- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

High Growth Tech Stocks To Watch In The United States

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 1.9%, but it is up 21% over the past year with earnings forecasted to grow by 15% annually. In this context, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Aldeyra Therapeutics (NasdaqCM:ALDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on developing and commercializing medicines for immune-mediated diseases, with a market cap of $341.97 million.

Operations: Aldeyra Therapeutics focuses on developing and commercializing treatments for immune-mediated diseases. The company operates with a market cap of $341.97 million.

Aldeyra Therapeutics, with an expected revenue growth of 49.4% per year, has demonstrated significant progress in its R&D efforts, particularly with the recent Phase 3 trial success for reproxalap in treating dry eye disease (P=0.004). Despite a net loss increase to $16.85M from $8.99M YoY and high volatility over the past three months, Aldeyra's advancements in RASP modulators across multiple indications highlight its innovative potential within biotech. The company's forecasted earnings growth at 62.33% annually positions it as a transformative player amidst industry challenges and opportunities.

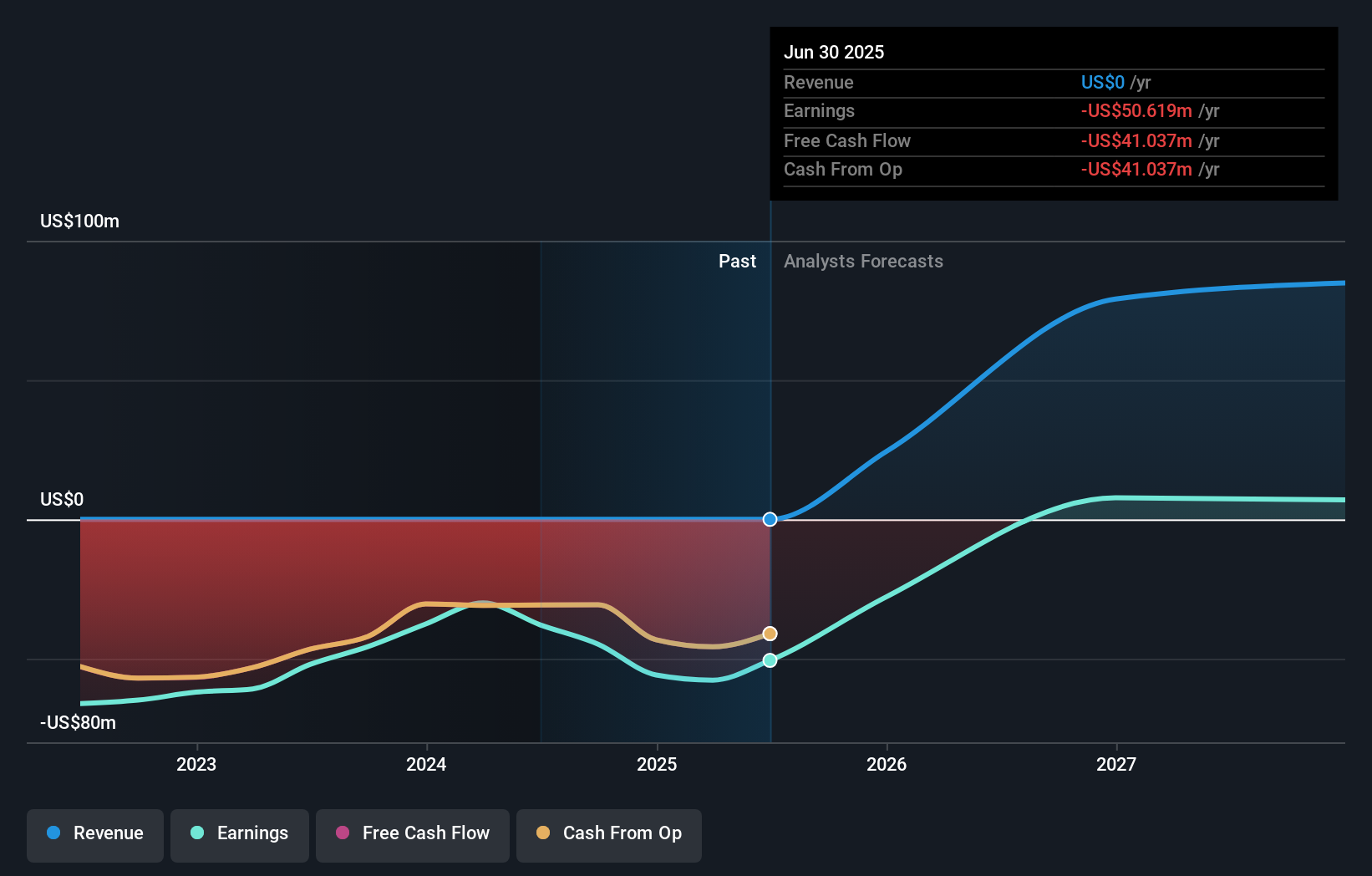

CSG Systems International (NasdaqGS:CSGS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CSG Systems International, Inc., along with its subsidiaries, offers revenue management and digital monetization, customer experience, and payment solutions mainly to the communications industry across various regions including the Americas, Europe, the Middle East, Africa, and Asia Pacific; it has a market cap of approximately $1.37 billion.

Operations: CSG Systems International, Inc. generates revenue primarily through its data processing services, amounting to $1.17 billion. The company focuses on providing solutions for revenue management, digital monetization, customer experience, and payments within the communications sector across multiple global regions.

CSG Systems International's strategic shift towards SaaS platforms, exemplified by partnerships with Lyse and Telenor Denmark, underscores its commitment to innovation in the telecommunications sector. Despite a modest revenue growth forecast of 3% annually, CSG's earnings are projected to rise significantly at 20.3% per year. The company has invested heavily in R&D, allocating $56 million last year to enhance its cloud-native solutions. Additionally, recent share repurchases totaling $136.55 million reflect confidence in long-term value creation for shareholders.

Progress Software (NasdaqGS:PRGS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Progress Software Corporation develops, deploys, and manages business applications in the United States and internationally, with a market cap of $2.49 billion.

Operations: Progress Software generates revenue primarily from its software products designed to develop, deploy, and manage high-impact applications, amounting to $711.72 million. The company's operations span both domestic and international markets.

Progress Software's strategic focus on innovative AI and software solutions is evident with the recent release of Semaphore 5.10, enhancing metadata management through AI-assisted modeling. Despite a modest revenue growth forecast of 2.7% annually, earnings are projected to rise significantly at 21.2% per year, indicating strong profitability potential. The company invested $56 million in R&D last year to drive innovation across its product lines, reflecting its commitment to long-term growth and technological advancement.

Make It Happen

- Click this link to deep-dive into the 249 companies within our US High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Established dividend payer and good value.