- United States

- /

- Professional Services

- /

- NasdaqGS:HURN

If You Had Bought Huron Consulting Group (NASDAQ:HURN) Stock Five Years Ago, You'd Be Sitting On A 23% Loss, Today

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Huron Consulting Group Inc. (NASDAQ:HURN) shareholders for doubting their decision to hold, with the stock down 23% over a half decade. There was little comfort for shareholders in the last week as the price declined a further 1.2%.

Check out our latest analysis for Huron Consulting Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Huron Consulting Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 3.3% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

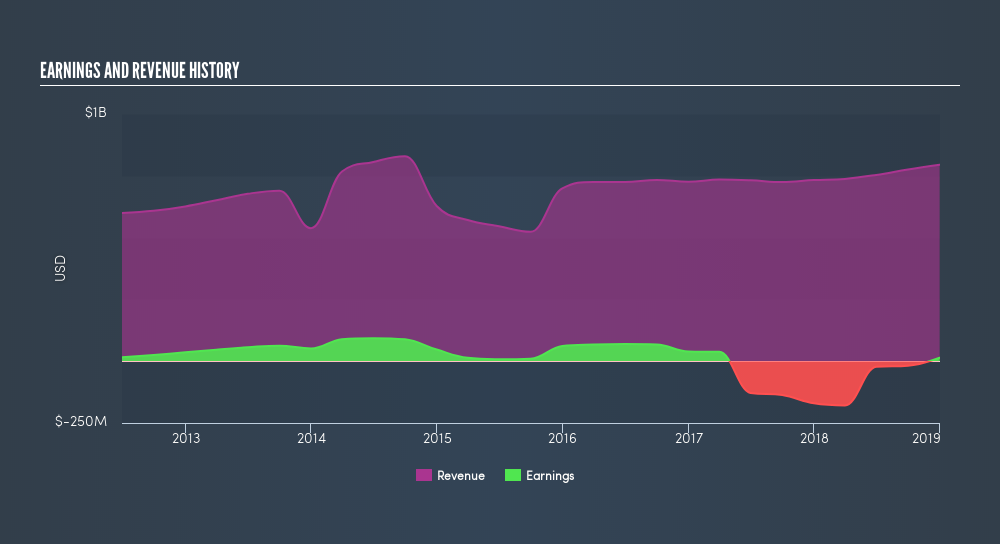

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We know that Huron Consulting Group has improved its bottom line lately, but what does the future have in store? So we recommend checking out this freereport showing consensus forecasts

A Different Perspective

It's good to see that Huron Consulting Group has rewarded shareholders with a total shareholder return of 22% in the last twelve months. Notably the five-year annualised TSR loss of 5.0% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before forming an opinion on Huron Consulting Group you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:HURN

Huron Consulting Group

Provides consultancy and managed services in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives