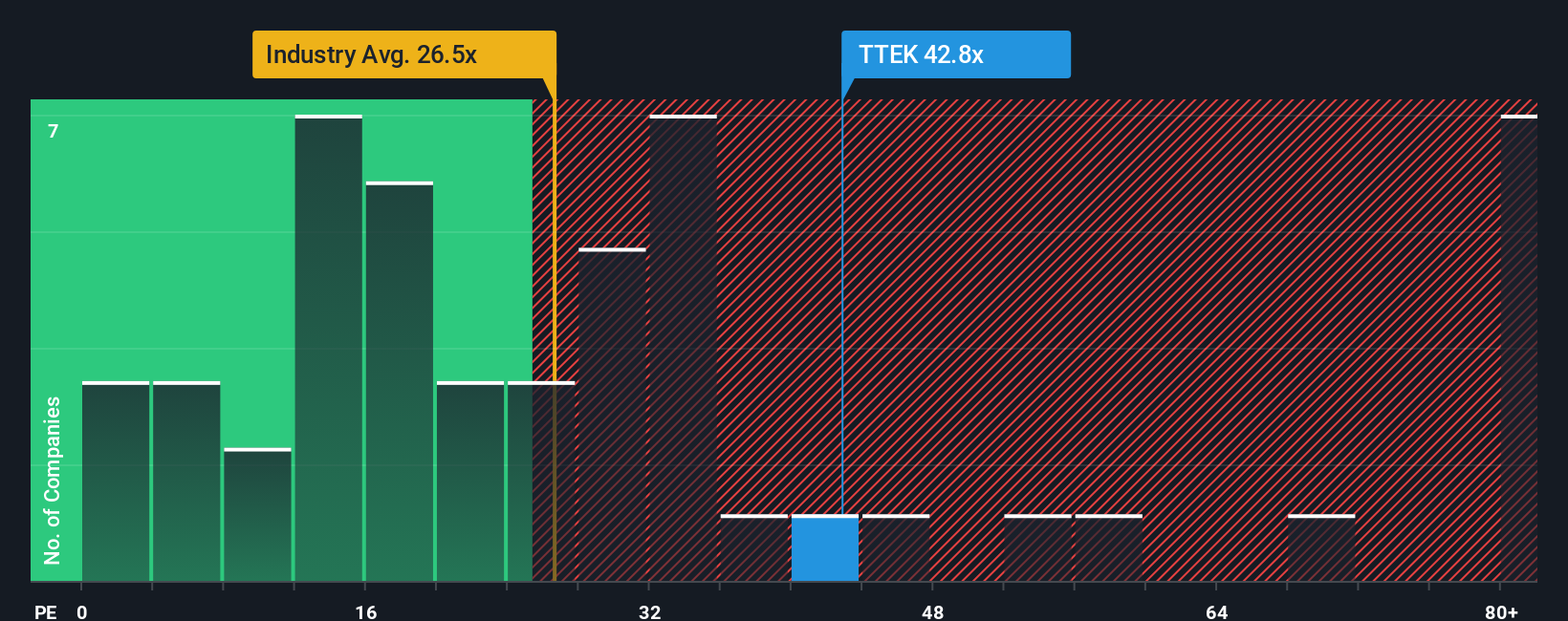

While analysts see upside, comparing Tetra Tech’s price-to-earnings ratio of 41x with the US industry average of 29.8x and peer average of 36.1x suggests shares are expensive. Even the fair ratio sits at 37x, so today’s price leaves little margin for error if growth falters. Is the optimism baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tetra Tech Narrative

If you see the numbers differently or want to dig deeper, you can craft your own narrative in just a few clicks. Do it your way

A great starting point for your Tetra Tech research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio by hunting out fresh opportunities that others might be missing. These unique stock lists showcase tomorrow’s leaders, not yesterday’s headlines.

- Capitalize on the income potential of companies paying attractive yields when you scan through these 19 dividend stocks with yields > 3% for investors seeking steady cash flow.

- Start your search for tomorrow’s breakthrough technologies by targeting these 24 AI penny stocks that are propelling artificial intelligence to new heights.

- Position yourself ahead of value shifts by reviewing these 896 undervalued stocks based on cash flows that analysts think the market is seriously underpricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services that focuses on water, environment, and sustainable infrastructure.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives