- United States

- /

- Diversified Financial

- /

- NYSE:GHLD

July 2025's Leading Growth Companies With Strong Insider Commitment

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of cautious optimism, with major indices like the S&P 500 and Nasdaq Composite showing gains ahead of key Federal Reserve announcements and tech earnings reports, investors are keenly observing the influence of economic data on market movements. In this environment, growth companies with high insider ownership stand out as potentially strong candidates for investment consideration; their leadership's vested interest often signals confidence in long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 24.6% | 75.8% |

| Victory Capital Holdings (VCTR) | 10.1% | 32.4% |

| Super Micro Computer (SMCI) | 13.9% | 36.3% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.4% |

| Atour Lifestyle Holdings (ATAT) | 22.9% | 23.5% |

| Astera Labs (ALAB) | 12.8% | 45.6% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

We'll examine a selection from our screener results.

Oddity Tech (ODD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oddity Tech Ltd. is a consumer tech company that develops digital-first brands for the beauty and wellness sectors globally, with a market cap of approximately $3.82 billion.

Operations: The company's revenue is primarily generated from its Personal Products segment, which accounts for $703.49 million.

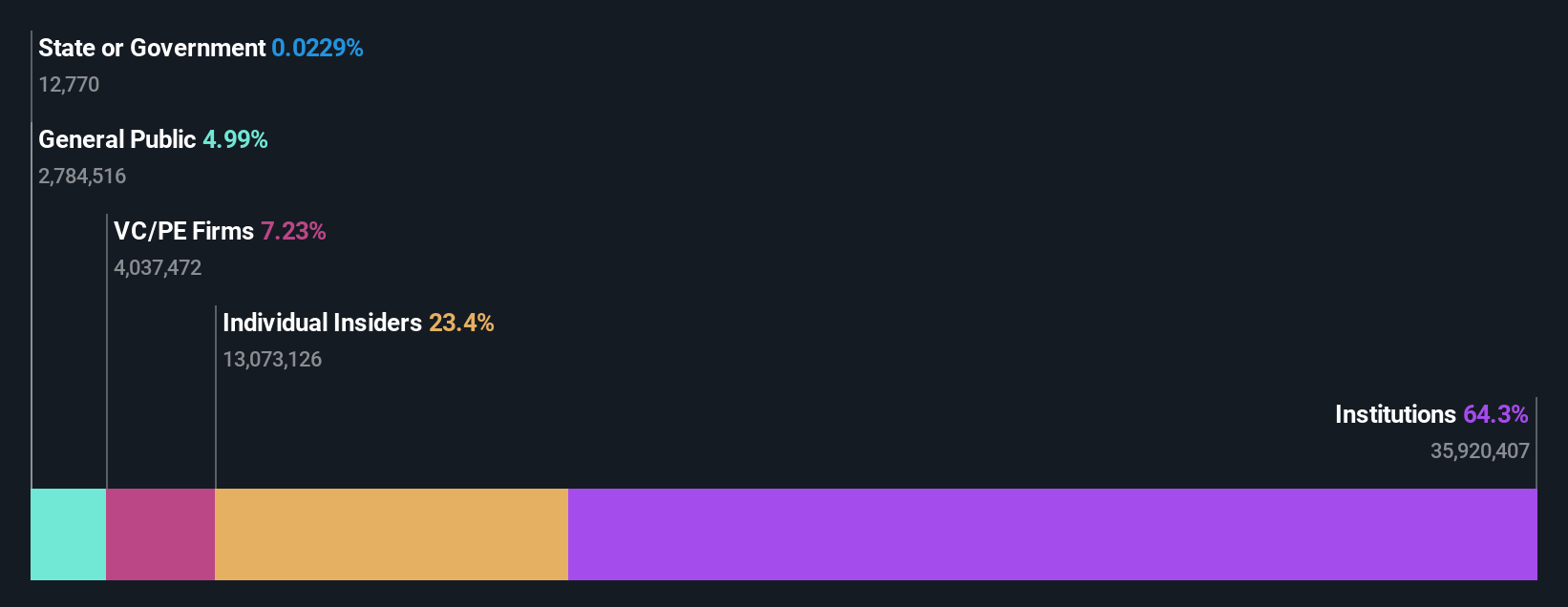

Insider Ownership: 23.4%

Oddity Tech is positioned as a growth company with substantial insider ownership, evidenced by its forecasted earnings growth of 24.88% annually, outpacing the US market's 15%. Despite high share price volatility recently, Oddity's revenue is expected to grow at 16.2%, surpassing the broader market's 9.1%. With a projected Return on Equity of 28.9% in three years and trading below estimated fair value, Oddity presents both opportunities and risks for investors seeking growth potential.

- Delve into the full analysis future growth report here for a deeper understanding of Oddity Tech.

- Our expertly prepared valuation report Oddity Tech implies its share price may be too high.

TaskUs (TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. offers outsourced digital services across the Philippines, United States, India, and internationally with a market cap of approximately $1.51 billion.

Operations: The company generates revenue primarily through its Direct Marketing segment, which accounted for $1.05 billion.

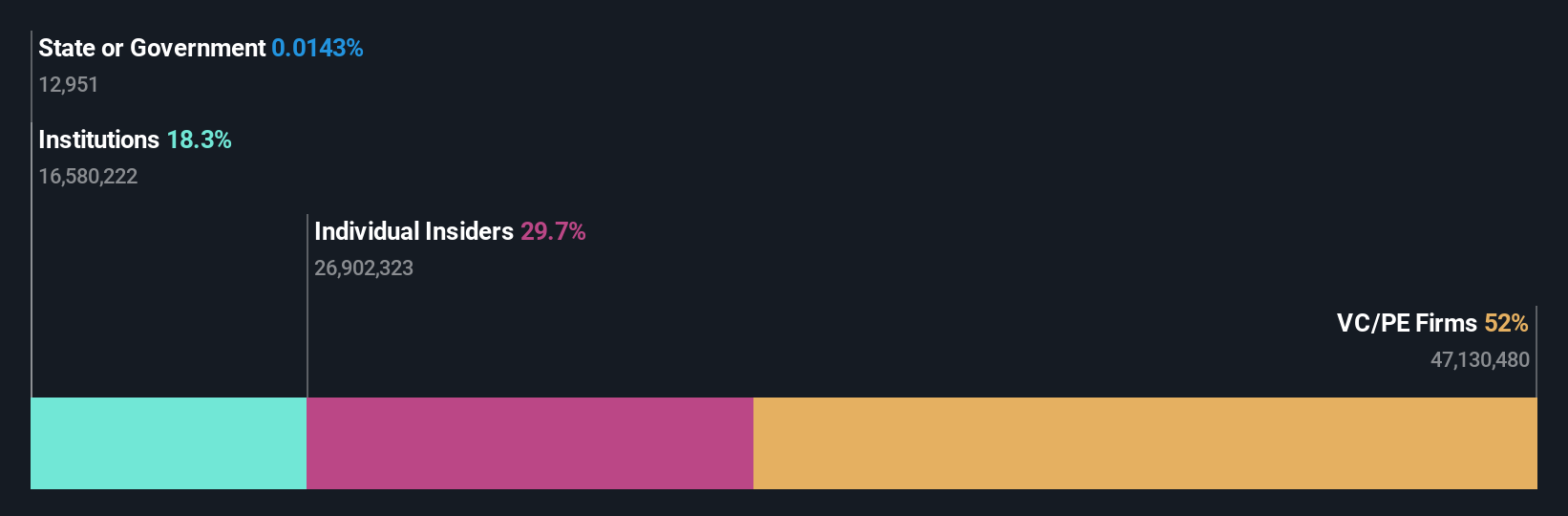

Insider Ownership: 29.1%

TaskUs exhibits strong growth potential with forecasted earnings growth of 26.5% annually, surpassing the US market's 14.9%. Despite trading significantly below its estimated fair value, TaskUs faces challenges including a pending class action lawsuit and low return on equity projections. Recent strategic partnerships in AI aim to enhance customer support capabilities, while insider ownership remains high as co-founders plan to acquire remaining shares from other stakeholders for approximately US$170 million.

- Navigate through the intricacies of TaskUs with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility TaskUs' shares may be trading at a discount.

Guild Holdings (GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company, with a market cap of $1.24 billion, operates in the United States through its subsidiary by originating, selling, and servicing residential mortgage loans.

Operations: The company's revenue segments include $828.98 million from origination and $153.36 million from servicing residential mortgage loans in the United States.

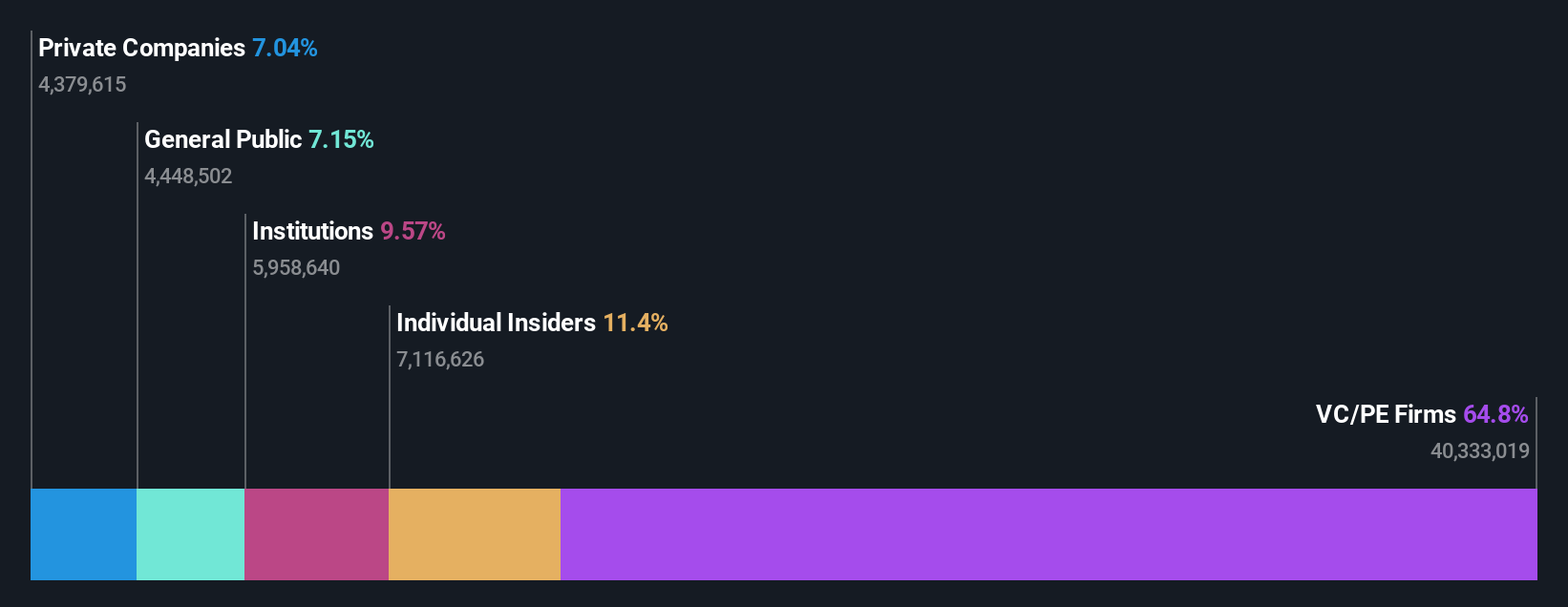

Insider Ownership: 11.4%

Guild Holdings is set to be acquired by Bayview Asset Management for approximately US$1.3 billion, transitioning to a privately held entity while retaining its management team. The company's earnings are expected to grow significantly at 41.7% annually, outpacing the US market despite recent financial losses and interest coverage concerns. Trading below estimated fair value, Guild Holdings' revenue growth forecasts surpass the market average but remain below 20%. Recent bylaw amendments limit officer liability under Delaware law.

- Take a closer look at Guild Holdings' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Guild Holdings is trading beyond its estimated value.

Key Takeaways

- Dive into all 187 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHLD

Guild Holdings

Through its subsidiary, originates, sells, and services residential mortgage loans in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives