- United States

- /

- Professional Services

- /

- NasdaqGS:SAIC

Will SAIC’s (SAIC) $500 Million Debt Offering Reshape Its Growth and Balance Sheet Strategy?

Reviewed by Simply Wall St

- Science Applications International Corp. recently priced a US$500.0 million senior notes offering due 2033, planning to use the proceeds to repay its revolving credit facility, cover offering expenses, and support general corporate purposes including growth initiatives.

- This sizable debt refinancing reflects management’s focus on optimizing the capital structure and providing greater financial flexibility for future projects and operational needs.

- We’ll explore how this refinancing move could influence SAIC’s investment narrative, particularly its approach to balance sheet management and growth funding.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Science Applications International Investment Narrative Recap

To be a shareholder in Science Applications International Corp. right now, you have to believe the company can successfully navigate government spending uncertainty, defend its margins amid rising competition, and ultimately convert a strong contract pipeline into renewed top-line and earnings growth. The recent US$500.0 million note offering primarily enhances short-term balance sheet flexibility and isn't expected to fundamentally shift the most important catalyst, SAIC's ability to return to organic revenue growth. Key risks tied to prolonged government budget delays and pricing pressure remain unchanged.

Of the recent developments, the appointment of Bob Ritchie as Chief Growth Officer is aligned with efforts to accelerate growth and innovation in high-value defense and digital integration areas. While this organizational change is important for addressing SAIC's core challenges, the refinancing initiative is more about safeguarding operational agility than altering near-term catalysts such as contract backlog conversion or margin expansion.

On the other hand, with elevated competition from commercial tech firms and the move toward fixed-price contracting, investors should also understand how this could further impact...

Read the full narrative on Science Applications International (it's free!)

Science Applications International's narrative projects $7.7 billion revenue and $344.8 million earnings by 2028. This requires 1.0% yearly revenue growth and a $54 million earnings decrease from $399.0 million.

Uncover how Science Applications International's forecasts yield a $116.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

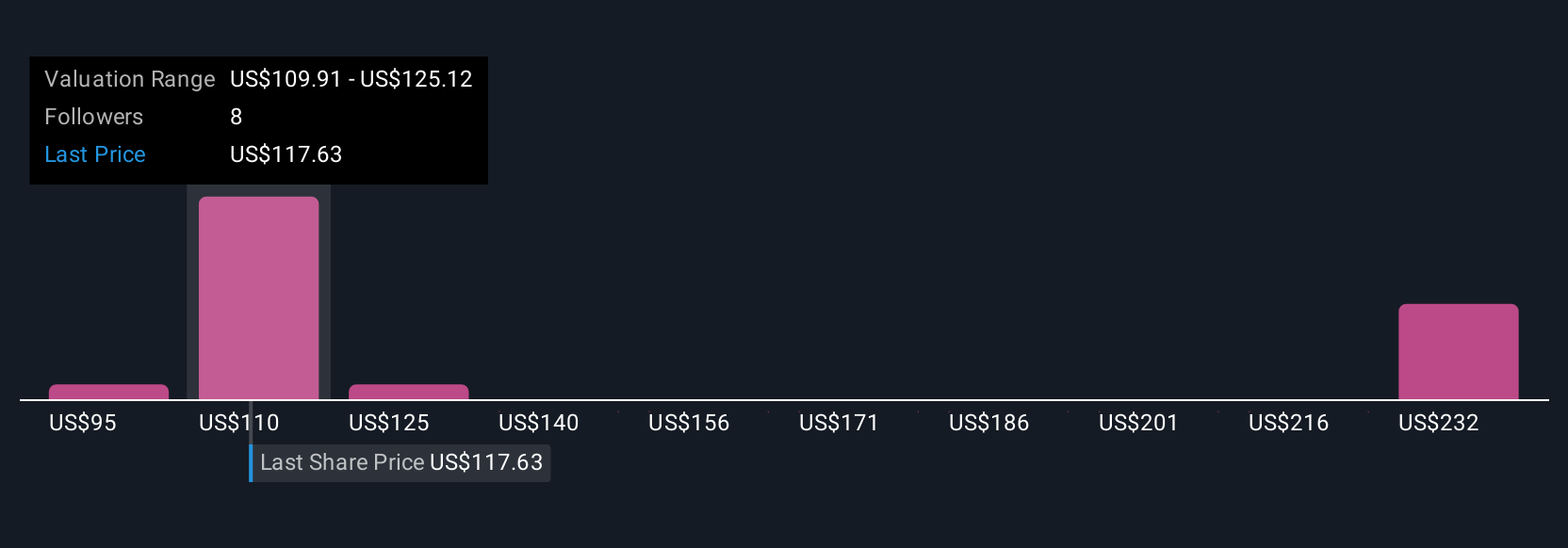

Simply Wall St Community members provided four individual fair value estimates for SAIC, ranging from US$94.71 to US$192.06 per share. This variety of investor perspectives contrasts with ongoing concerns about how flat or shrinking government budgets might continue to weigh on revenue momentum, be sure to compare these different outlooks for a fuller picture.

Explore 4 other fair value estimates on Science Applications International - why the stock might be worth as much as 89% more than the current price!

Build Your Own Science Applications International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Science Applications International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Science Applications International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Science Applications International's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIC

Science Applications International

Provides technical, engineering, and enterprise information technology (IT) services in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives