- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

Is Healthcare Services Group (NASDAQ:HCSG) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Healthcare Services Group, Inc. (NASDAQ:HCSG) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Healthcare Services Group

How Much Debt Does Healthcare Services Group Carry?

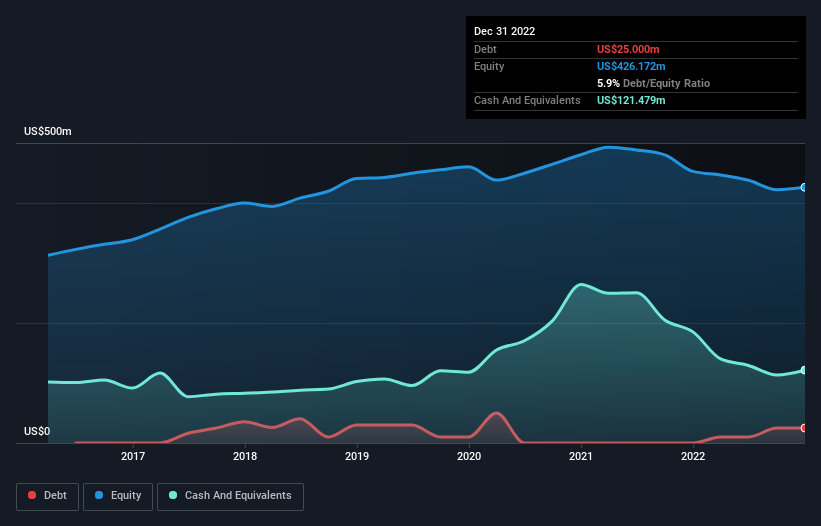

The image below, which you can click on for greater detail, shows that at December 2022 Healthcare Services Group had debt of US$25.0m, up from none in one year. But on the other hand it also has US$121.5m in cash, leading to a US$96.5m net cash position.

How Strong Is Healthcare Services Group's Balance Sheet?

According to the last reported balance sheet, Healthcare Services Group had liabilities of US$178.6m due within 12 months, and liabilities of US$113.5m due beyond 12 months. On the other hand, it had cash of US$121.5m and US$343.4m worth of receivables due within a year. So it actually has US$172.7m more liquid assets than total liabilities.

This surplus suggests that Healthcare Services Group is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Succinctly put, Healthcare Services Group boasts net cash, so it's fair to say it does not have a heavy debt load!

While Healthcare Services Group doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Healthcare Services Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Healthcare Services Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Healthcare Services Group actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Healthcare Services Group has net cash of US$96.5m, as well as more liquid assets than liabilities. The cherry on top was that in converted 103% of that EBIT to free cash flow, bringing in -US$13m. So we don't think Healthcare Services Group's use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Healthcare Services Group's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives