- United States

- /

- Entertainment

- /

- NasdaqGS:SEAT

High Growth Tech Stocks to Watch in October 2024

Reviewed by Simply Wall St

The United States market has shown robust performance, rising 1.2% over the last week and up 31% over the past year, with earnings projected to grow by 16% annually. In this environment, identifying high growth tech stocks involves looking for companies with strong fundamentals and innovative capabilities that align well with these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 44.28% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.45% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| Travere Therapeutics | 27.16% | 69.88% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Aviat Networks (NasdaqGS:AVNW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aviat Networks, Inc. offers microwave networking and wireless access solutions across various global regions, with a market cap of $276.85 million.

Operations: The company generates revenue primarily through its wireless communications equipment segment, totaling $408.08 million.

Aviat Networks has demonstrated a robust trajectory in the tech sector, outpacing the Communications industry with a 5.2% earnings growth compared to the industry's -4.3%. This growth is underpinned by significant R&D investments, aligning with its revenue forecasts which are expected to surge by 14.3% annually, notably faster than the broader US market's 8.8%. Looking ahead, Aviat anticipates an aggressive expansion in earnings at an annual rate of 57.1%, reflecting its strategic focus on innovation and market adaptation. Recent financial disclosures reveal a fiscal year revenue jump to $408 million from $344 million previously, setting a confident tone for their projected increase to between $450 million and $490 million next year.

- Click here to discover the nuances of Aviat Networks with our detailed analytical health report.

Understand Aviat Networks' track record by examining our Past report.

CSG Systems International (NasdaqGS:CSGS)

Simply Wall St Growth Rating: ★★★★☆☆

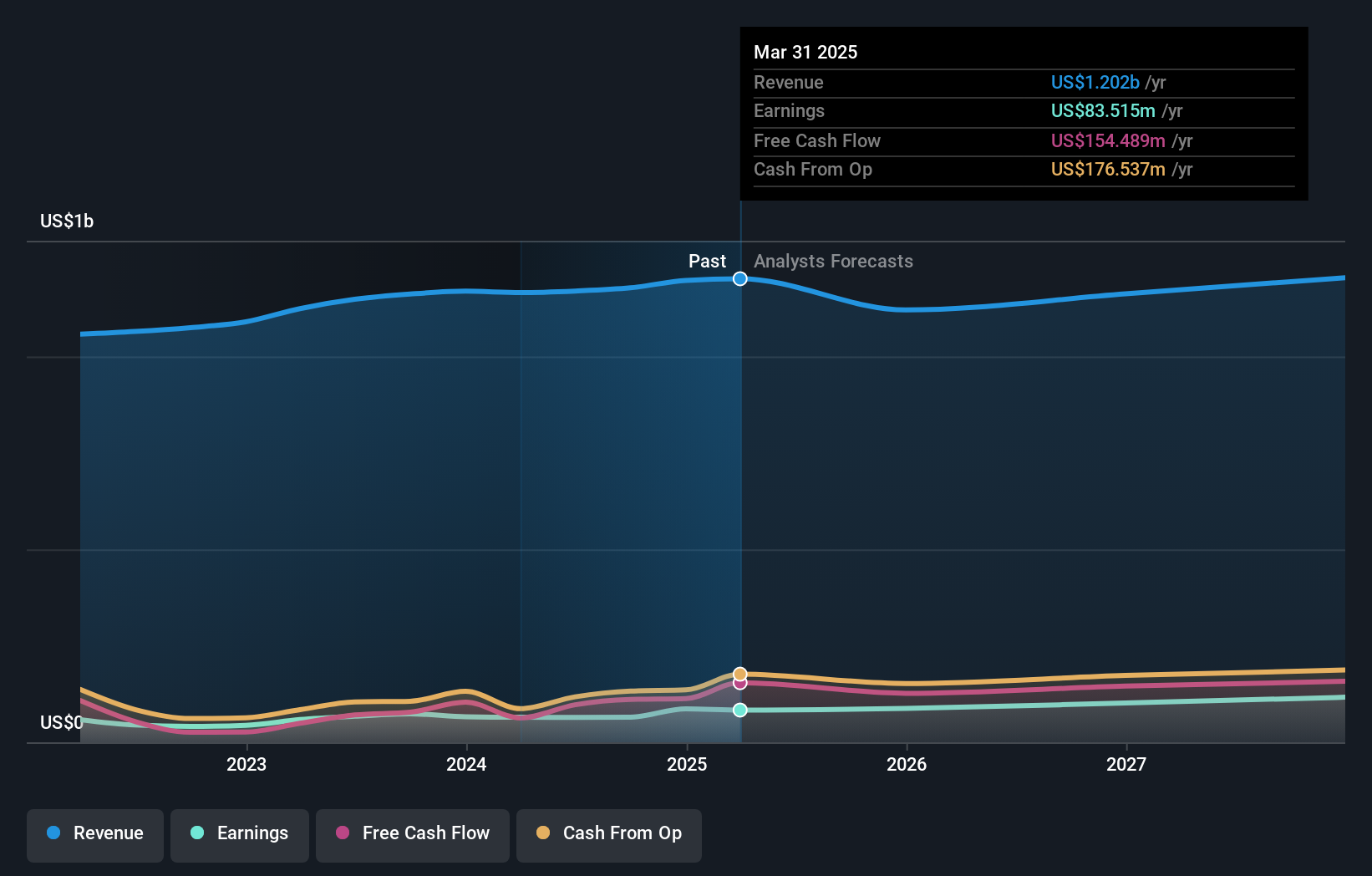

Overview: CSG Systems International, Inc. offers revenue management, digital monetization, customer experience, and payment solutions mainly to the communications sector across various global regions and has a market cap of approximately $1.37 billion.

Operations: The company generates revenue primarily through its data processing segment, which accounts for $1.17 billion. Its operations are focused on providing solutions to enhance customer experience and enable digital monetization in the communications sector across multiple regions globally.

CSG Systems International, despite a challenging year with a 4.2% dip in earnings, is poised for recovery with anticipated earnings growth of 20.3% annually. This forecast outstrips the broader US market's expectation of 15.3%. The firm's commitment to innovation is evident from its R&D expenses, crucial for sustaining long-term growth in the competitive tech landscape. Recent strategic alliances, like the one with Cellusys, underscore CSG’s proactive approach in enhancing global roaming solutions which could open new revenue streams and improve customer satisfaction across mobile networks. This move aligns with industry shifts towards more integrated and customer-centric services, potentially setting CSG up for a stronger market position if these initiatives mature successfully.

Vivid Seats (NasdaqGS:SEAT)

Simply Wall St Growth Rating: ★★★★☆☆

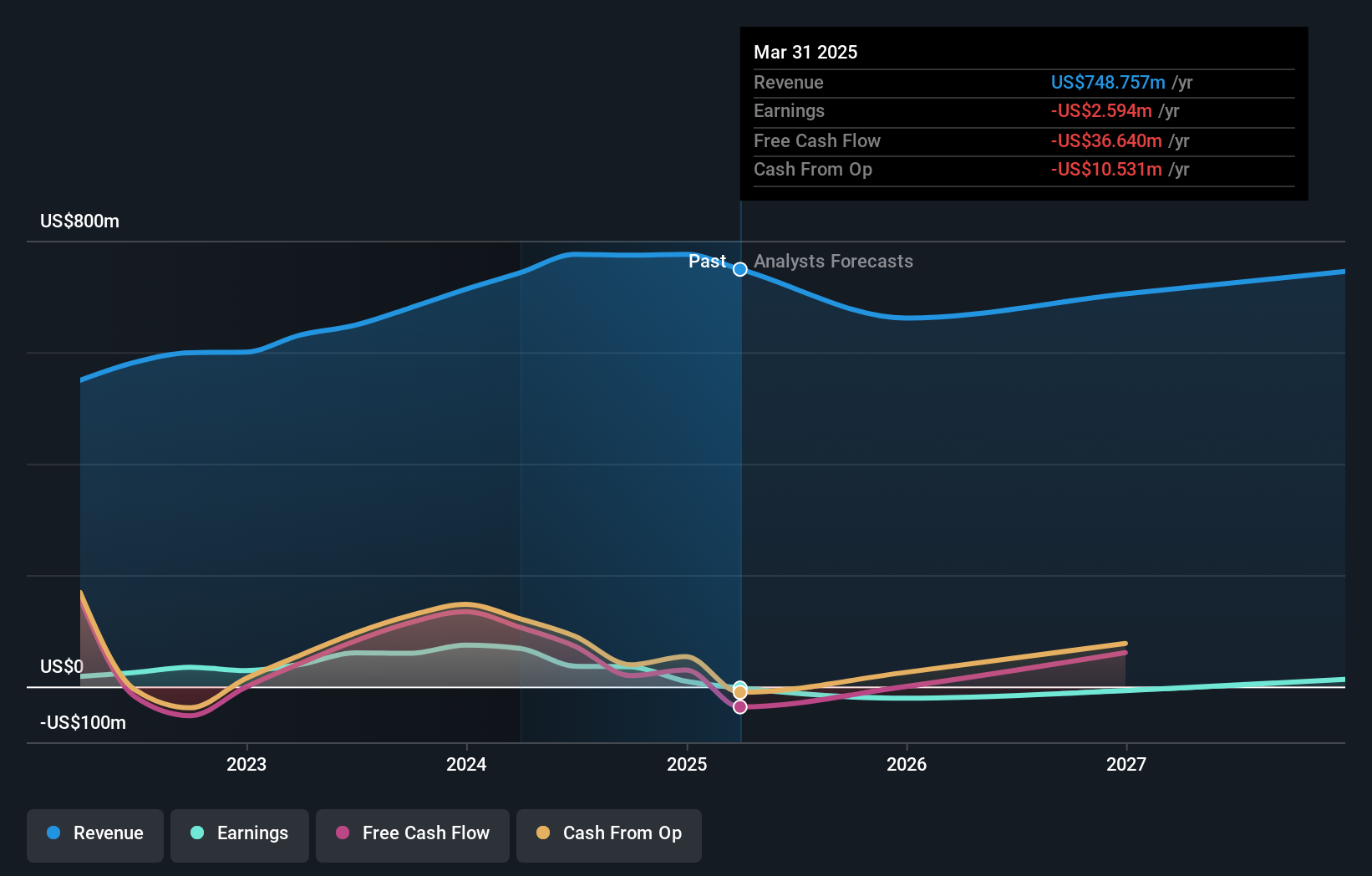

Overview: Vivid Seats Inc. operates an online ticket marketplace in the United States, Canada, and Japan with a market cap of $742.86 million.

Operations: The company generates revenue primarily through its Marketplace segment, accounting for $651.72 million, while the Resale segment contributes $123.89 million.

Vivid Seats, navigating a challenging landscape with recent earnings reflecting a net loss of $1.06 million compared to last year's net income of $30.71 million, still shows promise through strategic initiatives like its exclusive media deal with I Am Athlete (IAA). This partnership could revitalize its market presence by integrating live event experiences and exclusive content into its offerings, aiming to enhance user engagement and revenue streams. Despite a downward adjustment in revenue forecasts from $840 million to between $810 million and $830 million, the company's focus on unique fan experiences and content creation underscores its adaptability in the dynamic entertainment sector. Moreover, Vivid Seats has actively repurchased shares worth approximately $20 million this year, signaling confidence in its future trajectory amidst current volatility.

- Delve into the full analysis health report here for a deeper understanding of Vivid Seats.

Explore historical data to track Vivid Seats' performance over time in our Past section.

Summing It All Up

- Investigate our full lineup of 254 US High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEAT

Vivid Seats

Operates an online ticket marketplace in the United States, Canada, and Japan.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives