- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

A Look at Innodata’s (INOD) Valuation After Record Q3 Results and Strengthening AI Partnerships

Reviewed by Simply Wall St

Innodata (INOD) just reported its best-ever third quarter, as revenues, profitability, and cash balances all reached new highs. The company’s CEO emphasized continued growth and deeper partnerships with major tech and AI players.

See our latest analysis for Innodata.

Innodata’s share price has surged 48.8% over the past three months, showing strong momentum as investors digest record quarterly results and optimism about its AI-driven growth. For investors thinking longer-term, the stock’s 1-year total shareholder return of 25.4% and a remarkable 1,791% gain over three years highlight how much its story has evolved.

If breakthroughs in AI are on your radar, now is a good time to check out the market’s leaders in this space. See the full list of tech and AI growth stories here: See the full list for free.

With shares riding a wave of optimism and analysts pointing to even brighter prospects ahead, the key question now is whether Innodata remains undervalued in light of its progress, or if investors have already factored in its future growth potential.

Most Popular Narrative: 39.3% Undervalued

With the latest fair value estimate at $93.75, Innodata’s share price of $56.93 appears well below what the most widely followed narrative argues the company is worth. This gap in valuations forms the backdrop for what could be a pivotal period as both investors and management aim to seize on transformational growth in the AI sector.

Increasing adoption of AI across industries requires curated and high-quality datasets. Innodata's evolving role from simple data provider to strategic partner, working closely with clients' data scientists, is likely to support premium pricing, recurring contracts, and market share gains, with positive impact on both revenue stability and net margins.

Curious how this premium valuation forecast is built? One piece of the puzzle: the narrative banks on surprising efficiency gains and a bold upward trajectory in recurring revenues. Want the play-by-play behind these projections? Don’t miss the full narrative.

Result: Fair Value of $93.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as over-reliance on a handful of major tech clients and rising operational costs could quickly challenge this compelling growth narrative.

Find out about the key risks to this Innodata narrative.

Another View: Market Multiples Tell a Different Story

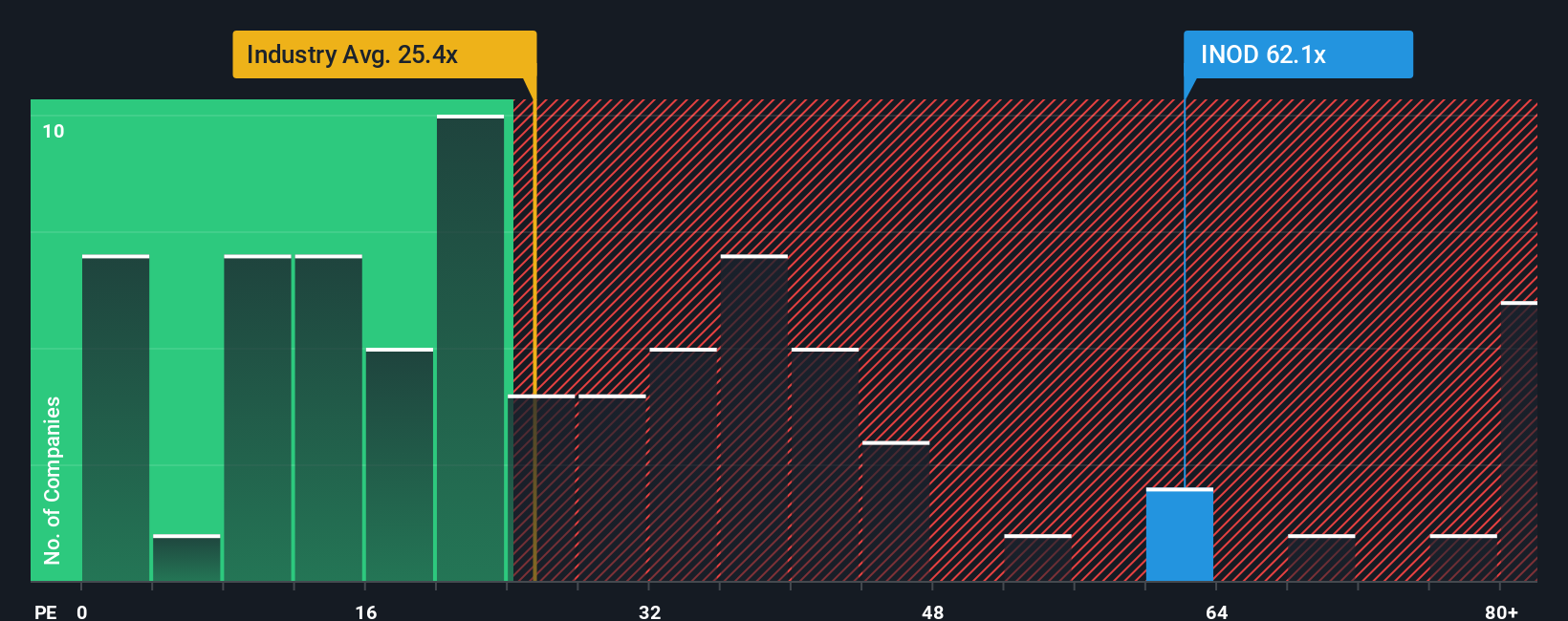

From a price-to-earnings perspective, Innodata’s valuation looks high at 53.9x, compared to the industry average of 23.8x, its peers at 37.2x, and even its fair ratio of 25.4x. This premium means investors are already expecting major growth. What happens if those high hopes cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Innodata Narrative

If this perspective does not quite match your own, or you like to dive into the numbers yourself, you can craft your own Innodata narrative in just a few minutes. Do it your way

A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You do not want to miss out on the next big trend. Use the Simply Wall Street Screener to uncover opportunities others might overlook and boost your portfolio’s potential.

- Benefit from steady streams of potential income as you browse these 14 dividend stocks with yields > 3% offering yields above 3% for reward-focused investors.

- Tap into some of the market’s most promising innovations by checking out these 30 healthcare AI stocks at the forefront of medicine and AI advancements.

- Catch momentum before others do by reviewing these 918 undervalued stocks based on cash flows packed with hidden gems currently trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success