- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

ExlService Holdings (EXLS) Posts 28.5% Earnings Growth, Reinforcing Bullish Investor Narratives

Reviewed by Simply Wall St

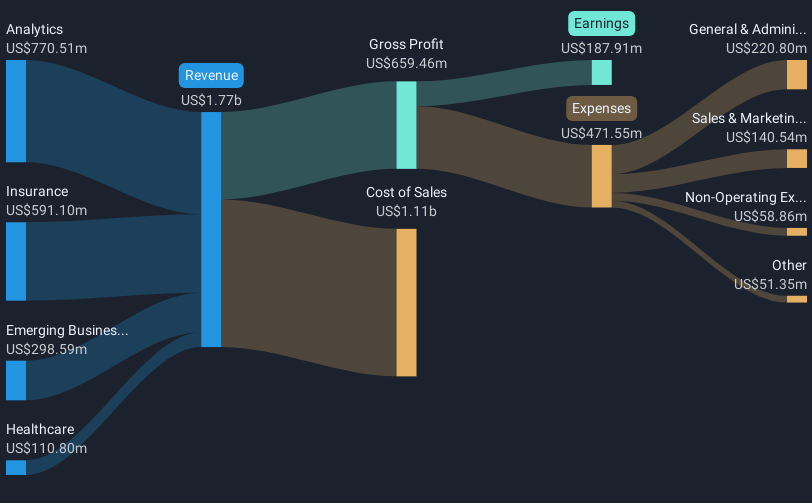

ExlService Holdings (EXLS) reported revenue that is forecast to grow at 10.4% per year, just ahead of the US market’s 10.2%, while net income delivered a standout 28.5% gain over the past year. Over the past five years, earnings have compounded at 19% annually, and net profit margins climbed to 11.9% from 10.6%, marking a further boost in profitability. With no identified risks and several upside factors in play, including favorable valuation metrics and a share price below analyst targets, investors are likely to view these results as a constructive signal for near-term performance.

See our full analysis for ExlService Holdings.Next, we’ll see how these headline numbers compare with the main stories and expectations circulating in the market, taking a closer look at how the company’s performance aligns with the broader narratives.

See what the community is saying about ExlService Holdings

AI-Led Revenue Mix Drives Margin Expansion

- Revenue per employee is increasing as ExlService shifts toward more data-driven and AI-powered services, helping drive net profit margin up to 11.9% from 10.6% even as the company invests heavily in new technologies.

- According to the analysts' consensus view, expanding AI and digital offerings create higher-margin, defensible service lines that should protect earnings as traditional usage-based contracts evolve.

- Deep proprietary data platforms and domain expertise give ExlService an edge, supporting the consensus view that operating leverage and scalability will sustain margin improvement. Margin gains of over 1 percentage point already support this thesis.

- The shift to outcome-based commercial models aligns management strategy with analysts' forecasts for earnings per share rising from $1.92 to $2.65 over the next three years, reinforcing long-term stability in profit growth.

To see how these operational shifts fit the big-picture consensus, get the full story in the analysts’ narrative: 📊 Read the full ExlService Holdings Consensus Narrative.

Price-to-Earnings Discount vs Industry Peers

- ExlService trades at a 25.3x price-to-earnings ratio, below the peer average of 33.4x and the industry average of 27.2x, while delivering higher historical earnings growth, signaling investors may be undervaluing its sustained profitability.

- The consensus narrative points out that despite strong compounding earnings and margin trends, the market is not pricing ExlService at a premium, perhaps due to caution over future industry dynamics.

- Even with analyst forecasts for revenue growth of 10.9% annually and margin expansion, valuation remains restrained. This underscores a potential disconnect between robust fundamentals and current market expectations.

- The 18.5% gap between the current share price ($38.54) and the nearest consensus price target ($52.71) reflects this ongoing hesitance, despite ExlService’s track record of outpacing industry averages.

Long-Term Risks: Margin Pressure and Sector Exposure

- Analysts project profit margins will see only modest improvement, reaching 12.2% in three years from 12.0% today, as rising wage inflation in key outsourcing hubs like India and the Philippines continues to elevate costs.

- The consensus narrative flags sector concentration and compliance challenges as principal risks, highlighting that heavy reliance on insurance and healthcare clients could amplify earnings volatility.

- Exposure to fast-changing regulatory environments in those sectors carries real risk for cross-border profitability, especially as new data privacy rules and reimbursement changes increase compliance costs.

- Margin gains may be limited by talent shortages. Costs have grown 16 to 17 percent despite only 9 percent headcount increases, which could dilute the benefits of higher-value service offerings if not managed proactively.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ExlService Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the results from a different angle? Share your unique take and craft a fresh narrative in just a few moments. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding ExlService Holdings.

See What Else Is Out There

While ExlService continues to grow revenue and margins, its concentrated sector exposure and rising costs could limit further profit expansion and add volatility.

If you want to focus on steadier performers with consistent top and bottom-line results, see which companies stand out in our stable growth stocks screener (2122 results) selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives