- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (CTAS) Announces 15% Dividend Increase Continuing 42-Year Growth Streak

Reviewed by Simply Wall St

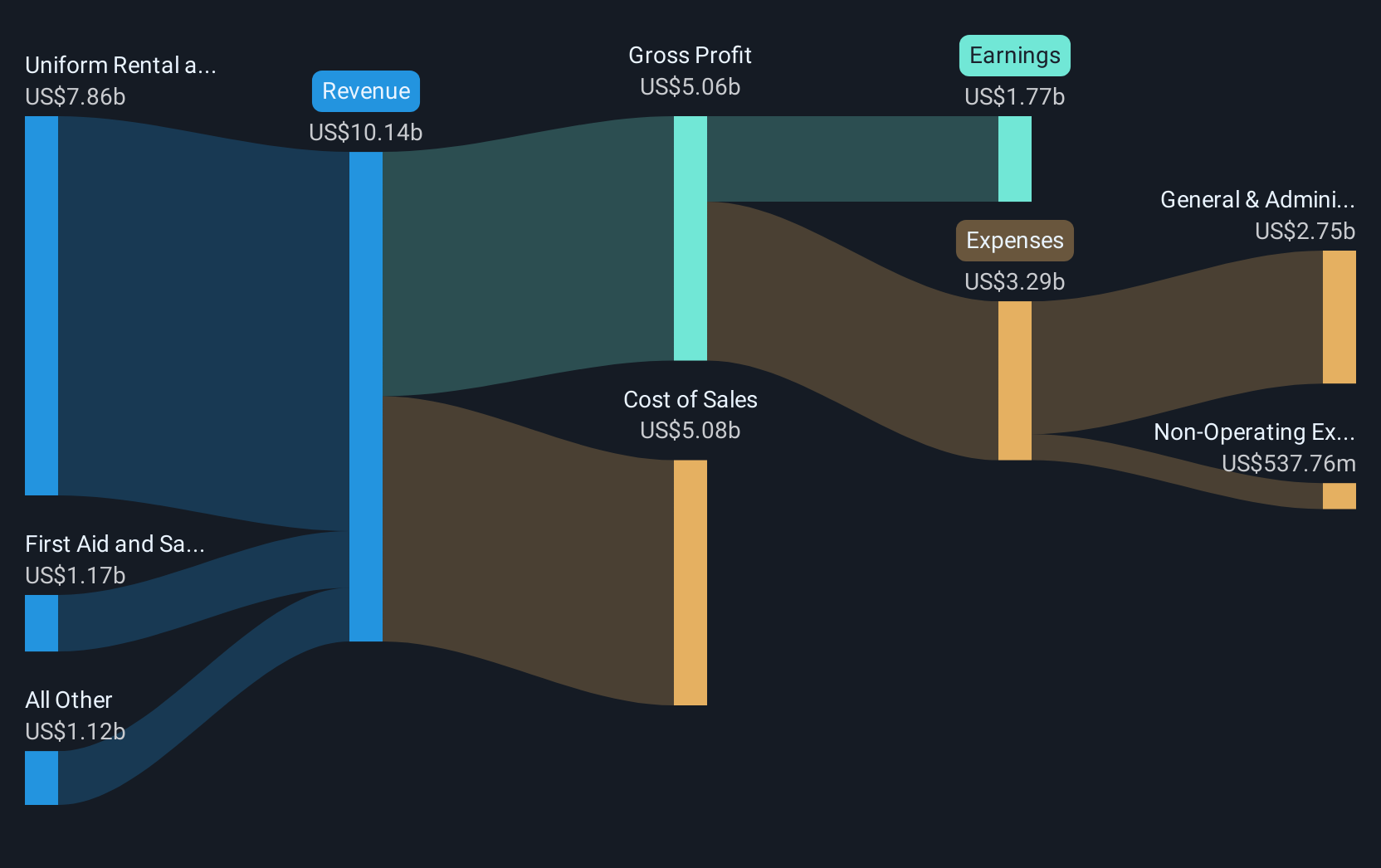

Cintas (CTAS) recently announced a 15% dividend increase, reflecting its robust financial health and long-standing shareholder rewards tradition. Over the last quarter, Cintas shares recorded a 5% price increase. This performance aligns with broader market trends, as the S&P 500 experienced a similar upward trajectory driven by strong corporate earnings. Cintas's solid earnings report and proactive capital return strategies, such as the share buyback and enhanced dividend, likely complemented these broader market movements. However, its removal from key indices may have offset further gains, illustrating the complex interplay between individual company events and overall market dynamics.

We've spotted 1 possible red flag for Cintas you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent 15% dividend increase at Cintas underscores its financial robustness and focus on rewarding shareholders, as outlined in your narrative. Over the past five years, Cintas shares have delivered a total return of 211.01%, showcasing strong long-term performance. In contrast, over the past year, Cintas has exceeded the US Commercial Services industry return of 11.1% but has underperformed the broader US market, which returned 17.5% over the same period.

The announcement of increased dividends, alongside share buybacks, could positively influence revenue and earnings forecasts by signaling confidence in future earnings stability. However, given the company's current price of $222.68, which is slightly above the consensus analyst price target of $218.93, this suggests that the market has already baked in these expected capital returns to some extent. Nevertheless, the dividend hike might alleviate possible investor concerns arising from the pressure on traditional business volumes highlighted in your analysis. The potential increase in market share through the expansion into specialized offerings could further support revenue growth, albeit at a slower rate than the broader market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives