- United States

- /

- Consumer Services

- /

- NasdaqGS:DRVN

Some Confidence Is Lacking In Driven Brands Holdings Inc.'s (NASDAQ:DRVN) P/S

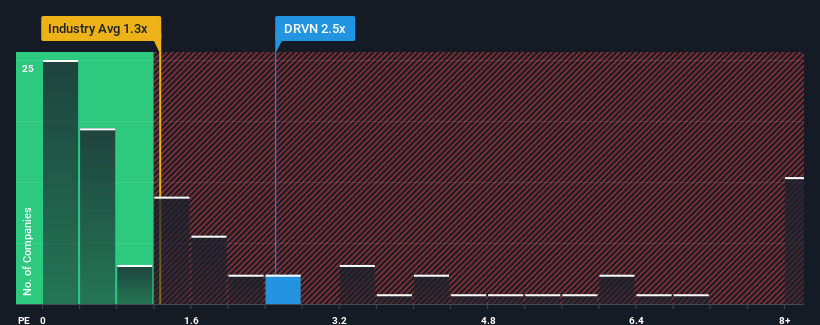

Driven Brands Holdings Inc.'s (NASDAQ:DRVN) price-to-sales (or "P/S") ratio of 2.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Commercial Services industry in the United States have P/S ratios below 1.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Driven Brands Holdings

What Does Driven Brands Holdings' Recent Performance Look Like?

Recent times have been advantageous for Driven Brands Holdings as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying to much for the stock.

Keen to find out how analysts think Driven Brands Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Driven Brands Holdings' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. The strong recent performance means it was also able to grow revenue by 239% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 93% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Driven Brands Holdings' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Driven Brands Holdings, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Driven Brands Holdings (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Driven Brands Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DRVN

Driven Brands Holdings

Provides automotive services to retail and commercial customers in the United States, Canada, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives