- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

Healthcare Services Group (HCSG) Margin Decline Reinforces Profitability Concerns Against Bullish Growth Narratives

Reviewed by Simply Wall St

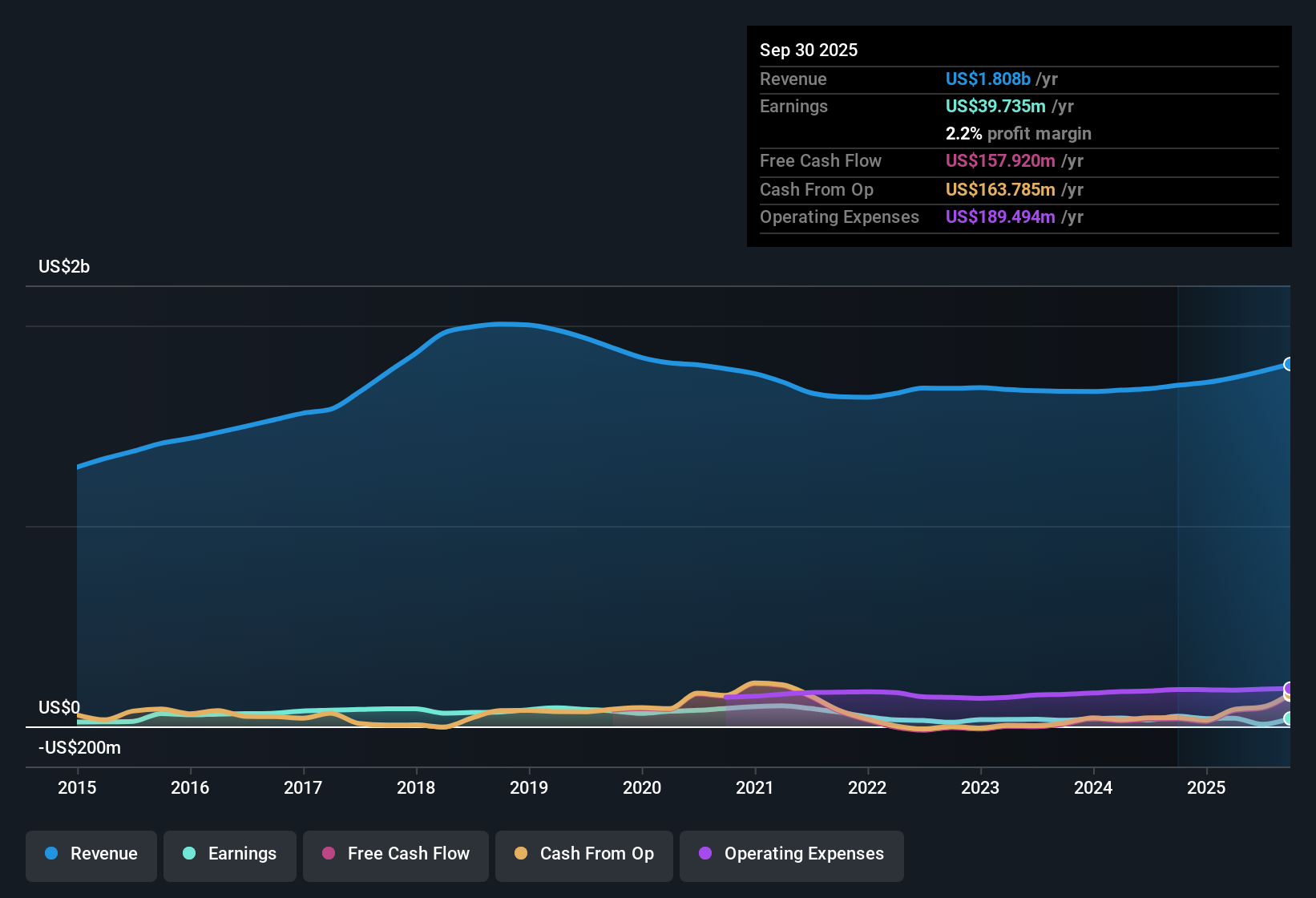

Healthcare Services Group (HCSG) reported net profit margins of 0.6%, down from 1.9% last year, highlighting compressed profitability. Earnings have declined by 26.7% annually over the last five years, but the company’s earnings are forecast to grow rapidly at 46.3% per year for the next three years, far outpacing the 15.5% US market average. Despite stronger growth prospects, revenue is only expected to grow at 5.2% per year, lagging the broader market’s 10.1% pace. Investors remain watchful given the sharp divergence between historical declines and bullish earnings forecasts.

See our full analysis for Healthcare Services Group.The big question now is how these results compare to the broader stories circulating in the market. Some expectations may be confirmed, while others could face a rethink as we dig into the prevailing narratives.

See what the community is saying about Healthcare Services Group

Margins Set to Climb from 0.6% to 5.8%

- Analysts anticipate profit margins will rise from the current 0.6% to 5.8% over the next three years, highlighting a shift from recent margin pressure toward substantial improvement if forecasts prove accurate.

- According to the analysts' consensus narrative, this expected margin expansion is driven by a combination of effective cost controls and the company's ability to pass some expense inflation on to customers, as well as solid 90%+ client retention.

- The targeted decline in SG&A and service costs as a percent of revenue is intended to support this improvement and directly backs up the case for sustained margin growth.

- Despite recent margin compression, consensus highlights that operational changes and bundled solutions across dining and environmental services could increase recurring revenue and earnings consistency.

See if analysts expectations of a margin turnaround match longer term market consensus for Healthcare Services Group. 📊 Read the full Healthcare Services Group Consensus Narrative.

Share Buyback and Reduced Outstanding Shares

- Management has launched a $50 million accelerated share buyback plan, and analysts expect the number of shares outstanding to decline by 1.2% per year for the next three years.

- The consensus narrative notes that this move is designed to deliver stronger earnings per share growth and could potentially draw increased investor attention as rising free cash flow and a strong balance sheet support the buyback.

- Analysts believe this buyback, combined with operational improvements, could help Healthcare Services Group achieve $123 million in earnings and $1.07 in earnings per share by September 2028, versus $10.8 million today.

- These targets assume that the company's continued focus on cross-selling, bundled solutions, and high client retention will support durable long-term EPS gains.

Premium Valuation Despite DCF Discount

- The current share price of $18.85 sits below the DCF fair value of $23.17, but Healthcare Services Group trades at a significant P/E premium at 126.2x compared to the industry average of 27.4x and peer average of 38.8x.

- The analysts’ consensus view suggests that while the discounted cash flow points to some upside, the stock’s lofty P/E ratio could limit new investor interest unless margin and earnings improvements materialize as expected.

- The analyst price target of $18.00 is only modestly above the current share price, signaling an expectation that the stock is fairly valued and further re-rating may depend on real bottom-line progress.

- What stands out is that despite future growth forecasts, the current premium to sector and industry multiples reflects notable market skepticism about the pace or durability of Healthcare Services Group’s turnaround.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Healthcare Services Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the numbers? Share your unique perspective and build your own narrative in just a few minutes. Do it your way.

A great starting point for your Healthcare Services Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Healthcare Services Group’s earnings outlook is improving, its current earnings quality and valuation are questionable because of compressed margins and a significant premium to peers.

If you want stocks with more reasonable pricing and potential upside, discover opportunities that look undervalued based on strong fundamentals by using these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives