- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Is Tetra Tech’s (TTEK) Strong Sales Growth Enough to Offset Falling Earnings Per Share?

Reviewed by Sasha Jovanovic

- RBC Capital recently maintained an 'Outperform' rating for Tetra Tech while lowering its price target, citing ongoing analysis of the engineering and consulting services sector and Tetra Tech's differentiated market position.

- Despite a compounded annual sales growth rate of 14% and a backlog of US$4.28 billion, Tetra Tech experienced a 15.5% annual decline in earnings per share over the past two years, highlighting a contrast between strong sales momentum and weakening profitability.

- We'll examine how Tetra Tech's robust backlog and sales growth, paired with declining per-share earnings, influence its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Tetra Tech Investment Narrative Recap

For those considering Tetra Tech as a potential holding, confidence in the company’s ability to convert its US$4.28 billion backlog and industry-leading 14% sales growth into stronger, more consistent earnings is essential. RBC Capital’s decision to lower its price target while maintaining an ‘Outperform’ rating doesn’t materially shift the biggest near-term catalyst, ongoing demand for specialized engineering expertise in water and environmental solutions, or the main risk, which remains the potential for inconsistent earnings as backlog conversion faces headwinds.

Among recent announcements, Tetra Tech’s new US$990 million contract with NAVFAC Pacific stands out. This sizable addition to the pipeline is particularly relevant, as it highlights the company’s strength in securing large-scale government contracts at a time when maintaining backlog momentum is a critical short-term catalyst.

In contrast, persistent margin pressure driven by the wind down of episodic, high-margin disaster response work is something investors should be aware of...

Read the full narrative on Tetra Tech (it's free!)

Tetra Tech's narrative projects $4.7 billion in revenue and $559.6 million in earnings by 2028. This requires a 0.8% annual revenue decline and a $343.5 million earnings increase from current earnings of $216.1 million.

Uncover how Tetra Tech's forecasts yield a $43.60 fair value, a 29% upside to its current price.

Exploring Other Perspectives

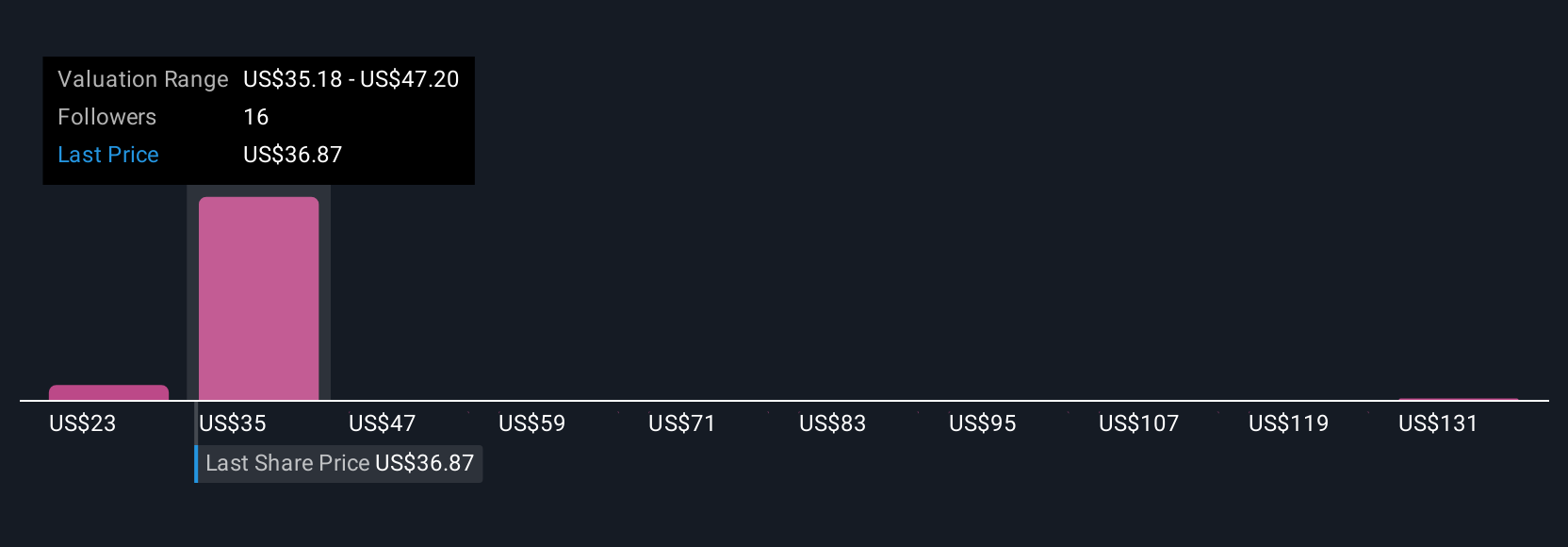

Five members of the Simply Wall St Community see Tetra Tech’s fair value between US$23.16 and US$143.35. Amid these wide-ranging views, the durability of Tetra Tech’s significant backlog and pipeline emerges as a key question for performance going forward, reminding you to consider several perspectives before forming your own view.

Explore 5 other fair value estimates on Tetra Tech - why the stock might be worth 31% less than the current price!

Build Your Own Tetra Tech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tetra Tech research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tetra Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tetra Tech's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services that focuses on water, environment, and sustainable infrastructure.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives