- United States

- /

- Professional Services

- /

- NasdaqGS:STRR

Market Still Lacking Some Conviction On Hudson Global, Inc. (NASDAQ:HSON)

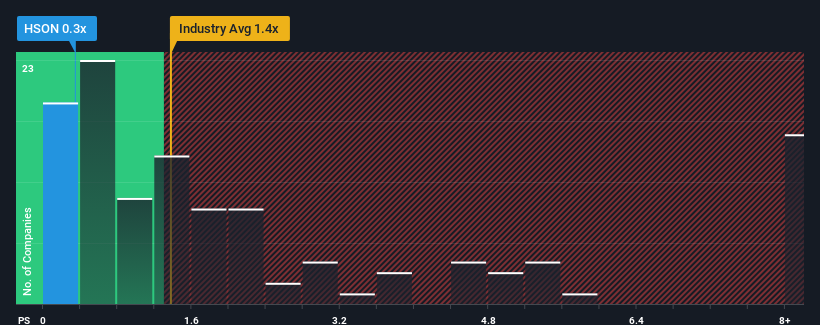

With a price-to-sales (or "P/S") ratio of 0.3x Hudson Global, Inc. (NASDAQ:HSON) may be sending bullish signals at the moment, given that almost half of all the Professional Services companies in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Hudson Global

How Hudson Global Has Been Performing

While the industry has experienced revenue growth lately, Hudson Global's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Hudson Global's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Hudson Global's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 9.3% over the next year. With the industry only predicted to deliver 5.5%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Hudson Global's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Hudson Global's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hudson Global you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRR

Star Equity Holdings

Provides talent solutions for mid-to-large-cap multinational companies and government agencies under the Hudson RPO brand in the Americas, the Asia Pacific, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives