- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

SS&C Technologies Holdings (NasdaqGS:SSNC) Authorizes US$1.5 Billion Buyback and Affirms Dividend

Reviewed by Simply Wall St

SS&C Technologies Holdings (NasdaqGS:SSNC) announced a major share repurchase program of $1,500 million and affirmed a quarterly dividend of $0.25 per share on May 22, 2025, which likely supported its 5% share price increase over the past month. Despite the stock market facing fluctuations driven by global trade tensions stoked by President Trump's trade policies, the company's share activities presented a counter-narrative. This positive shareholder-focused strategy may have mitigated broader market concerns, showcasing resilience amid a period where major indexes and tech shares experienced declines.

You should learn about the 2 warning signs we've spotted with SS&C Technologies Holdings.

The recent announcement of SS&C Technologies Holdings' US$1.5 billion share repurchase program and quarterly dividend underscores a focus on enhancing shareholder value. This move likely contributed to the 5% rise in its share price this past month, even as global trade tensions pressured broader markets. Over the past five years, the company's total shareholder return, including dividends, was 45.13%. This indicates resilience and strength relative to the US Professional Services industry, which saw a return of 9.8% over the last year, and the broader US market's 9.1% return.

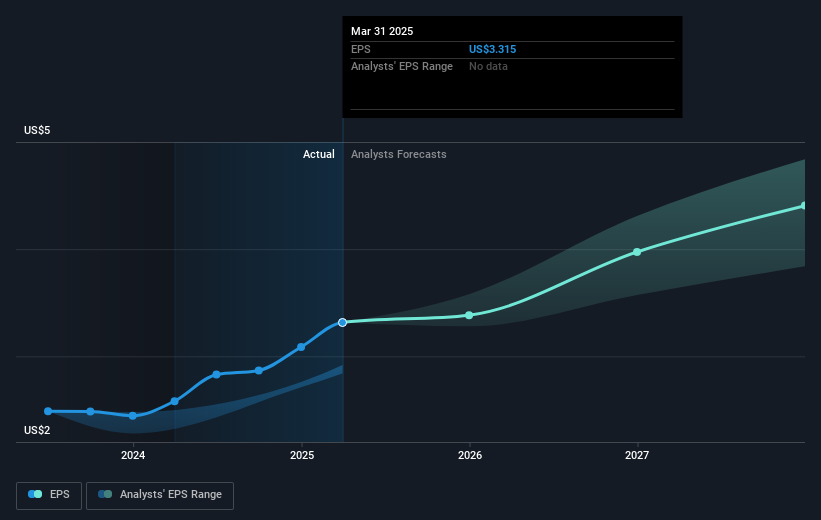

The ongoing share buybacks and dividends are leveraging the company's resources to sustain investor confidence while potentially impacting revenue and earnings forecasts positively. Expansion into international markets such as Australia and the Middle East, coupled with AI-driven automation platforms like Blue Prism, is expected to drive revenue growth, albeit facing geopolitical and currency risks. These initiatives, combined with the recent price movements, place SS&C's current share value at US$77.95 in context with the US$92.99 consensus price target, reflecting a 16.2% discount and suggesting room for potential appreciation. As analysts anticipate a shift in profit margins and revenue over the next few years, these factors may contribute positively to achieving the projected growth targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives