- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

CSG Systems (CSGS) Earnings Growth Surges 28%, Reinforcing Bullish Profitability and Valuation Narratives

Reviewed by Simply Wall St

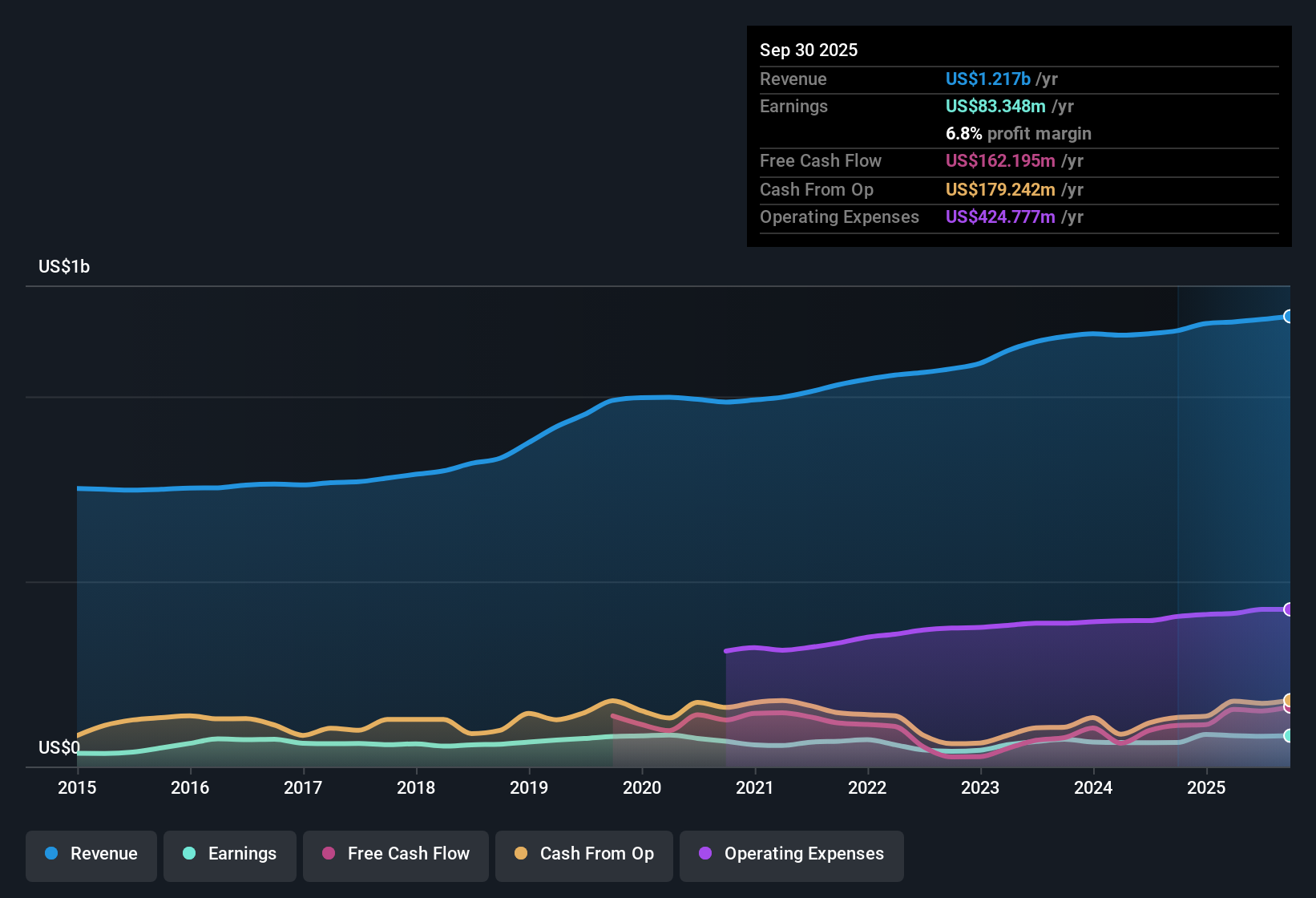

CSG Systems International (CSGS) delivered earnings growth of 28.1% over the past year, outpacing its 5-year average annual growth of 6.7%. Net profit margins improved to 6.8% from last year’s 5.5%, while earnings are expected to increase at 15.65% per year moving forward. Despite a modest 1.8% forecasted revenue growth that lags the broader US market, the company’s Price-to-Earnings ratio of 24.4x looks compelling against both industry and peer averages. The combination of accelerated profitability and attractive valuation is likely to be welcomed by investors, though financial positioning remains a point of focus.

See our full analysis for CSG Systems International.Next, we will see how these latest numbers compare to the major narratives and investor beliefs about CSG Systems International, with a close look at where the results agree and where there might be surprises.

See what the community is saying about CSG Systems International

Margin Expansion Outpaces Flat Revenue

- Analysts expect CSG’s profit margins to climb from 6.8% today to 9.9% in three years, even though revenue is forecasted to edge slightly lower by 0.3% annually over the same period.

- Analysts' consensus view highlights that despite muted top-line growth, margin gains are propelled by strategic moves such as expanding into new verticals and increased operational efficiency.

- Recent shifts to cloud-based and AI-driven solutions are credited with a 250-basis-point year-over-year operating margin gain. This reinforces the earnings resilience narrative.

- However, part of the latest margin boost stems from a one-off $6 million high-margin license deal, raising questions about the sustainability of these improvements according to analysts.

- To see how these dynamics fit into the broader take on CSG's future, check the detailed consensus narrative. 📊 Read the full CSG Systems International Consensus Narrative.

Customer Concentration Remains a Key Watchpoint

- Charter and Comcast together contributed 36% of total revenue, underscoring the material risk tied to just two customers even as diversification efforts continue.

- In the consensus narrative, analysts highlight that while CSG’s push into new industries and verticals is helping to broaden the customer base, the overreliance on major clients means any contract renegotiation or loss could sharply impact revenue and margins.

- Bears note that in a scenario where a top customer delays spending or exits, there is little margin for error on guidance, making growth less predictable.

- Still, proponents argue that recurring revenue from long-term deals and a growing acquisition pipeline should help counterbalance some of this concentration risk.

Valuation Still Looks Compelling vs. Peers

- CSG's current Price-to-Earnings ratio stands at 24.4x, which is below both the US Professional Services industry average of 25.1x and the peer group average of 27.9x. The $78.15 share price trails the $80.70 analyst target by about 3%.

- Through the lens of the consensus narrative, this valuation reflects investor willingness to pay a premium for durable earnings and margin expansion, even with slower revenue growth expectations.

- Analysts point to disciplined capital allocation, stable dividends, and improving earnings as factors justifying a valuation premium over broader sector multiples.

- Uncertainty remains around whether current margin gains will persist, but the modest discount to peer averages gives some cushion if momentum slows.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CSG Systems International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on the figures? Share your take on CSG Systems International by crafting a unique narrative in just a few minutes. Do it your way

A great starting point for your CSG Systems International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

CSG Systems International’s flat revenue outlook and concentrated customer risk raise questions about the consistency and predictability of its future growth.

If you want steadier performance, use our stable growth stocks screener (2078 results) to discover companies that maintain reliable earnings and revenue even when market conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives