- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Paychex (PAYX) Q2 2026 Margin Compression Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

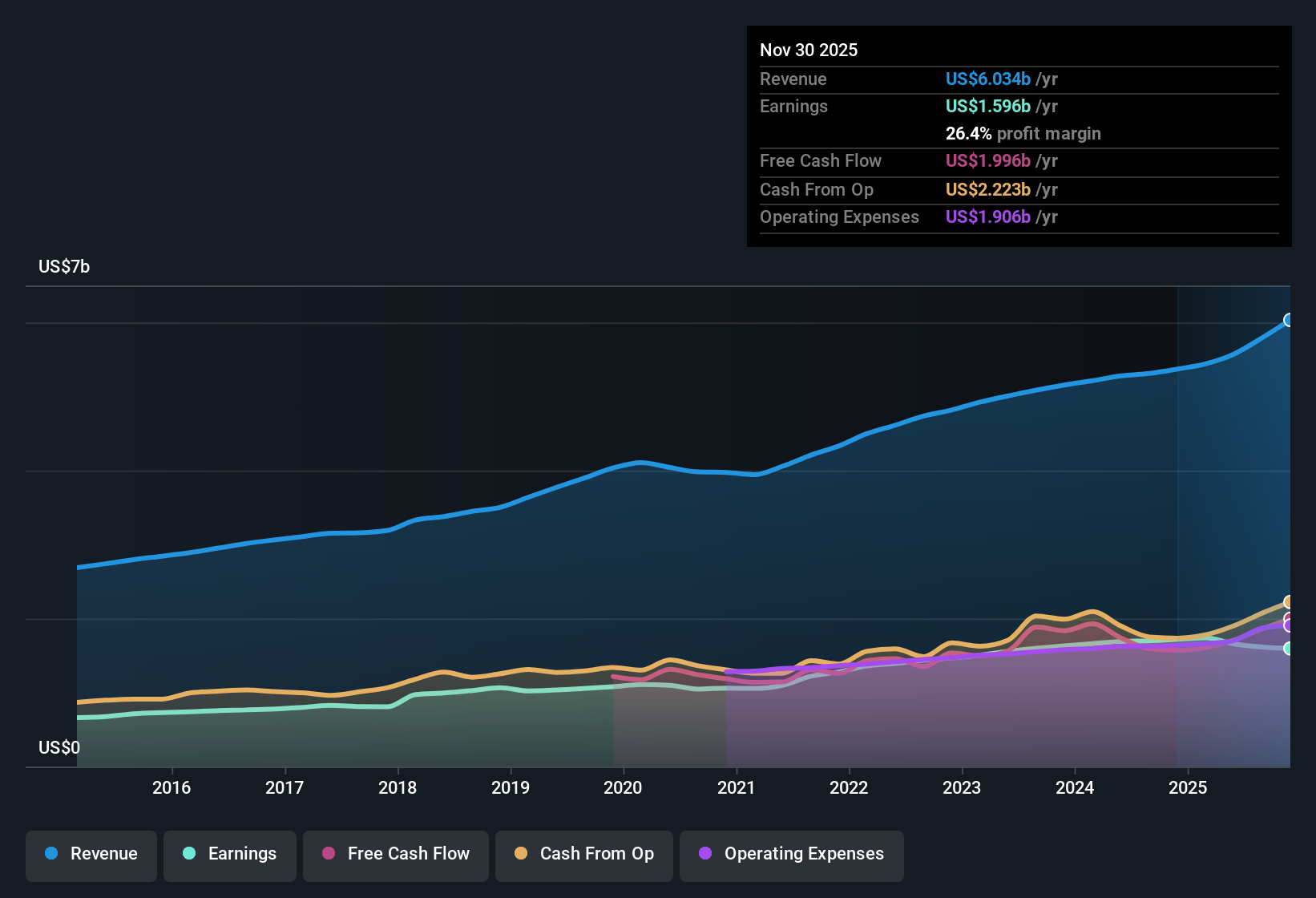

Paychex (PAYX) just posted Q2 2026 results showing revenue of $1.6 billion and basic EPS of $1.10, with net income of $395 million underscoring a solid profit base for the quarter. The company has seen revenue move from $1.32 billion in Q2 2025 to $1.56 billion in Q2 2026, while EPS shifted from $1.15 to $1.10 over the same period, setting up a nuanced backdrop for how investors read the latest release. With that mix of higher revenue and slightly softer EPS, margins sit squarely at the center of the story for this earnings season.

See our full analysis for Paychex.With the headline numbers on the table, the next step is to see how they line up against the prevailing narratives around Paychex's growth, income profile, and margin trajectory.

See what the community is saying about Paychex

Revenue Growth Slows Versus Market

- On a trailing basis, Paychex generated about $6.0 billion in revenue, growing around 6.9 percent per year, which is slower than the 10.5 percent growth pace expected for the broader US market.

- Analysts' consensus view sees the pending Paycor acquisition and tech investments as revenue drivers, yet the current 6.9 percent revenue growth rate

- is below the market benchmark. This makes the consensus call for roughly 10.2 percent annual revenue growth over the next three years a step up from what the trailing numbers show today,

- and highlights that the expanded HCM portfolio will need to translate into faster top line growth than the business has delivered recently to fully match that optimistic path.

Margins Under Pressure From 32 percent To 26.4 percent

- Net margin has moved from 32 percent to 26.4 percent over the last year, while trailing net income stands at about $1.6 billion alongside a 3.85 percent dividend yield.

- Consensus narrative expects efficiency gains and Paycor cost synergies to lift profitability, yet the recent margin step down

- runs against the idea of improving operating leverage, especially when integration work and higher employee costs are called out as potential drags on net margins,

- and means any future margin expansion story needs to be judged against the fact that profitability on a percentage basis is currently lower than it was a year ago even as earnings quality is described as high.

Discount To DCF Fair Value Despite 26.4 percent Margin

- With the stock at $112.28 and a DCF fair value of about $146.06, shares trade at roughly a 23 percent discount. The P E of 25.3 times sits just above the US Professional Services industry at 24.2 times and below the peer average of 27.3 times.

- Bulls point to an 11.18 percent forecast earnings growth rate and that valuation gap as upside potential, but the current setup

- also includes a trailing 26.4 percent net margin that is lower than last year and revenue growth running below the 10.5 percent market benchmark, both of which temper how aggressive that discount may look,

- and comes with a high level of debt and a 3.85 percent dividend yield, so investors are effectively weighing a value style entry price and income stream against slower recent growth and leverage when they judge the bullish case.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Paychex on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to explore the underlying data, frame your own long term view, then Do it your way and share it.

A great starting point for your Paychex research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Paychex faces slowing revenue growth, compressed margins, and meaningful leverage, which together raise questions about how resilient its earnings profile will be through tougher cycles.

If that combination of slower growth and higher debt makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1944 results) to quickly shift your attention toward businesses built on stronger financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAYX

Paychex

Provides human capital management solutions (HCM) for payroll, employee benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion