- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

AI Logo Partnership Could Be a Game Changer for LegalZoom.com (LZ)

Reviewed by Sasha Jovanovic

- LegalZoom.com recently announced a partnership with Design.com, allowing small businesses to create AI-generated logos and protect their brand through integrated trademark services within the LegalZoom platform.

- This collaboration, alongside the launch of embedded legal services flow for partner platforms, highlights LegalZoom's efforts to streamline business formation, branding, and compliance in a single user experience.

- We'll explore how LegalZoom's integration of AI-powered branding tools could broaden its partner ecosystem and reinforce its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

LegalZoom.com Investment Narrative Recap

LegalZoom’s investment case centers on its ability to expand digital legal and compliance solutions for small businesses while fending off margin pressures and competition from both low-cost platforms and established legal brands. The recent integration of AI-powered branding tools with Design.com is unlikely to materially impact LegalZoom’s most immediate catalyst, accelerating adoption of high-margin recurring subscriptions, but it does little to resolve the risk of increased churn from bundling lower-retention services in its premium offerings.

Of LegalZoom’s recent announcements, the launch of its embedded legal services flow stands out in relevance. By enabling third-party platforms to incorporate formation and compliance services directly into their own user journeys, LegalZoom aims to boost conversion rates and user retention, aligning closely with the company’s focus on predictable recurring revenue, a key point for investors eyeing stickier customer relationships.

Yet, in contrast to these product wins, there’s still the ongoing risk that commoditization of legal services and aggressive price competition could…

Read the full narrative on LegalZoom.com (it's free!)

LegalZoom.com's narrative projects $876.4 million revenue and $72.3 million earnings by 2028. This requires 7.5% yearly revenue growth and a $43.5 million earnings increase from $28.8 million.

Uncover how LegalZoom.com's forecasts yield a $11.64 fair value, a 15% upside to its current price.

Exploring Other Perspectives

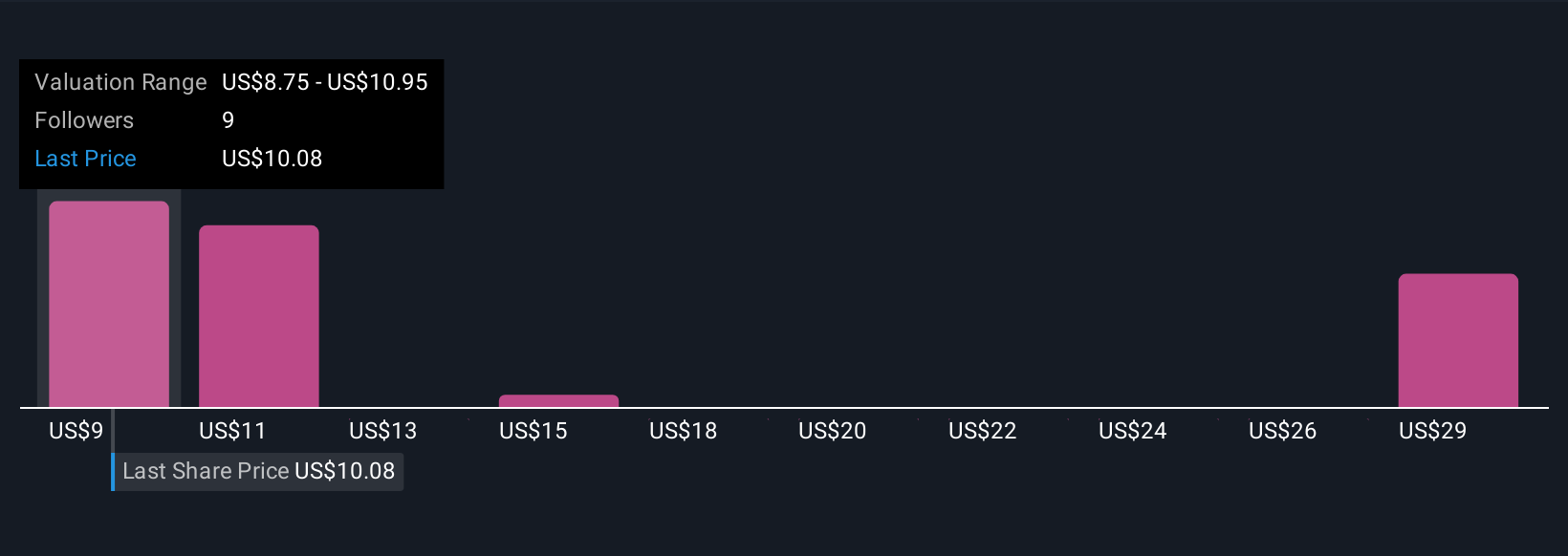

Four Simply Wall St Community members place fair values for LegalZoom between US$8.75 and US$31.69 per share. As you review these diverse estimates, consider how increased customer churn from bundling lower-retention products might weigh on long-term revenue predictability.

Explore 4 other fair value estimates on LegalZoom.com - why the stock might be worth 13% less than the current price!

Build Your Own LegalZoom.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LegalZoom.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LegalZoom.com's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives