- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

What Innodata (INOD)'s Major Stake Sale by Palisades Means for Shareholders

Reviewed by Sasha Jovanovic

- Palisades Investment Partners recently reduced its stake in Innodata by selling 361,144 shares valued at approximately US$18.24 million in the third quarter of 2025, dropping its holding to 0.23% of assets under management from 8.2% previously.

- This significant institutional exit comes as Innodata's management highlights projected 45% sales growth for the year and continued analyst support for its position in AI-driven digital transformation services.

- We'll examine how Palisades Investment Partners' sizable share sale may influence Innodata's investment narrative and ongoing growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Innodata Investment Narrative Recap

Investing in Innodata means believing that the company will capture long-term benefits from the growing demand for AI-driven data engineering and digital transformation services. The recent share sale by a major institutional investor may create some short-term volatility, but is not expected to materially affect the immediate catalyst: Innodata’s management is reaffirming robust 45% sales growth for the year. The most significant short-term risk remains the company’s reliance on a few large technology clients for a sizable portion of revenue. Among recent announcements, Innodata’s award of two major LLM development programs from a Big Tech client, with potential annual revenue of US$44 million, stands out. These wins are directly relevant as they reinforce the company’s sales growth expectations and expand its presence in high-value AI services at a time when customer concentration risk is front of mind. Yet while headline growth targets remain in sight, investors should also be aware that if key customer contracts shift or get scaled back...

Read the full narrative on Innodata (it's free!)

Innodata's narrative projects $350.9 million in revenue and $41.6 million in earnings by 2028. This requires 15.4% yearly revenue growth and a $1.1 million decrease in earnings from the current $42.7 million.

Uncover how Innodata's forecasts yield a $78.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

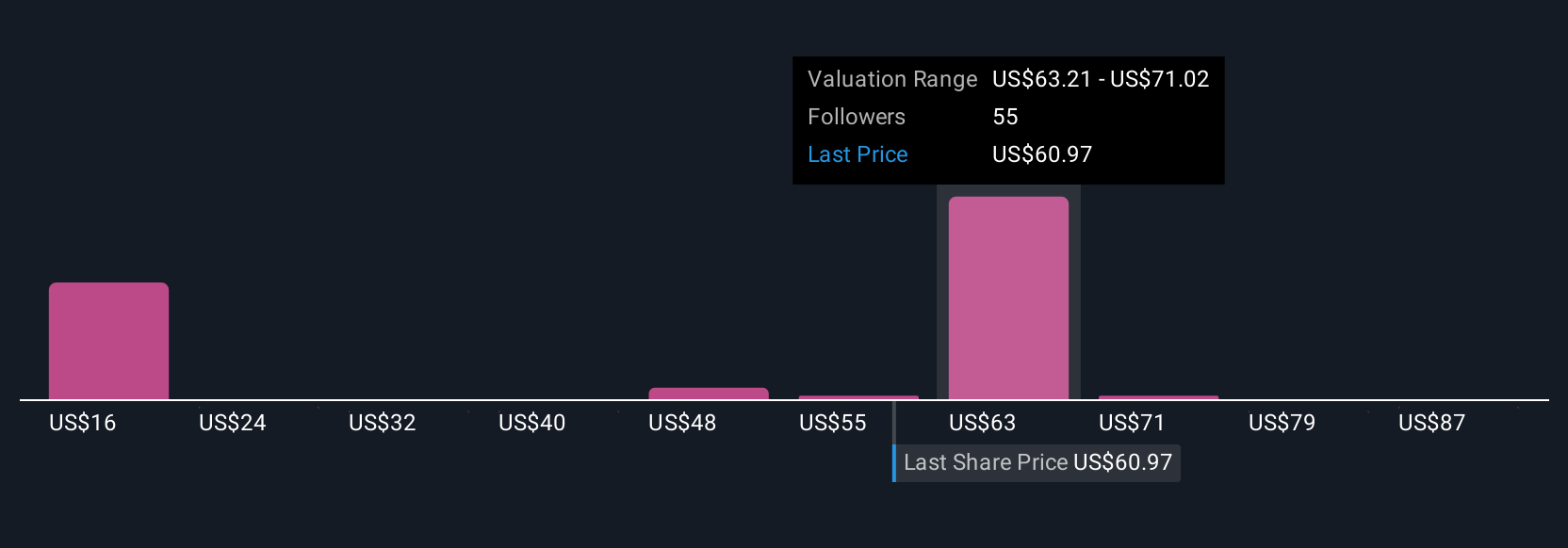

Sixteen members of the Simply Wall St Community estimate Innodata’s fair value spans from US$15.06 to US$94.45, illustrating sharply divergent outlooks. As you compare these views, consider how reliance on a handful of large clients could amplify both upside and downside in Innodata’s business.

Explore 16 other fair value estimates on Innodata - why the stock might be worth as much as 27% more than the current price!

Build Your Own Innodata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innodata research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Innodata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innodata's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives