- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

Is LegalZoom (LZ) Still Undervalued? A Fresh Look at Its Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for LegalZoom.com.

LegalZoom.com’s strong 39.4% total shareholder return over the past year stands out, due to building momentum and renewed optimism around its path to profitability. The stock’s nearly 20% share price return in the last three months suggests recent buyers are betting on its growth story picking up pace.

If you’re curious where else rapid growth and fresh momentum might be surfacing, now is an ideal time to discover fast growing stocks with high insider ownership

But with shares approaching analysts’ price targets and solid gains already logged, investors face a key question: Is LegalZoom.com still undervalued, or is the market already reflecting its future growth prospects?

Most Popular Narrative: 14.4% Undervalued

With the current closing price well below the consensus fair value, LegalZoom.com is catching attention for its rapid business transformation and potential upside. The most popular narrative links LegalZoom's valuation to high-margin offerings, tech partnerships, and scalable growth.

"Strong momentum in high-margin, recurring subscription offerings, especially within compliance and concierge do-it-for-me products, signals continued growth in predictable revenues and improved customer retention. This directly supports higher net margins and earnings stability. Enhanced automation and AI deployment throughout the business is driving operating efficiency gains and enabling scalable delivery of higher-touch services, which underpins continued EBITDA margin expansion and a reduced cost structure."

Want to know what is powering these big moves? The narrative’s future valuation depends on ambitious profit margin expansion and bold recurring revenue bets. Which game-changing assumptions are driving the consensus target? Uncover the specifics that could be shaping LegalZoom's fair value call.

Result: Fair Value of $11.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in online legal services and regulatory scrutiny could quickly challenge LegalZoom’s optimistic growth and margin assumptions.

Find out about the key risks to this LegalZoom.com narrative.

Another View: Price-to-Earnings Paints a Different Picture

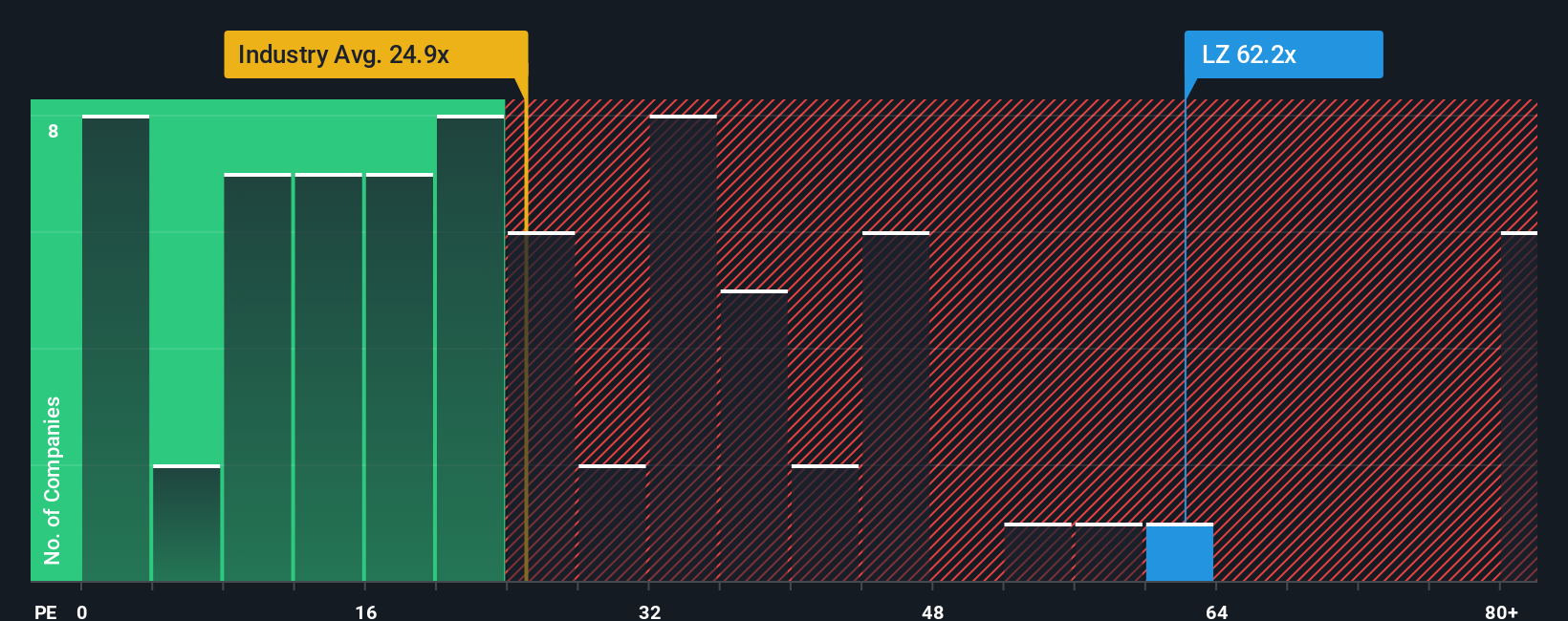

While analyst price targets and narratives suggest LegalZoom.com is undervalued, the market’s price-to-earnings ratio tells a contrasting story. The stock trades at 62.5x, far above its industry peers at 25.4x and the fair ratio of 31.5x. This wide gulf could signal valuation risk, especially if growth expectations do not materialize. Is the optimism already priced in, or could momentum keep carrying the shares higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LegalZoom.com Narrative

If you think there’s more behind LegalZoom.com’s story or want to dig into the numbers yourself, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. If you want to get ahead of the market, these unique ideas from Simply Wall Street’s screener give you an edge.

- Unlock growth potential with these 836 undervalued stocks based on cash flows, which stand out for their attractive prices based on future cash flows and solid fundamentals.

- Tap into the rise of AI by checking out these 27 AI penny stocks, leading the way in artificial intelligence innovation and disruption.

- Add diversity to your portfolio by targeting these 20 dividend stocks with yields > 3%, designed to boost your income with yields well above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives