- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

Healthcare Services Group's (NASDAQ:HCSG) Dividend Will Be Increased To US$0.21

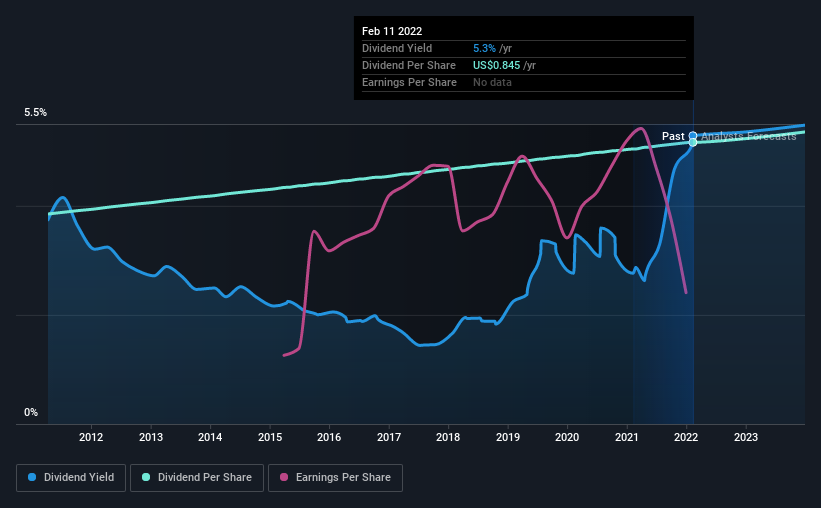

The board of Healthcare Services Group, Inc. (NASDAQ:HCSG) has announced that it will be increasing its dividend on the 25th of March to US$0.21. This will take the dividend yield to an attractive 5.2%, providing a nice boost to shareholder returns.

Check out our latest analysis for Healthcare Services Group

Healthcare Services Group Is Paying Out More Than It Is Earning

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, the company's dividend was higher than its profits, and made up 83% of cash flows. While the cash payout ratio isn't necessarily a cause for concern, the company is probably focusing more on returning cash to shareholders than growing the business.

Looking forward, earnings per share is forecast to fall by 14.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 164%, which could put the dividend in jeopardy if the company's earnings don't improve.

Healthcare Services Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2012, the dividend has gone from US$0.63 to US$0.84. This implies that the company grew its distributions at a yearly rate of about 3.0% over that duration. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Healthcare Services Group's earnings per share has shrunk at 10% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Healthcare Services Group will make a great income stock. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think Healthcare Services Group is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Healthcare Services Group (of which 1 doesn't sit too well with us!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet and fair value.

Market Insights

Community Narratives