- United States

- /

- Professional Services

- /

- NasdaqGS:FA

Does First Advantage’s 2025 Pullback Create a Valuation Opportunity After DCF Upside?

- Wondering whether First Advantage is a bargain or a value trap at today’s price? You are not alone. This article walks through what the numbers are really saying about the stock.

- The share price has slipped 3.7% over the last week, but it is still up 6.9% over the past month and remains well below where it started the year, down 26.7% year to date and 32.1% over the last 12 months, which has many investors reassessing its risk and reward profile.

- Recent headlines around tighter labor markets and ongoing demand for background screening services have put First Advantage back on some investors’ radars, as businesses look for scalable compliance and verification tools. At the same time, concerns about macro uncertainty and corporate hiring budgets have helped keep the share price in check, creating a gap between sentiment and fundamentals that we will explore.

- On our checklist based valuation framework, First Advantage scores a 3 out of 6. This means it looks undervalued on half of the metrics we track. In the next sections we will dig into those methods and then finish by looking at a more holistic way to think about valuation that goes beyond any single model.

Find out why First Advantage's -32.1% return over the last year is lagging behind its peers.

Approach 1: First Advantage Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, so that distant cash is not treated as valuable as cash received now.

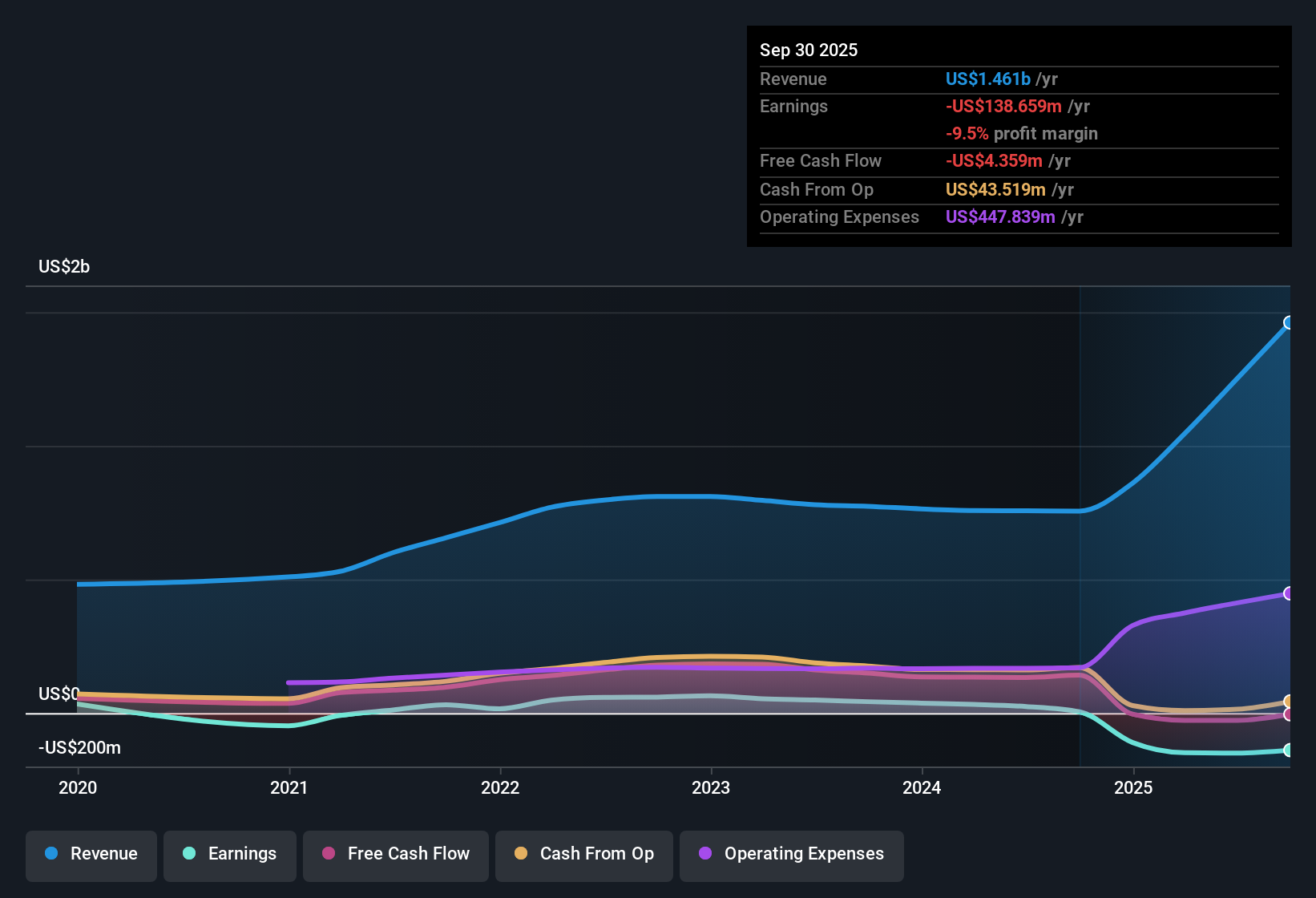

For First Advantage, the 2 Stage Free Cash Flow to Equity model starts from last twelve month free cash flow of around $7.1 million in the red, then uses analyst forecasts and gradual growth assumptions from Simply Wall St. Analysts project free cash flow rising to about $205.6 million in 2026 and $235 million in 2027, with extrapolated estimates reaching roughly $366.9 million by 2035 as the business scales.

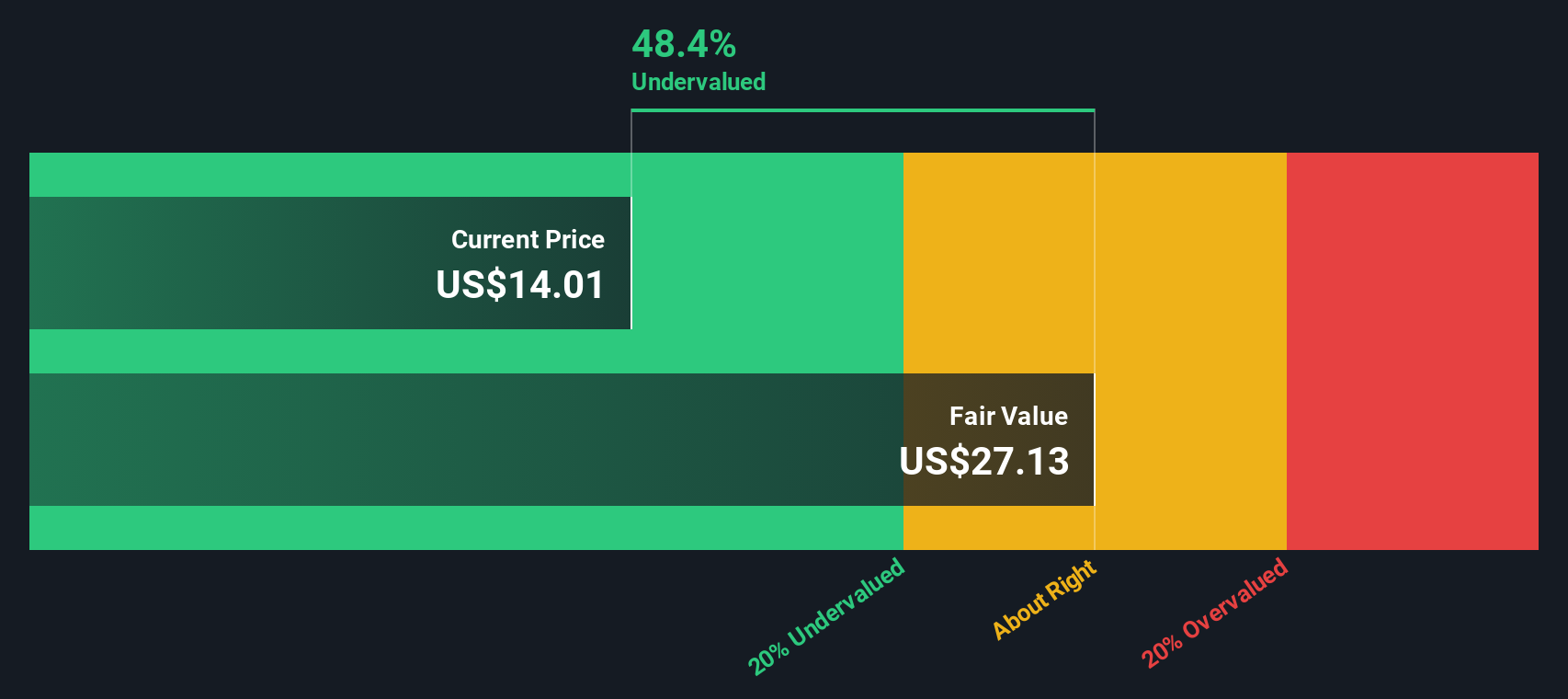

When all these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $27.59 per share. Compared to the current market price, this suggests the stock may be trading at roughly a 51.1% discount, assuming these cash flow expectations occur as modeled.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests First Advantage is undervalued by 51.1%. Track this in your watchlist or portfolio, or discover 935 more undervalued stocks based on cash flows.

Approach 2: First Advantage Price vs Sales

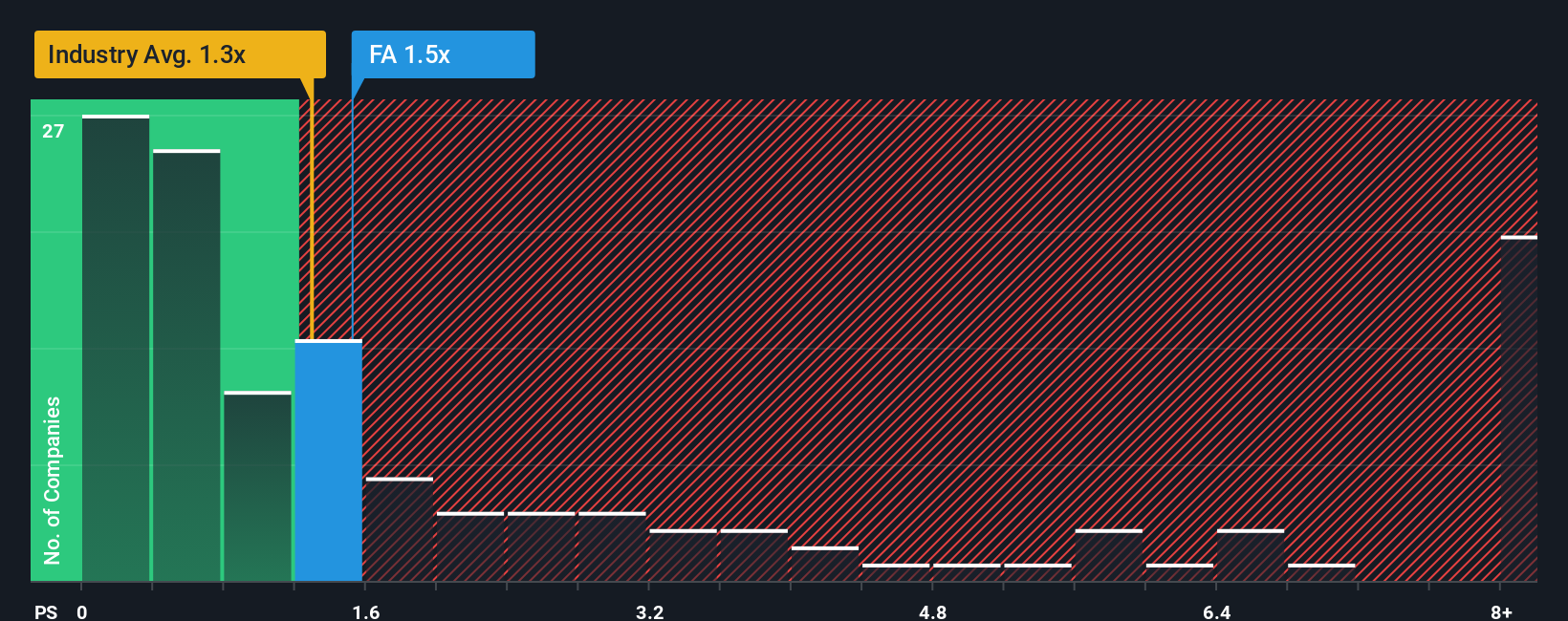

For companies like First Advantage that are still normalizing profitability, the Price to Sales, or P S, ratio is a practical way to compare what investors are paying for each dollar of revenue, rather than for still volatile earnings.

In general, faster growing and lower risk businesses can justify a higher P S multiple, while slower growth or higher uncertainty tends to pull that multiple down toward a more modest range. That is why context is crucial when deciding what a reasonable P S ratio should be.

First Advantage currently trades on a P S ratio of about 1.61x. This sits slightly above the Professional Services industry average of around 1.31x, and also above the peer group average of roughly 1.44x, suggesting the market is already paying a small premium for its revenues. Simply Wall St calculates a Fair Ratio of about 1.59x for First Advantage, a proprietary estimate of what the P S should be after factoring in the company’s growth outlook, risk profile, profit margins, industry positioning and market cap. Because this Fair Ratio is tailored to the company’s fundamentals, it is more informative than a simple comparison with peers or the industry in isolation. With the actual 1.61x sitting very close to the 1.59x Fair Ratio, the shares appear to be fairly priced on this measure.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Advantage Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of First Advantage’s story with a concrete forecast and Fair Value estimate. A Narrative is your explanation for how the business will grow, what its future revenue, earnings and margins might look like, and what you think the stock is worth based on those assumptions. On Simply Wall St’s Community page, used by millions of investors, you can choose or create a Narrative that links your story about First Advantage to specific numbers, which are then turned into a Fair Value you can compare against the current share price to inform your own decision to buy, hold, or sell. Because these Narratives update dynamically when new earnings, news, or guidance arrive, your view of Fair Value evolves as the facts do. For example, some investors might back a more optimistic Narrative with a Fair Value near $21.0, while others prefer a cautious Narrative closer to $16.0, reflecting very different expectations for First Advantage’s long term performance.

Do you think there's more to the story for First Advantage? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FA

First Advantage

Provides employment background screening, identity, and verification solutions worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.