- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Innodata (INOD) Is Up 43.2% After Breakthrough AI Contracts Drive Revenue and Profit Surge – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Innodata recently reported explosive revenue growth and moved into profitability, driven by significant new deals and an expanding pipeline in the AI data services market.

- This shift marks a strengthening of Innodata’s market position as enterprise demand for AI data solutions continues to accelerate.

- We'll explore how Innodata's surge in new AI contracts may influence its longer-term investment thesis and earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Innodata Investment Narrative Recap

To own Innodata, you need to believe its rapid expansion in AI data services can maintain momentum as contracts scale and customer demand grows. The latest surge in revenue and movement to profitability is a clear positive in the short term; however, the company remains highly exposed to a concentrated group of large clients, a lost contract could quickly swing earnings, so recent gains have not materially lowered this key risk.

The most impactful recent announcement is Innodata’s raised 2025 revenue guidance, now targeting at least 45% organic growth rather than the previous 40%. This update reflects growing confidence in the sales pipeline and directly ties to the company’s ability to win and expand large enterprise AI contracts, which remains the principal catalyst for both near-term revenue upside and continued market share gains.

However, it’s important for investors to note there’s still significant volatility risk if even one major customer reduces their spend or seeks in-house solutions...

Read the full narrative on Innodata (it's free!)

Innodata's narrative projects $350.9 million revenue and $41.6 million earnings by 2028. This requires 15.4% yearly revenue growth and a decrease in earnings of $1.1 million from $42.7 million currently.

Uncover how Innodata's forecasts yield a $64.40 fair value, a 20% upside to its current price.

Exploring Other Perspectives

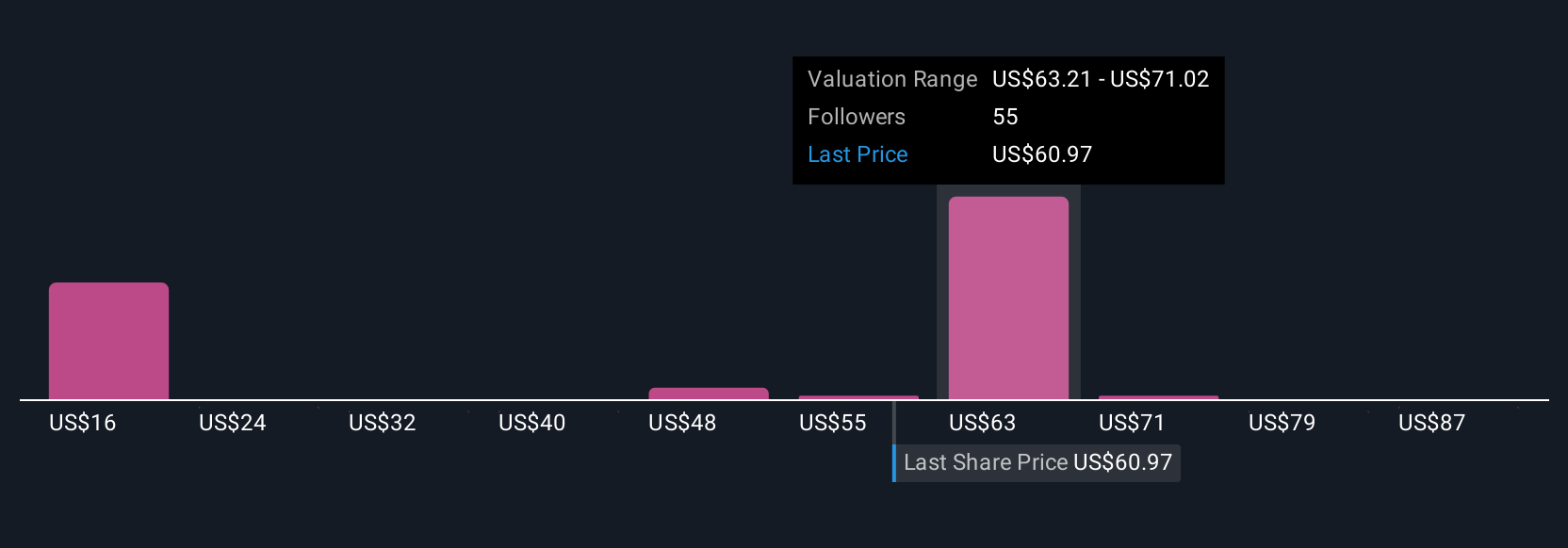

The Simply Wall St Community contributed 14 fair value estimates for Innodata, ranging widely from US$16.34 up to US$94.45 per share. While many individual views highlight possible under or overvaluation, the company’s dependence on a concentrated customer base means you should weigh the potential for abrupt revenue swings when reviewing these outlooks.

Explore 14 other fair value estimates on Innodata - why the stock might be worth as much as 76% more than the current price!

Build Your Own Innodata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innodata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innodata's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives