- United States

- /

- Commercial Services

- /

- NasdaqCM:FTEK

Fuel Tech, Inc.'s (NASDAQ:FTEK) Price Is Out Of Tune With Revenues

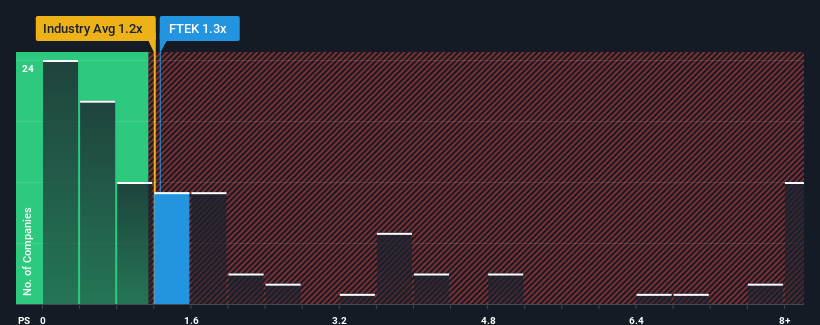

There wouldn't be many who think Fuel Tech, Inc.'s (NASDAQ:FTEK) price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S for the Commercial Services industry in the United States is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Fuel Tech

How Fuel Tech Has Been Performing

Fuel Tech could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fuel Tech.Is There Some Revenue Growth Forecasted For Fuel Tech?

Fuel Tech's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.3%. The latest three year period has also seen an excellent 31% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 10% per annum over the next three years. That's shaping up to be materially lower than the 20% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that Fuel Tech's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Fuel Tech's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Fuel Tech's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Fuel Tech that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FTEK

Fuel Tech

Engages in the development, commercialization, and application of technologies for air pollution control, process optimization, water treatment.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026