- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

Is Accelerated AI Adoption and Raised Outlook Reframing the Investment Case for ExlService Holdings (EXLS)?

Reviewed by Sasha Jovanovic

- ExlService Holdings recently reported strong fiscal Q3 2025 results, surpassing both revenue and earnings per share estimates and raising its full-year revenue outlook.

- An important development is that 56% of total revenue now comes from data and AI-powered solutions, with significant Insurance segment growth linked to client adoption of AI-driven operations.

- We’ll explore how management’s emphasis on accelerated AI adoption and increased revenue guidance influence ExlService Holdings’ current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ExlService Holdings Investment Narrative Recap

If you’re considering ExlService Holdings, the conviction starts with belief in long-term demand for data and AI-powered solutions, particularly as highly regulated sectors like insurance and healthcare accelerate digital adoption. The recent results underscore management’s focus on AI-driven workflow adoption, boosting short-term outlooks; however, the most immediate catalyst, continued client transition to AI solutions, remains balanced by the persistent risk that clients could eventually migrate to in-house or alternative automation platforms. This risk wasn’t materially altered by the recent news, but it does remain central to any thesis on the company.

The October announcement of a record share repurchase, over 3 million shares in Q3 alone, stands out for investors following the company’s capital allocation strategy. While not directly tied to the AI-driven narrative, this move complements recent upbeat earnings and guidance, potentially adding support for per-share metrics at a time when ExlService has highlighted adaptability in shifting toward higher-margin offerings amid rapid industry changes.

But on the flip side, investors need to be aware that as clients become more AI-savvy, the risk of internalizing these solutions rather than outsourcing to ExlService...

Read the full narrative on ExlService Holdings (it's free!)

ExlService Holdings' narrative projects $2.7 billion revenue and $326.3 million earnings by 2028. This requires 10.9% yearly revenue growth and an $90 million earnings increase from $236.3 million.

Uncover how ExlService Holdings' forecasts yield a $52.29 fair value, a 32% upside to its current price.

Exploring Other Perspectives

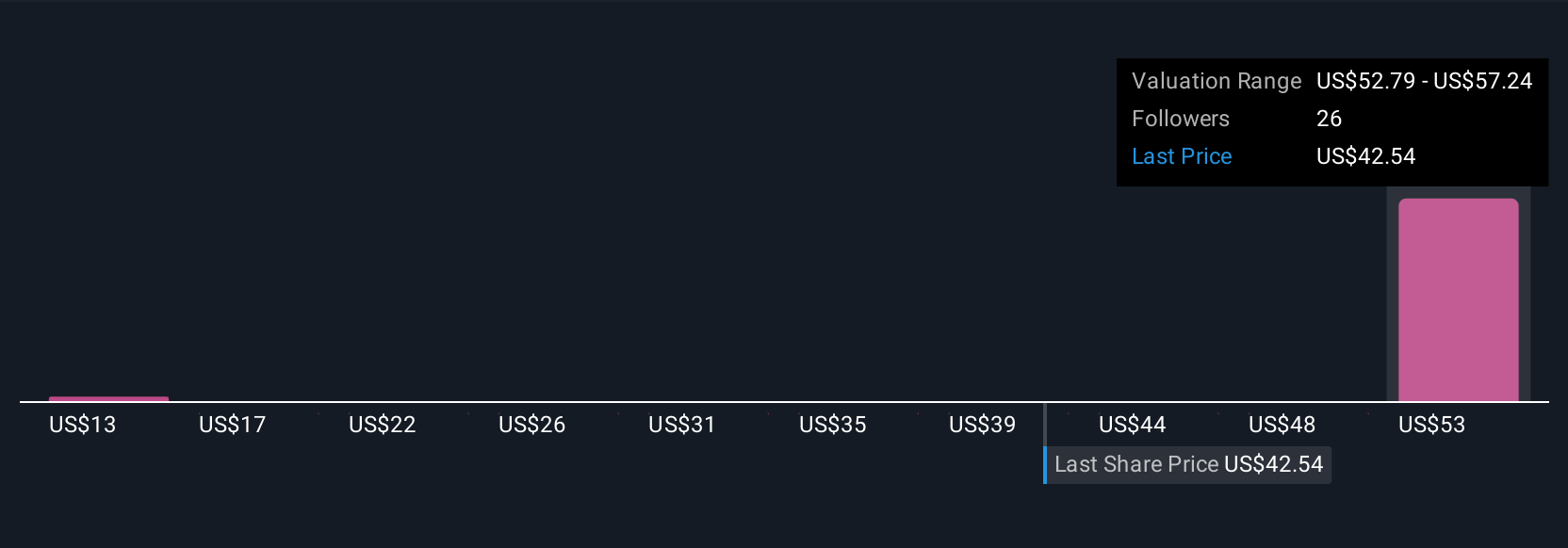

Two community-generated fair value estimates for ExlService Holdings span a narrow US$52.29 to US$57.36 range, reflecting moderate but closely aligned views among private investors on its potential. Even as optimism builds around AI-related revenue growth, many see the ongoing possibility that technological shifts could change outsourcing demand, suggesting it is worth exploring other market opinions before deciding your next move.

Explore 2 other fair value estimates on ExlService Holdings - why the stock might be worth as much as 44% more than the current price!

Build Your Own ExlService Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ExlService Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ExlService Holdings' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives