- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

What Does an ICF International (ICFI) Board Member's Stock Purchase Reveal About Management Confidence?

Reviewed by Sasha Jovanovic

- Earlier this month, Randall Mehl, a board member at ICF International, purchased 1,000 shares of the company in open-market transactions, signaling personal confidence in the company's prospects.

- Insider buying at this level can offer investors a rare window into management’s outlook and is often viewed as a meaningful gesture of support for the business.

- We'll explore how this insider share purchase reflects executive sentiment and what it could mean for ICF International's broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

ICF International Investment Narrative Recap

To be a shareholder in ICF International, you would need to believe in the company’s ability to capitalize on growing demand for energy efficiency, technology, and disaster recovery services despite short-term federal contract challenges and integration risks. While Randall Mehl’s insider share purchase signals executive confidence, it does not materially alter the near-term catalyst of increasing commercial energy contracts or address the key risk of further U.S. government contract delays. Among the recent announcements, the new multi-year $40 million Southern California energy program contract awarded in August stands out. This contract aligns directly with ICF's catalyst of expanding commercial energy revenues, supporting the business case for margin resilience and offsetting some effects of federal funding pressures. Yet, in contrast to these growth drivers, investors should also be aware that ongoing reductions in government contract funding still represent...

Read the full narrative on ICF International (it's free!)

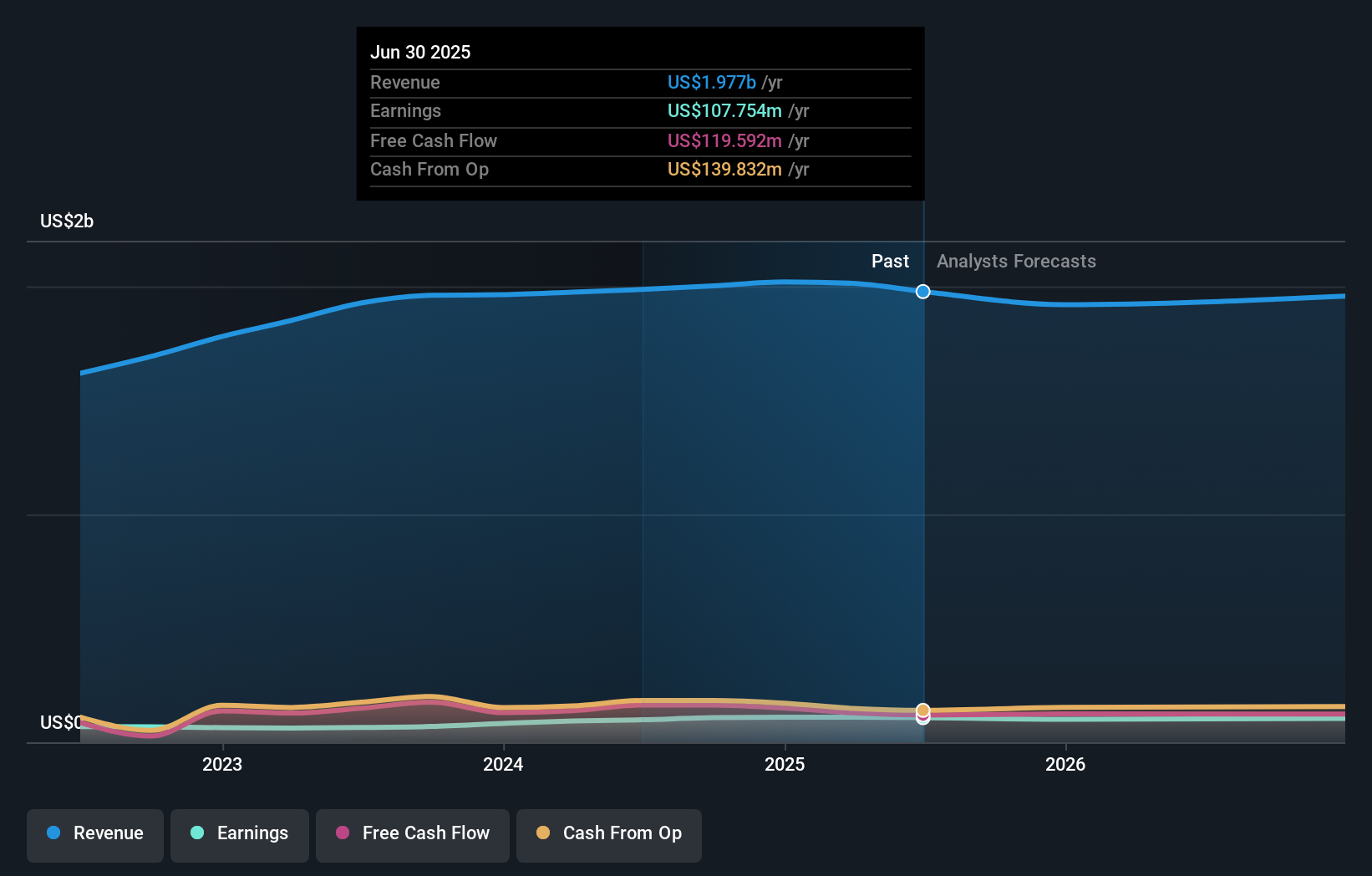

ICF International is projected to reach $1.9 billion in revenue and $97.8 million in earnings by 2028. This outlook is based on an expected annual revenue decline of 0.9% and a decrease in earnings of $10 million from the current $107.8 million.

Uncover how ICF International's forecasts yield a $103.25 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate ICF’s fair value from US$103.25 to US$127.10, showing a range of investor expectations. Yet, ongoing declines in federal contract activity could continue to weigh on short-term revenue and profit potential, highlighting why perspectives differ so widely.

Explore 2 other fair value estimates on ICF International - why the stock might be worth just $103.25!

Build Your Own ICF International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICF International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICF International's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives