- United States

- /

- Professional Services

- /

- NasdaqGS:EXPO

A Look at Exponent (EXPO) Valuation as Shares Trade Sideways

Reviewed by Simply Wall St

See our latest analysis for Exponent.

While Exponent's share price has edged up modestly in the past week, the bigger story is the stock’s multi-year drift. The recent one-year total shareholder return is down almost 35%, and the five-year total shareholder return is essentially flat. Despite interim rebounds, momentum remains soft as investors re-evaluate growth prospects and risk appetite around the $69.06 level.

Curious about which other companies have been drawing renewed interest? Now might be the perfect time to use our screener and discover fast growing stocks with high insider ownership.

With performance lagging and the price trading below analyst targets, investors are left to consider whether Exponent is undervalued right now, or if the market is simply reflecting cautious expectations for its future growth.

Most Popular Narrative: 21.5% Undervalued

Exponent’s latest close sits well below the most popular narrative’s calculated fair value, suggesting a significant gap between the market’s caution and analyst conviction. The following excerpt highlights why insiders see enduring strength beneath Exponent’s recent sluggish price and earnings trends.

The intensifying focus on safety, risk management, and product reliability, especially in emerging fields such as advanced driver assistance systems, battery storage, and wearables, is positioning Exponent as a preferred partner for critical litigation and proactive risk projects. This should help sustain premium pricing and secure net margins as these markets expand.

Want to know what powers this big upside call? There are bold expectations for future growth, margin resilience, and a striking multiple. Serious assumptions are at play. Which critical forecasts set these numbers apart? The story behind the math is one click away.

Result: Fair Value of $88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin contraction and slowing utilization could challenge Exponent’s ability to sustain earnings growth in the near term. This may potentially test analyst optimism.

Find out about the key risks to this Exponent narrative.

Another View: High Market Multiple Raises Questions

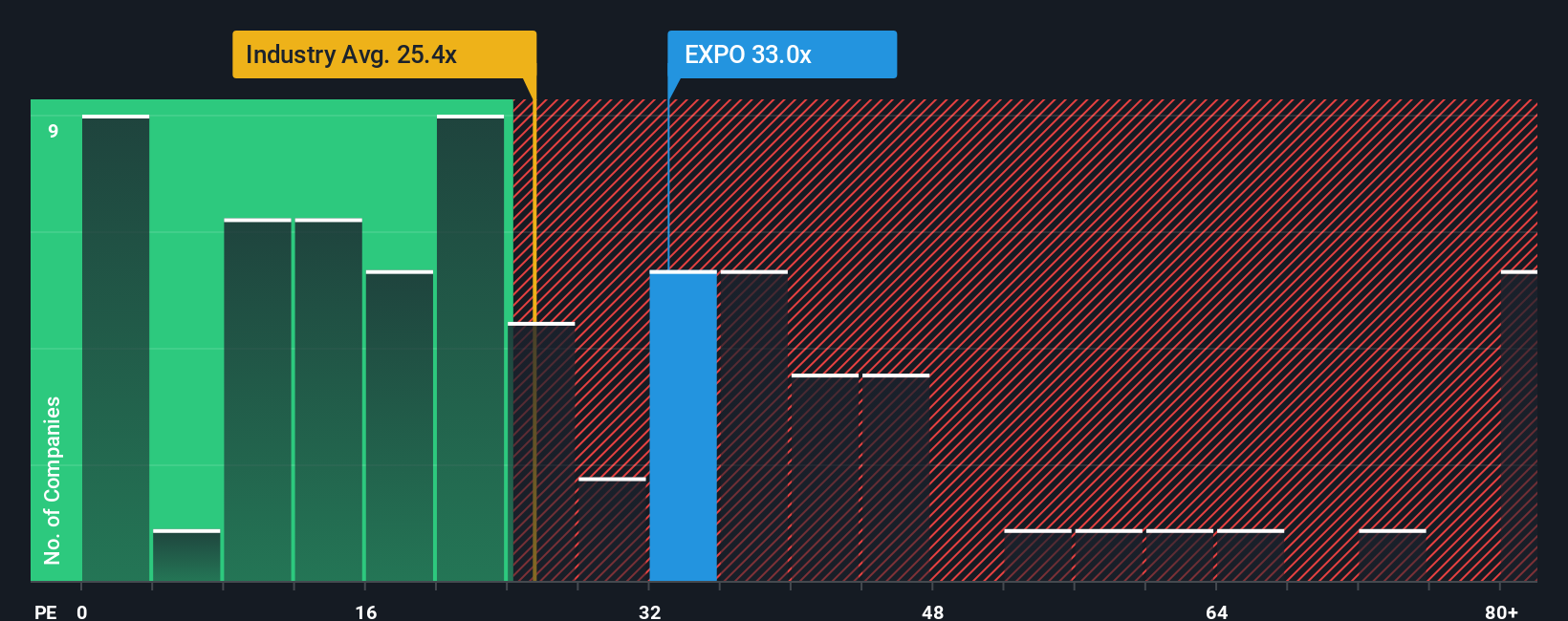

Instead of focusing on discounted future cash flows, let’s look at valuation through the price-to-earnings lens. Exponent trades at 33.9 times earnings, well above the industry average of 25.6 and also higher than both the peer average of 17.5 and a fair ratio of 21.8. This richer multiple raises valuation risk. If the market starts favoring companies closer to those benchmarks, prices could come under pressure. Are investors paying up for quality, or overlooking looming risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exponent Narrative

If you want to reach your own conclusion or dive deeper, you can look at the data and craft your own perspective in just minutes. Do it your way

A great starting point for your Exponent research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by checking out stocks beyond Exponent that are capturing investor attention for their innovation, performance, and market potential. Don’t be the one who looks back and wishes they had acted sooner. Seize the opportunity with these powerful tools.

- Uncover emerging technology players making headlines in artificial intelligence with these 24 AI penny stocks and see which companies are blazing a new trail.

- Boost your passive income strategy by unlocking opportunities among these 17 dividend stocks with yields > 3% offering robust yields above 3%.

- Ride the next big wave in digital finance by tapping into these 79 cryptocurrency and blockchain stocks transforming how the world transacts and invests.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exponent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPO

Exponent

Operates as a science and engineering consulting company in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives