- United States

- /

- Commercial Services

- /

- NasdaqCM:GFAI

Lacklustre Performance Is Driving Guardforce AI Co., Limited's (NASDAQ:GFAI) 47% Price Drop

Guardforce AI Co., Limited (NASDAQ:GFAI) shares have retraced a considerable 47% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

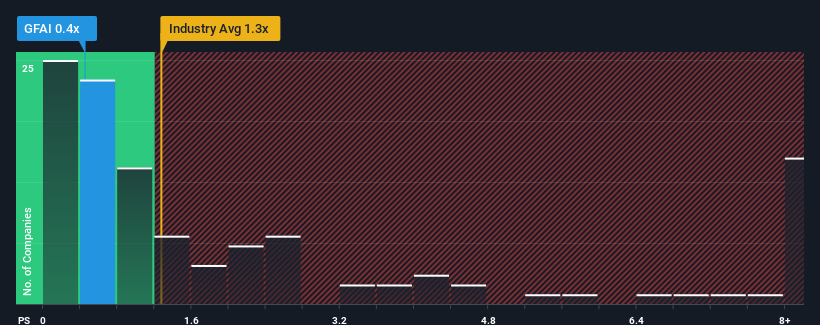

Since its price has dipped substantially, Guardforce AI may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Commercial Services industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Guardforce AI

What Does Guardforce AI's Recent Performance Look Like?

Guardforce AI could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Guardforce AI's future stacks up against the industry? In that case, our free report is a great place to start.How Is Guardforce AI's Revenue Growth Trending?

In order to justify its P/S ratio, Guardforce AI would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 4.0% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.1% each year as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.1% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Guardforce AI's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The southerly movements of Guardforce AI's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Guardforce AI's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 3 warning signs for Guardforce AI (2 are a bit concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GFAI

Guardforce AI

Engages in the provision of secured logistics services in the Asia Pacific.

Flawless balance sheet low.

Market Insights

Community Narratives