- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

CSG Systems International, Inc.'s (NASDAQ:CSGS) 29% Share Price Surge Not Quite Adding Up

CSG Systems International, Inc. (NASDAQ:CSGS) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

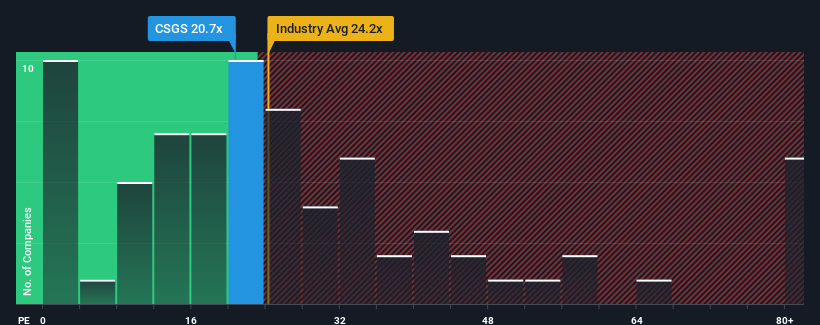

Since its price has surged higher, CSG Systems International may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.7x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

CSG Systems International certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for CSG Systems International

Is There Enough Growth For CSG Systems International?

The only time you'd be truly comfortable seeing a P/E as high as CSG Systems International's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. The latest three year period has also seen an excellent 38% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the nine analysts watching the company. With the market predicted to deliver 11% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it interesting that CSG Systems International is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On CSG Systems International's P/E

The large bounce in CSG Systems International's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that CSG Systems International currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with CSG Systems International.

Of course, you might also be able to find a better stock than CSG Systems International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives