- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

SS&C Technologies (SSNC): Assessing Valuation After Major Boothbay Win and Bullish Analyst Recognition

Reviewed by Kshitija Bhandaru

If you have been tracking SS&C Technologies Holdings (SSNC) lately, you have probably noticed a wave of attention, and with good reason. The company just landed a major client, Boothbay Fund Management, choosing SS&C GlobeOp as its fund administrator to help scale Boothbay's complex, multi-manager platform. This fresh partnership, coupled with public recognition from UBS, highlights how SS&C's automation and AI strategy are earning fans across the financial sector. For investors weighing their next move, these events could be signals worth a closer look.

Digging into the stock’s action, SS&C shares are up about 16% year-to-date and more than 20% over the past year. The stock has seen a 7% climb in the past three months, signaling steady upward momentum. On top of this, the company is still benefiting from recent expansion moves, such as the Calastone acquisition, which adds even more fuel to its growth story. All of this is happening in a sector that is facing both rising demand and new types of risks, especially around regulation and cybersecurity.

So, with this momentum building and strong client wins on the table, is SS&C Technologies Holdings still undervalued, or is the market fully pricing in its growth? Let’s dig into the valuation details to find out.

Most Popular Narrative: 10.2% Undervalued

Based on the most widely followed narrative, SS&C Technologies Holdings shares are seen as undervalued, implying strong upside potential if the company's promised growth materializes.

Expansion into international markets, particularly Australia and the Middle East, is a key growth catalyst for SS&C. Substantial client wins and increased presence are expected to contribute positively to revenue. The integration of AI-driven automation platforms like Blue Prism, which are designed to enhance operational efficiency, is anticipated to reduce costs and improve net margins over time.

Curious about why analysts believe SS&C could leap ahead? This narrative points to a combination of international expansion, new technology, and powerful collaborations as the factors driving the value call. If you want to discover the bold assumptions behind that price target, you will want to explore the full story behind these numbers.

Result: Fair Value of $97.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued foreign exchange swings or a slowdown in SS&C's healthcare business could quickly challenge the optimistic outlook that is currently driving the stock higher.

Find out about the key risks to this SS&C Technologies Holdings narrative.Another View: What Do Earnings Multiples Say?

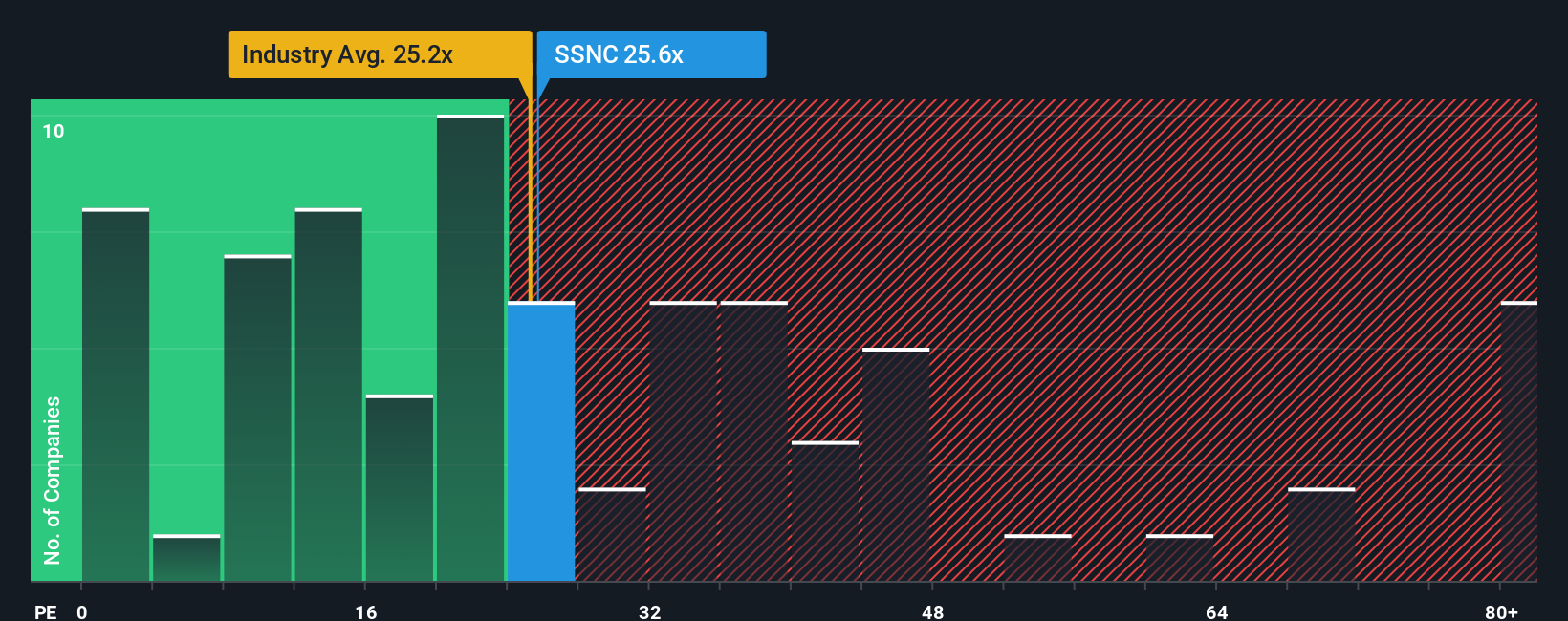

While one approach suggests SS&C Technologies Holdings is undervalued, another measure compares its market price to current industry earnings ratios and indicates the stock may not be as inexpensive as some believe. Can both perspectives be valid?

See what the numbers say about this price — find out in our valuation breakdown.For a deeper look, let’s examine the valuation breakdown to understand what the numbers truly reveal.

Build Your Own SS&C Technologies Holdings Narrative

If you think there is more to the story or want to back up your own take, you can customize and publish your own narrative in just a few minutes. Do it your way.

A great starting point for your SS&C Technologies Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock the next tier of opportunities. Successful investors never settle, so why should you? See for yourself what’s making headlines in tomorrow’s markets right now.

- Capitalize on strong financial foundations by checking out the penny stocks with strong financials to spot early-stage winners among solid up-and-comers. penny stocks with strong financials

- Tap into unstoppable trends as you browse AI penny stocks driving innovation in automation and smart technologies. AI penny stocks

- Maximize your potential returns by searching undervalued stocks based on cash flows to find compelling opportunities overlooked by the crowd. undervalued stocks based on cash flows

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives