- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

Should Weakening Consumer Confidence Challenge LegalZoom's (LZ) Subscription Model Resilience?

Reviewed by Sasha Jovanovic

- In late September, U.S. consumer confidence saw a sharper-than-expected decline, fueling investor concerns over the demand outlook for discretionary online services like those offered by LegalZoom. This economic backdrop prompted investors to reassess companies in the sector, as LegalZoom's performance during this period appeared tied more to shifting macroeconomic sentiment than to company-specific developments.

- This climate of weakening consumer confidence raises fresh uncertainty regarding LegalZoom's reliance on discretionary spending for its subscription-based legal services.

- We'll assess how heightened consumer caution may influence LegalZoom's growth prospects and affect the company's investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

LegalZoom.com Investment Narrative Recap

To be a LegalZoom shareholder, you need to believe online self-serve legal services will keep growing even in times of softer consumer confidence, with partnerships and recurring subscription models powering revenue expansion. The recent decline in U.S. consumer confidence does create questions about near-term demand for discretionary purchases, but it doesn't appear to have changed the biggest short-term catalyst, LegalZoom's gains in high-margin, recurring subscriptions, or the primary risk around increased competition and potential customer churn. For now, the overall demand story and competitive pressures seem more important than the latest economic backdrop.

LegalZoom's August launch of affordable, self-guided and attorney-assisted patent services is particularly relevant given sensitivity to consumer spending, as it aligns with the company's push into new, high-value offerings that could offset fluctuations in demand. This effort reinforces the company’s catalyst of expanding and bundling its product suite to attract higher-value clients, aiming to strengthen recurring revenues even during periods of reduced discretionary spending.

Yet, while recurring subscriptions offer a cushion against weak consumer sentiment, the evolving competitive threat from new AI-powered document solutions remains something investors should be aware of...

Read the full narrative on LegalZoom.com (it's free!)

LegalZoom.com's narrative projects $876.4 million revenue and $72.3 million earnings by 2028. This requires 7.5% yearly revenue growth and a $43.5 million earnings increase from $28.8 million today.

Uncover how LegalZoom.com's forecasts yield a $11.64 fair value, a 14% upside to its current price.

Exploring Other Perspectives

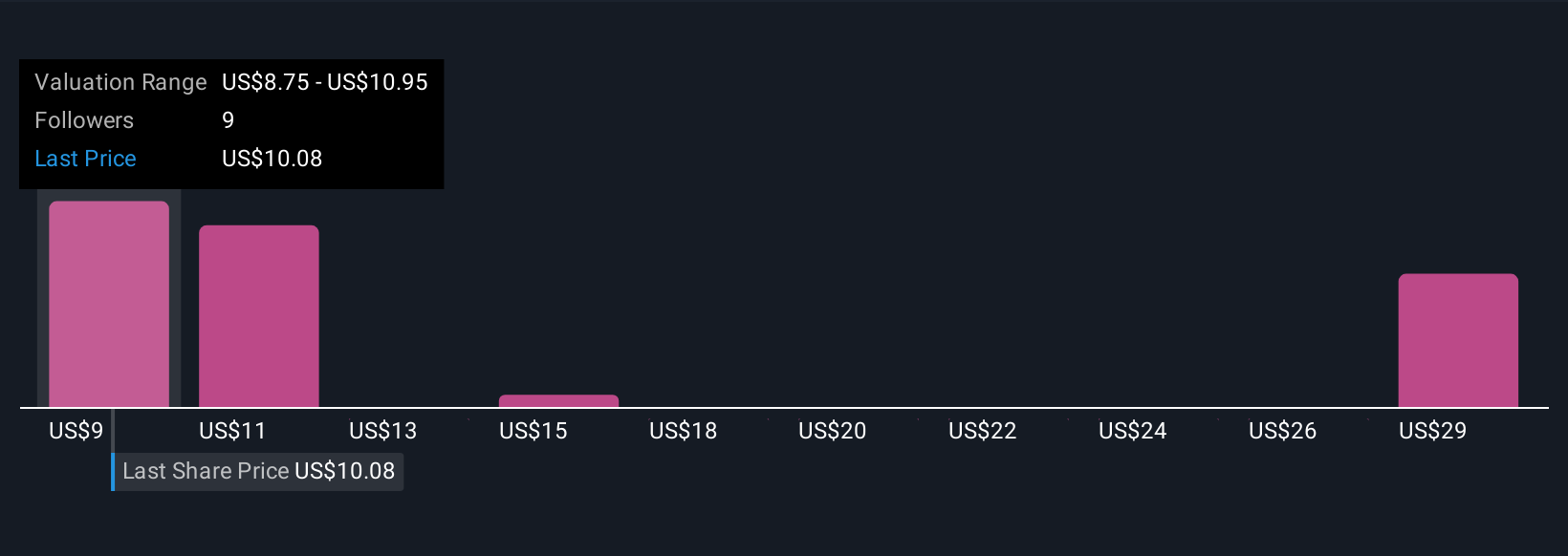

Five fair value estimates from the Simply Wall St Community span from US$8.75 up to US$30.66, reflecting a broad spectrum of growth assumptions. As you consider these diverging outlooks, keep in mind the rising risk that new low-cost AI rivals could impact LegalZoom's pricing power and subscriber retention.

Explore 5 other fair value estimates on LegalZoom.com - why the stock might be worth over 2x more than the current price!

Build Your Own LegalZoom.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LegalZoom.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LegalZoom.com's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives