- United States

- /

- Commercial Services

- /

- NasdaqGS:CWST

A Fresh Look at Casella Waste Systems (CWST) Valuation Following Solid Growth and Acquisition Updates

Reviewed by Simply Wall St

Casella Waste Systems (CWST) drew investor attention this week after delivering strong third-quarter results, fueled by ongoing integration of recent acquisitions and acquisitive growth. The company also raised its 2025 outlook, which highlights steady organic momentum.

See our latest analysis for Casella Waste Systems.

Over the past year, Casella Waste Systems’ share price reflected some turbulence, with a 1-year total shareholder return of -15.4%. However, following a steady climb this month and solid fundamental execution, there are signs that momentum could be rebuilding for long-term investors who remain confident in the company’s acquisitive growth strategy.

If Casella’s renewed momentum has your interest, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding but trading close to analyst targets, the question now is whether Casella Waste Systems is still undervalued after its latest rally, or if the market has already priced in the company’s ambitious growth outlook.

Most Popular Narrative: 14.5% Undervalued

Casella Waste Systems' last closing price of $96.39 sits well below the narrative fair value of $112.78, indicating a potential opportunity according to the most popular market perspective. This view is shaped by anticipated operational improvements and transformative sector dynamics now impacting the company’s forward path.

Sustained volume growth and higher control over pricing, which should directly contribute to sustained revenue growth and margin expansion. The heightened focus among municipalities, universities, and commercial clients on sustainability and ESG-driven solutions is increasing demand for Casella's Resource Solutions segment, strengthened by recent investments in upgraded recycling facilities and innovative processing capabilities. This is supporting top-line revenue growth and resiliency against commodity price swings.

Want to see what’s propelling this premium narrative? The secret is in aggressive growth assumptions, rising profit margins, and a bold projection for future earnings. The market’s valuation math gets turned upside down. Curious what numbers build this case? Dive deeper to unravel the full story behind this surprising fair value.

Result: Fair Value of $112.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent integration challenges and rising labor costs could undermine Casella’s margin improvements. These factors could potentially derail the current growth narrative if not addressed.

Find out about the key risks to this Casella Waste Systems narrative.

Another View: What Multiples Reveal

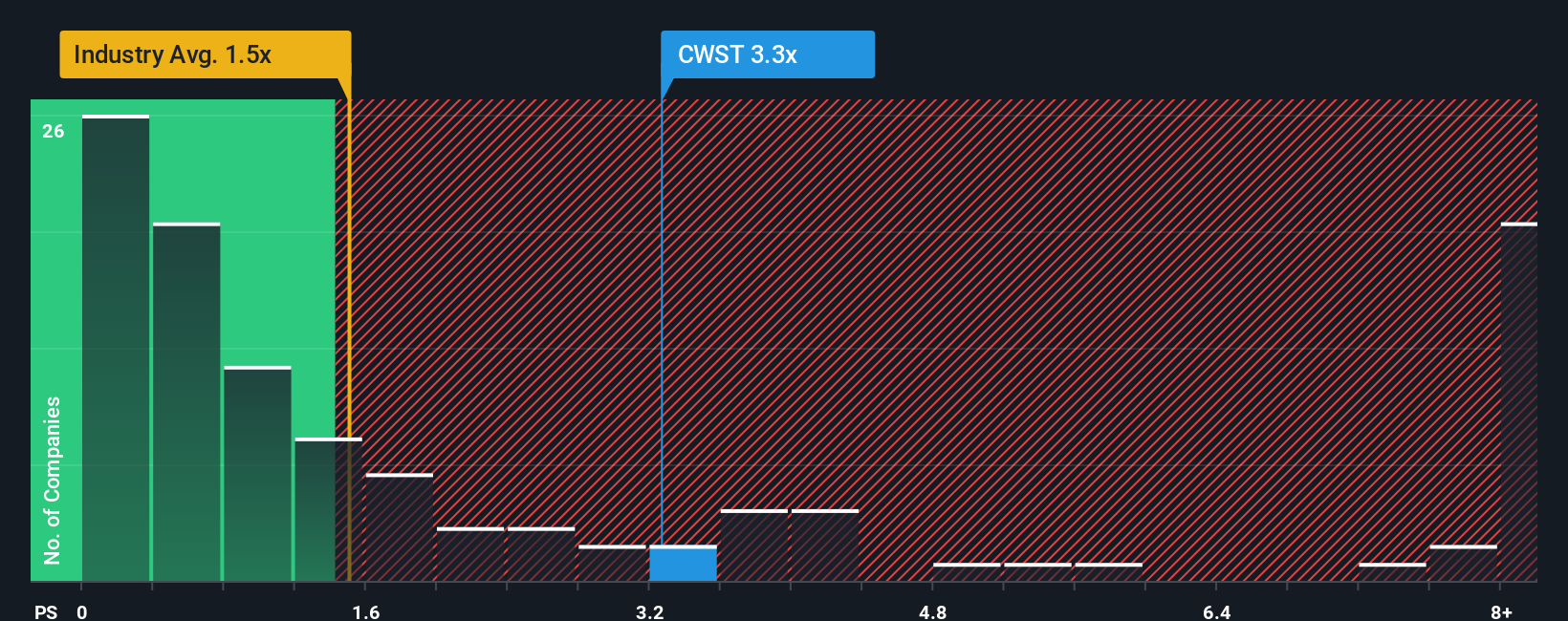

While the premium narrative values Casella Waste Systems above its current share price, looking at its price-to-sales ratio presents a different perspective. At 3.4x, the company is valued much higher than both the industry average of 1.1x and its peer average of 1.2x. This notable gap suggests investors are paying a considerable premium for future growth optimism. If the market adjusts toward the fair ratio of 1.7x, could this expose investors to downside risk, or is Casella positioned to justify the optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casella Waste Systems Narrative

If you think there’s another story hiding in the numbers, or would rather investigate the data yourself, you can easily create your own viewpoint in just a few minutes. Do it your way

A great starting point for your Casella Waste Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to one opportunity when there are so many untapped market movers waiting for smart investors like you? Use these hand-picked ideas to find your next winning stock before everyone else catches on.

- Unlock steady, long-term income streams and examine these 15 dividend stocks with yields > 3% offering attractive yields over 3% and proven financial strength.

- Spot tomorrow’s industry disruptors and check out these 25 AI penny stocks, which are rising fast with cutting-edge artificial intelligence advancements.

- Capitalize on market inefficiencies by reviewing these 915 undervalued stocks based on cash flows. These may be trading below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CWST

Casella Waste Systems

Operates as a vertically integrated solid waste services company in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026