- United States

- /

- Commercial Services

- /

- NasdaqCM:TOMZ

We Discuss Why TOMI Environmental Solutions, Inc.'s (NASDAQ:TOMZ) CEO Compensation May Be Closely Reviewed

Key Insights

- TOMI Environmental Solutions to hold its Annual General Meeting on 12th of September

- CEO Halden Shane's total compensation includes salary of US$550.0k

- The overall pay is comparable to the industry average

- TOMI Environmental Solutions' three-year loss to shareholders was 77% while its EPS was down 77% over the past three years

The results at TOMI Environmental Solutions, Inc. (NASDAQ:TOMZ) have been quite disappointing recently and CEO Halden Shane bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 12th of September. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for TOMI Environmental Solutions

How Does Total Compensation For Halden Shane Compare With Other Companies In The Industry?

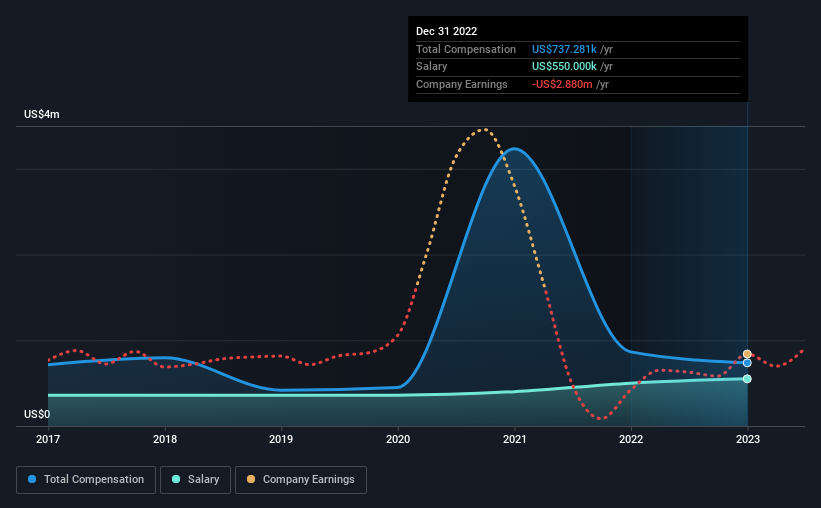

At the time of writing, our data shows that TOMI Environmental Solutions, Inc. has a market capitalization of US$24m, and reported total annual CEO compensation of US$737k for the year to December 2022. Notably, that's a decrease of 15% over the year before. In particular, the salary of US$550.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the American Commercial Services industry with market capitalizations below US$200m, reported a median total CEO compensation of US$702k. From this we gather that Halden Shane is paid around the median for CEOs in the industry. Moreover, Halden Shane also holds US$3.0m worth of TOMI Environmental Solutions stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$550k | US$500k | 75% |

| Other | US$187k | US$365k | 25% |

| Total Compensation | US$737k | US$865k | 100% |

On an industry level, around 22% of total compensation represents salary and 78% is other remuneration. TOMI Environmental Solutions is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

TOMI Environmental Solutions, Inc.'s Growth

Over the last three years, TOMI Environmental Solutions, Inc. has shrunk its earnings per share by 77% per year. It achieved revenue growth of 12% over the last year.

Overall this is not a very positive result for shareholders. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has TOMI Environmental Solutions, Inc. Been A Good Investment?

Few TOMI Environmental Solutions, Inc. shareholders would feel satisfied with the return of -77% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for TOMI Environmental Solutions you should be aware of, and 2 of them make us uncomfortable.

Important note: TOMI Environmental Solutions is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if TOMI Environmental Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TOMZ

TOMI Environmental Solutions

Provides disinfection and decontamination essentials in the United States and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success