- United States

- /

- Commercial Services

- /

- NasdaqGS:TILE

Why Interface (TILE) Is Up 17.8% After Boosting 2025 Sales Guidance and Q3 Forecasts

Reviewed by Simply Wall St

- Earlier this week, Interface, Inc. raised its full-year 2025 net sales guidance to a range of US$1.37 billion to US$1.39 billion, up from its previous range, and provided third quarter forecasts for net sales between US$350 million and US$360 million.

- This updated outlook indicates greater confidence in Interface's ongoing operational improvements and its ability to boost revenue through new initiatives.

- We'll examine how Interface's increased full-year guidance for 2025 shapes expectations for its ongoing earnings and revenue trajectory.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Interface Investment Narrative Recap

For an investor to own Interface stock, they need conviction in the company’s ability to grow revenue and earnings through ongoing productivity initiatives and product innovation, despite international market uncertainties and margin pressures. The recently raised full-year 2025 net sales guidance suggests improved internal momentum, but it does not eliminate the acute risk posed by continued softness in the macroeconomic environment across Europe and Australia, which remains a persistent headwind in the near term.

The most relevant recent announcement is the formal raise in full-year 2025 net sales guidance on August 1st, which follows a previous upward revision made in May. This consistency in raising targets underscores Interface’s drive to capitalize on operational improvements and expansion into new segments, though investors should still be monitoring for signs of slowing demand in key international geographies.

In contrast, investors should be aware that foreign exchange rate volatility continues to present a risk to Interface’s revenue performance in global markets...

Read the full narrative on Interface (it's free!)

Interface's narrative projects $1.5 billion revenue and $123.6 million earnings by 2028. This requires 4.3% yearly revenue growth and a $37.6 million earnings increase from $86.0 million today.

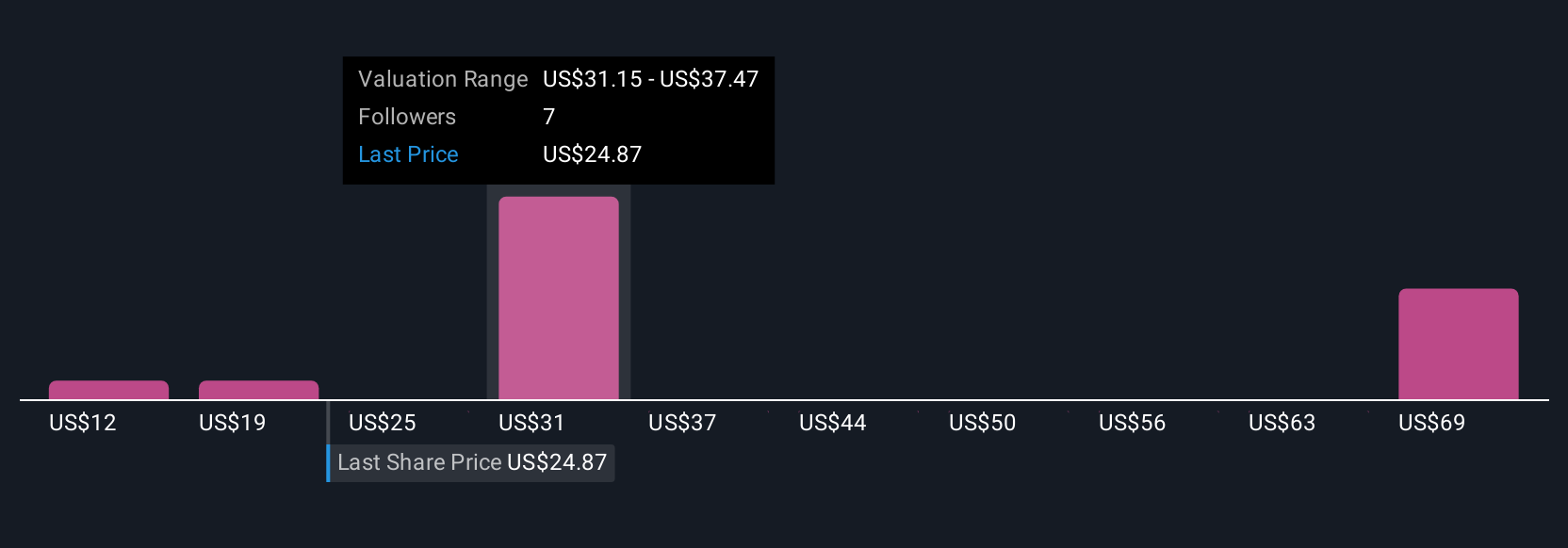

Uncover how Interface's forecasts yield a $31.33 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have submitted five fair value estimates for Interface ranging from US$12.21 to US$55.15 per share. With international soft demand still weighing on revenue, these diverse opinions make it essential to consider multiple viewpoints before reaching your own conclusion.

Explore 5 other fair value estimates on Interface - why the stock might be worth over 2x more than the current price!

Build Your Own Interface Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interface research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interface research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interface's overall financial health at a glance.

No Opportunity In Interface?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TILE

Interface

Designs, produces, and sells modular carpet products in the United States, Canada, Latin America, Europe, Africa, Asia, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives