- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

Assessing ExlService Holdings After Spring Transformation Deals and a 1.9% Share Rebound

Reviewed by Bailey Pemberton

Ever find yourself wondering whether now is the moment to make a move on ExlService Holdings? If you have been watching this stock, it probably feels like a crossroads. There are solid arguments on either side of the buy, hold, or sell debate. In the last week, shares have edged up 1.9%, a gentle rebound after a tricky June that saw the price slide 5.2%. Even with this recent slump, the stock has delivered a respectable 7.0% gain over the past year and an eye-catching 169.5% jump across five years, signaling staying power and ongoing investor interest.

These price movements haven't happened in a vacuum. While major headlines have been relatively quiet lately, business transformation deals announced by ExlService Holdings earlier this spring have kept the company in industry conversations and could be shaping investor sentiment about long-term growth. The stock’s negative year-to-date return of -6.2% hints at shifting perceptions of risk, but also at the potential for a comeback should positive catalysts arise.

When it comes to value, ExlService Holdings earns a solid 4 out of 6 on our valuation score, indicating it looks undervalued by multiple standard measures but still has room for debate. Up next, we will break down exactly which valuation approaches reveal the most about where this stock stands, and later explore a fresh perspective that might be the key to making your decision even easier.

Approach 1: ExlService Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and then discounting them back to their present value. This approach provides a forward-looking measure of value, accounting for both current performance and future growth expectations.

For ExlService Holdings, the most recent reported Free Cash Flow stands at $272.96 million. Analyst forecasts project this figure will rise to $329 million by the end of 2027. Looking further out, extrapolated projections suggest Free Cash Flow could reach approximately $475 million by 2035. These steady increases point to a business with a promising growth trajectory, powered by consistent performance in its sector.

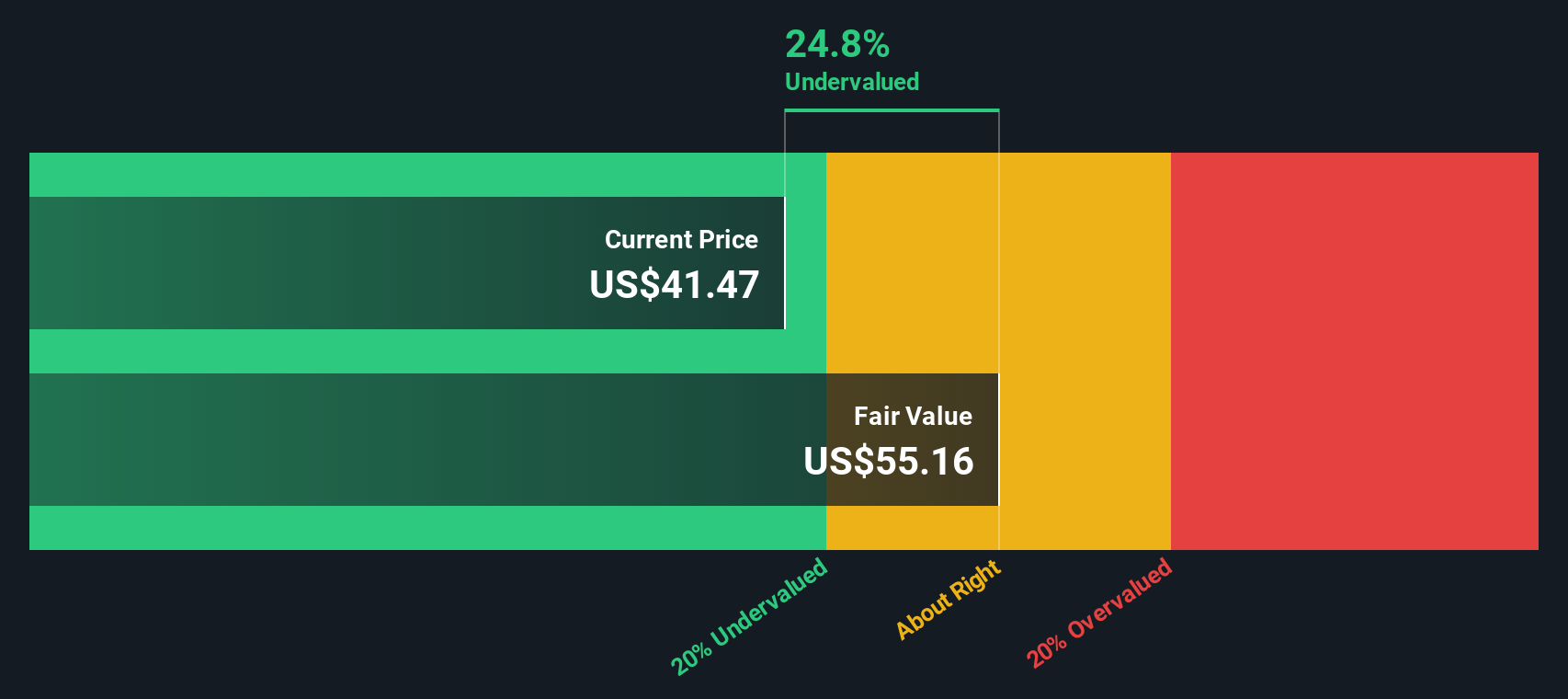

Based on this DCF analysis, the estimated intrinsic value per share comes to $55.13. With shares currently priced at a 24.8% discount compared to this valuation, the data suggest the stock is notably undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ExlService Holdings is undervalued by 24.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ExlService Holdings Price vs Earnings

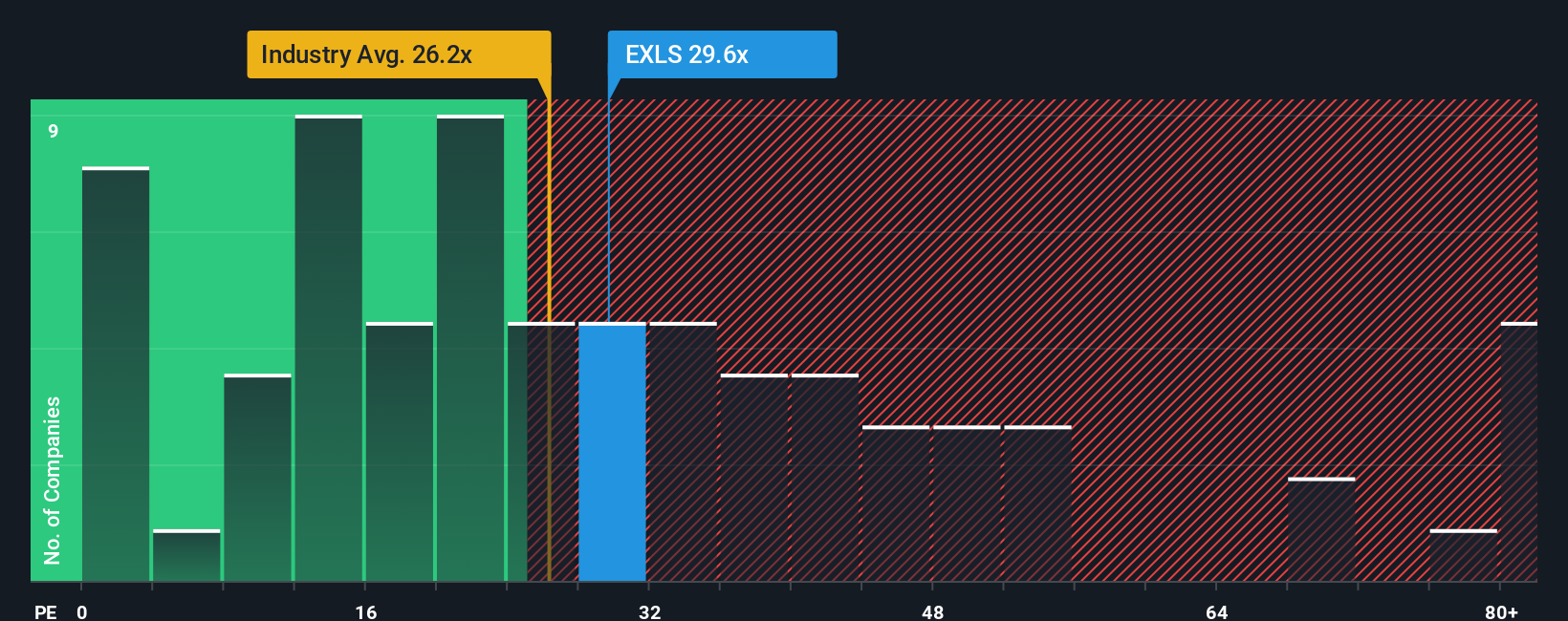

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like ExlService Holdings because it allows investors to assess how much they are paying for each dollar of earnings. This measure works best when a company has consistent earnings, as it can be easily compared across industry peers and historical averages.

It is important to note that growth prospects and perceived risk play a significant role in what constitutes a “normal” or “fair” PE ratio. Companies with stronger growth and lower risk typically command higher PE multiples, while slower-growing or riskier firms tend to have lower ratios.

ExlService Holdings currently trades on a PE ratio of 28.3x, which is above the Professional Services industry average of 27.0x but below the peer average of 34.1x. While these comparisons are useful, they do not always reflect the nuances of the business, such as specific growth drivers, profit margins, or unique risks.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for ExlService Holdings stands at 25.3x and reflects an analysis that factors in the company’s earnings growth, profit margins, risk profile, industry classification, and market cap. This tailored approach provides a clearer picture of what investors should expect to pay based on ExlService Holdings’ actual fundamentals, instead of relying solely on broad comparisons with peers or the sector.

Since the stock's current PE ratio is just a few points above its Fair Ratio, this suggests that shares are trading slightly above what fundamentals justify, but not by a wide margin.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

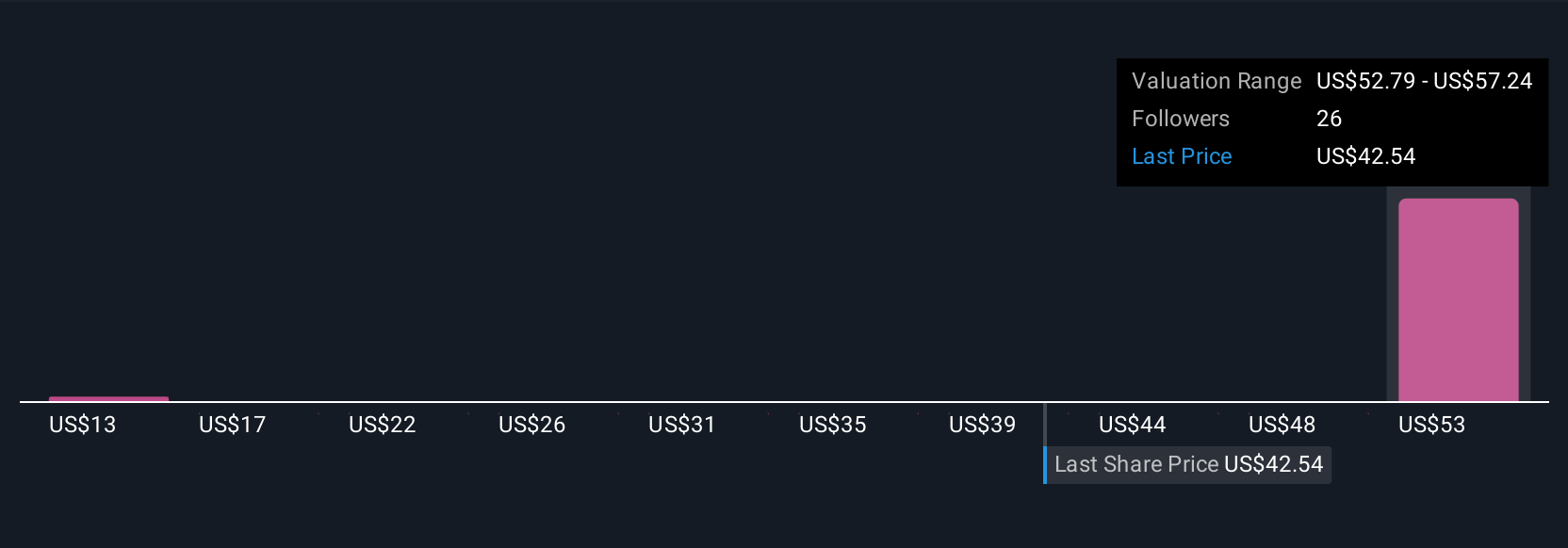

Upgrade Your Decision Making: Choose your ExlService Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story and outlook on a company, bringing together what you believe about its future revenue, earnings and margins, and connecting that directly to a fair value. Instead of relying solely on numbers, Narratives make it easy for investors to blend data with their real-world perspective, linking a company's journey and catalysts to the financial forecast and implied value. On Simply Wall St’s Community page, millions of investors can quickly build or browse Narratives, compare their own scenario to others, and see in real time how new developments or earnings shape the outlook. Narratives reveal at a glance if you think ExlService Holdings is a buy or sell, since your fair value estimate is compared directly to the latest share price and updates dynamically when forecasts or news change. For example, one Narrative sees ExlService Holdings thriving from accelerated AI adoption and strong competitive advantages, supporting a price target of $54.14 per share, while another highlights risks from rising competition, tighter regulation and sector concentration, estimating fair value closer to $44.12. Narratives let you explore all sides and make smarter decisions, all in one place.

Do you think there's more to the story for ExlService Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives