- United States

- /

- Professional Services

- /

- NasdaqGS:TASK

TaskUs (TASK): Assessing Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

TaskUs (TASK) shares have dropped nearly 7% in the latest trading session, extending a slide that has lasted throughout the past month. Investors are watching closely, especially after a string of challenging weeks for the company’s stock.

See our latest analysis for TaskUs.

TaskUs’s share price reaction stands out even more when set against its broader track record. Despite a tough month and a 1-day share price drop of 6.5%, the company actually delivered a positive 12.7% total shareholder return over the past year. While last year saw solid gains, momentum has clearly faded recently as short-term price pressure builds. This has prompted investors to reassess risk and growth expectations in the current environment.

If TaskUs’s pullback has you scanning the market for fresh opportunities, now’s a good moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading nearly 24% below analyst price targets and strong revenue growth numbers on the table, the real question is whether TaskUs represents genuine value at current levels or if the market has already factored in all its future potential.

Most Popular Narrative: 17% Undervalued

TaskUs recently closed at $13.73, a notable gap below the most popular narrative's fair value estimate of $16.62. With this difference, market watchers are debating whether the current stock price is overlooking the company's long-term transformation.

TaskUs is investing heavily in AI services and technologies, including Agentic AI and generative AI services. These investments are anticipated to drive record-breaking revenue growth in 2025, making AI services the fastest-growing service line and enhancing overall revenue.

Want to know the financial leap TaskUs’s narrative is built on? The secret lies in bold growth assumptions and a future earnings multiple rarely seen for outsourcing firms. Find out which of analysts’ projections stretch expectations, and how these power the company’s "undervalued" case. Curious? The answers are hidden deep in the full narrative.

Result: Fair Value of $16.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost escalations and heavy investment in AI could pressure margins. As a result, expectations for profit growth may prove too optimistic if these trends continue.

Find out about the key risks to this TaskUs narrative.

Another View: The SWS DCF Model Perspective

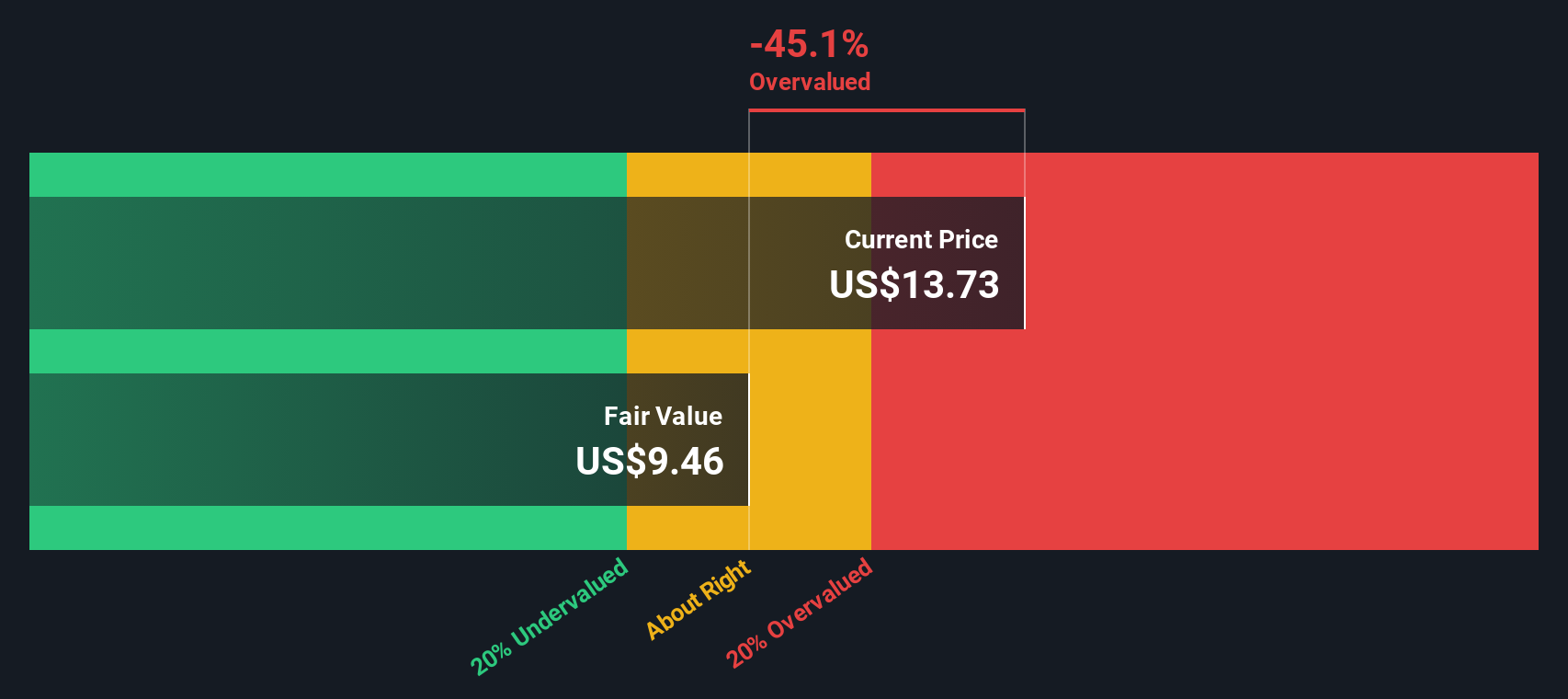

While analyst consensus suggests TaskUs is undervalued, the SWS DCF model tells a different story. According to this approach, TaskUs’s current share price of $13.73 actually sits above its estimated fair value of $9.50, which indicates the stock could be overvalued. Could the market be ignoring underlying risks, or does the consensus narrative miss something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TaskUs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TaskUs Narrative

If you’re not convinced by the prevailing views or want to see how your insights compare, you can craft a personalized TaskUs outlook in just a few minutes. Do it your way

A great starting point for your TaskUs research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Smart Investing Move?

Don’t stop at TaskUs. Let Simply Wall Street help you spot your next financial win by accessing unique stock ideas tailored to your interests and investing style.

- Grow your portfolio with high-upside potential by getting access to these 3583 penny stocks with strong financials identified based on solid financials and breakout momentum.

- Capture tomorrow’s technological advancements by starting to build positions in companies from these 24 AI penny stocks that are transforming industries with real-world AI applications.

- Boost your passive income with reliable yield by browsing these 19 dividend stocks with yields > 3% that offer attractive returns exceeding 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaskUs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TASK

TaskUs

Provides outsourced digital services for companies in Philippines, the United States, India, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Nike: A Market Leader with Resilience and Long-Term Growth Potential

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026