- United States

- /

- Pharma

- /

- NYSE:ANRO

Fuel Tech And 2 Other Promising Penny Stocks For Consideration

Reviewed by Simply Wall St

The U.S. stock market has recently faced turbulence, with major indices like the Dow Jones and Nasdaq experiencing declines amid renewed trade tensions and economic uncertainty. Despite these challenges, investors continue to explore diverse opportunities, including those presented by penny stocks. Although often associated with smaller or newer companies, penny stocks can offer significant potential for growth when backed by strong financials and solid business fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (OTCPK:SDCH) | $0.0456 | $12.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Perfect (NYSE:PERF) | $1.85 | $182.31M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.02 | $176.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Mofy AI (NasdaqCM:GMM) | $2.93 | $54.16M | ✅ 2 ⚠️ 4 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.38 | $55.02M | ✅ 1 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.48 | $87.41M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.51 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.847 | $5.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.21 | $70.83M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.8462 | $28.25M | ✅ 3 ⚠️ 6 View Analysis > |

Click here to see the full list of 732 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Fuel Tech (NasdaqCM:FTEK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fuel Tech, Inc. specializes in developing and commercializing technologies for air pollution control, process optimization, and water treatment, with a market cap of $49.13 million.

Operations: Fuel Tech, Inc. has not reported any specific revenue segments.

Market Cap: $49.13M

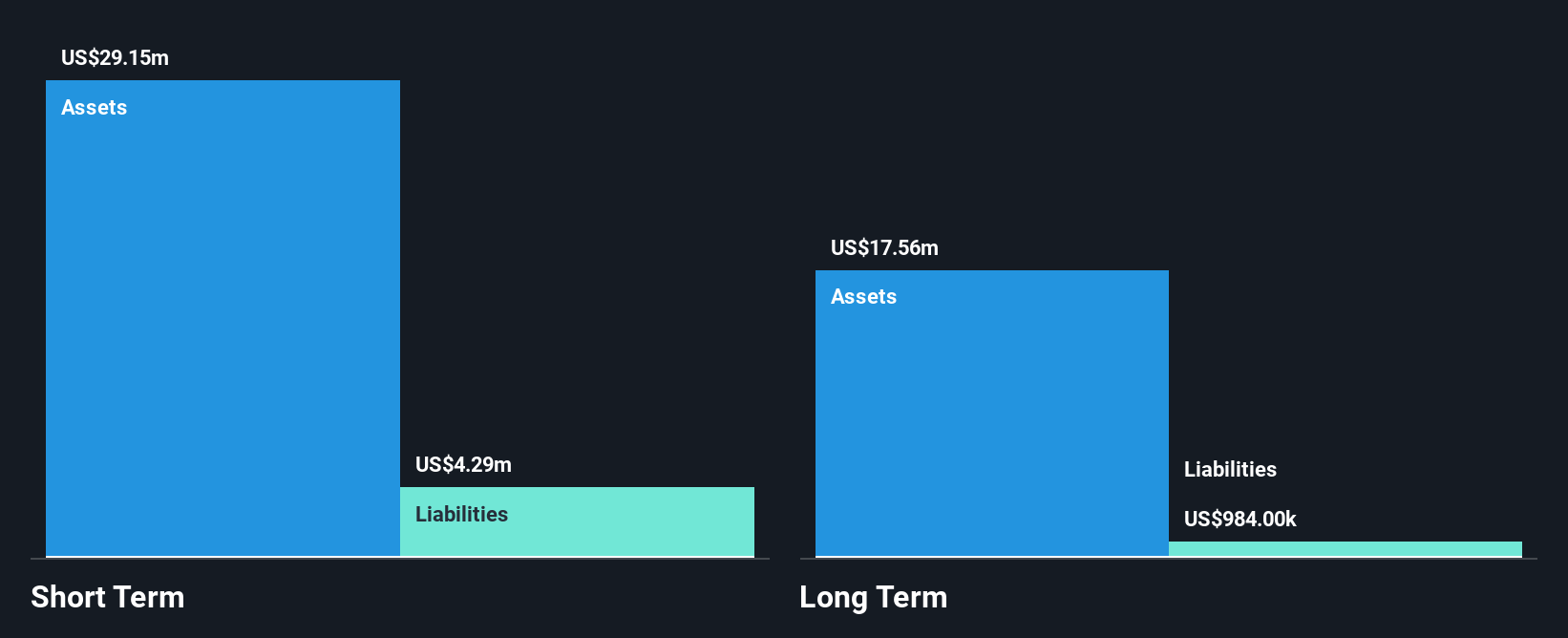

Fuel Tech, Inc., with a market cap of US$49.13 million, remains debt-free and has not significantly diluted shareholders over the past year. The company reported Q1 2025 sales of US$6.38 million but incurred a net loss of US$0.739 million, highlighting ongoing profitability challenges despite reducing losses by 44.5% annually over five years. Recent air pollution control orders totaling approximately US$4 million from customers in the U.S., Europe, and Japan indicate steady demand for its technologies. Fuel Tech's experienced management team and board contribute to its operational stability while it maintains a cash runway exceeding three years based on current free cash flow trends.

- Dive into the specifics of Fuel Tech here with our thorough balance sheet health report.

- Examine Fuel Tech's earnings growth report to understand how analysts expect it to perform.

I-Mab (NasdaqGM:IMAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: I-Mab is a biotech company that develops immuno-oncology agents for cancer treatment in the United States, with a market cap of $77.02 million.

Operations: I-Mab has not reported any specific revenue segments.

Market Cap: $77.02M

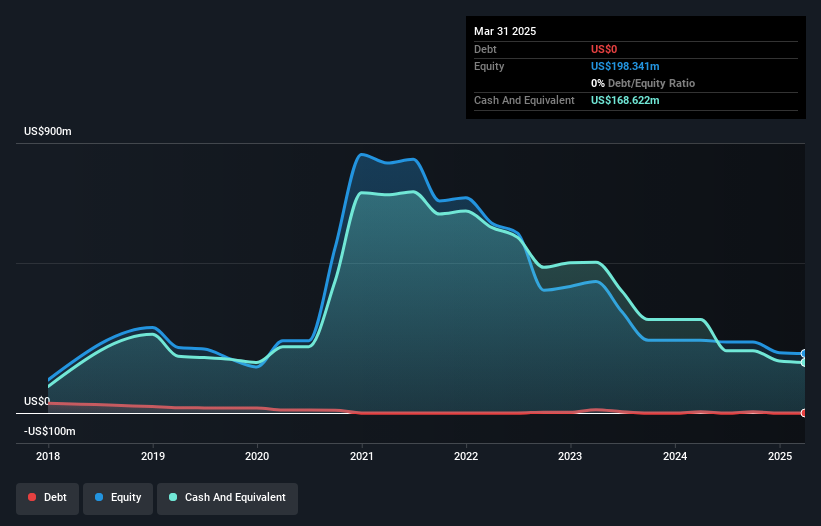

I-Mab, with a market cap of US$77.02 million, is pre-revenue and currently unprofitable but has reduced losses over the past five years. The company recently reported a Q1 2025 net loss of US$3.15 million, significantly down from the previous year's loss. Despite its financial challenges, I-Mab remains debt-free with short-term assets exceeding liabilities and holds sufficient cash for over three years based on current free cash flow. However, it faces potential delisting from Nasdaq due to non-compliance with the minimum bid price requirement but is actively working on regaining compliance by September 2025.

- Unlock comprehensive insights into our analysis of I-Mab stock in this financial health report.

- Gain insights into I-Mab's outlook and expected performance with our report on the company's earnings estimates.

Alto Neuroscience (NYSE:ANRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Neuroscience, Inc. is a clinical-stage biopharmaceutical company in the United States with a market cap of $77.16 million.

Operations: Alto Neuroscience, Inc. has not reported any revenue segments.

Market Cap: $77.16M

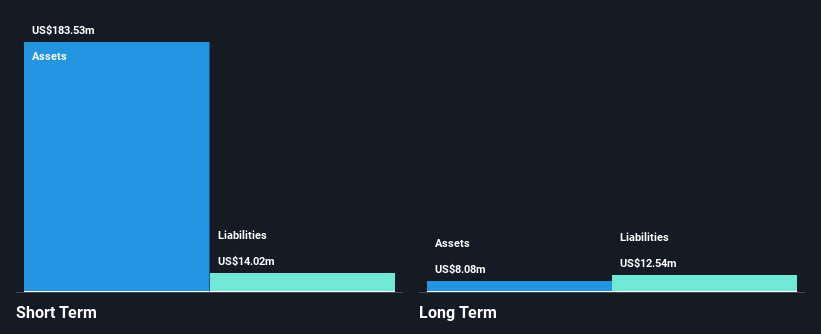

Alto Neuroscience, Inc., with a market cap of US$77.16 million, is pre-revenue and unprofitable, reporting a Q1 2025 net loss of US$15.17 million. Despite financial challenges, it has strong liquidity with short-term assets of US$163.5 million exceeding liabilities and more cash than debt. The company recently showcased significant advancements in EEG-based biomarkers for predicting placebo responses in MDD trials at the SOBP Annual Meeting, which could enhance trial precision and reduce variability. However, earnings are forecast to decline over the next three years without expected profitability during this period.

- Get an in-depth perspective on Alto Neuroscience's performance by reading our balance sheet health report here.

- Explore Alto Neuroscience's analyst forecasts in our growth report.

Key Takeaways

- Embark on your investment journey to our 732 US Penny Stocks selection here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANRO

Alto Neuroscience

Operates as a clinical-stage biopharmaceutical company in the United States.

Excellent balance sheet slight.

Market Insights

Community Narratives