- United States

- /

- Commercial Services

- /

- NasdaqCM:QRHC

Investors Give Quest Resource Holding Corporation (NASDAQ:QRHC) Shares A 28% Hiding

To the annoyance of some shareholders, Quest Resource Holding Corporation (NASDAQ:QRHC) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

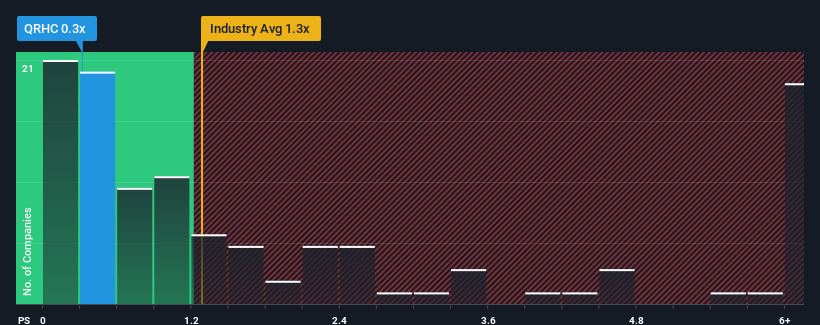

After such a large drop in price, Quest Resource Holding's price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Commercial Services industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Quest Resource Holding

What Does Quest Resource Holding's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Quest Resource Holding has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Quest Resource Holding's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Quest Resource Holding's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 110% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 9.7% as estimated by the three analysts watching the company. With the industry predicted to deliver 8.5% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Quest Resource Holding's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Quest Resource Holding's P/S?

Quest Resource Holding's recently weak share price has pulled its P/S back below other Commercial Services companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Quest Resource Holding remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Quest Resource Holding, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Quest Resource Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:QRHC

Quest Resource Holding

Provides solutions for the reuse, recycling, and disposal of various waste streams and recyclables in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives