- United States

- /

- Professional Services

- /

- NasdaqGS:CRAI

Does CRA International’s Latest Market Expansion Signal a Value Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if CRA International is offering good value right now? Let's take a closer look at the numbers and see what is really going on beneath the surface.

- The stock has had a mixed run lately, rising 3.0% over the past week but dipping 3.9% in the last month. Longer-term returns show solid growth, like 345.6% over five years.

- Recently, the company has been in the spotlight after announcing a series of strategic consulting projects and highlighting its expansion into new markets. These developments have caught investor attention, helping to explain some of the volatility and renewed interest in CRA International shares.

- On our valuation scorecard, CRA International comes in strong with a score of 4 out of 6, suggesting several undervalued traits but still a few factors to dig into. Up next, we will break down how this score is calculated using different valuation approaches and show you why the best insights might go beyond any single method.

Approach 1: CRA International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach helps investors understand what a business is truly worth, based on its ability to generate cash in the years ahead.

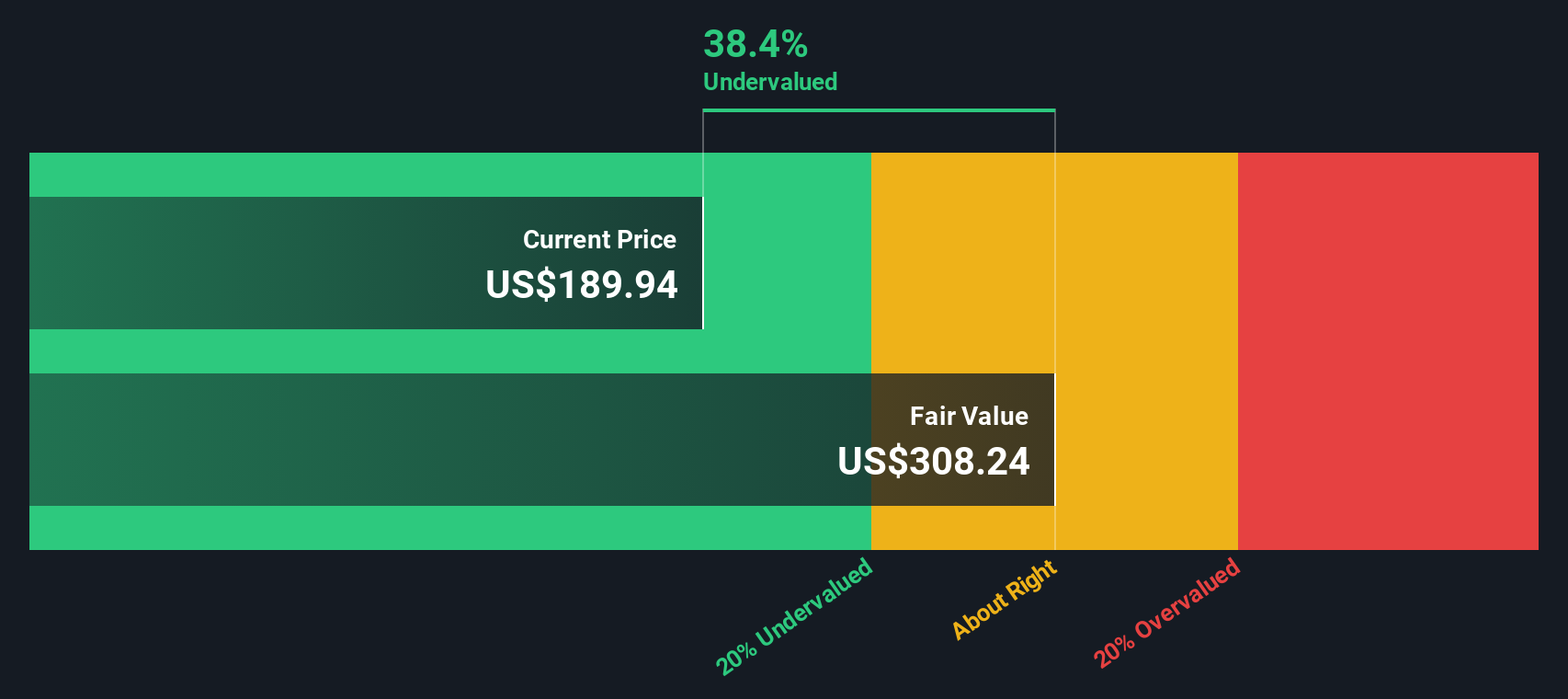

For CRA International, the most recent reported Free Cash Flow stands at $33.6 Million. Analyst forecasts predict that this figure will rise steadily over the coming years, reaching approximately $82.5 Million by 2027. Using these and further extrapolated projections, the DCF model estimates CRA International’s Free Cash Flow will grow to over $111.9 Million by 2035. These projections are all presented in USD for clarity.

Based on this trajectory, the model calculates an intrinsic value of $309.02 per share for CRA International. This is notably higher than the current share price, which suggests the stock is trading at a 39.1% discount to its fair value.

In summary, the DCF approach suggests CRA International appears significantly undervalued from a cash flow perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CRA International is undervalued by 39.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: CRA International Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool, especially for profitable companies like CRA International. It helps investors gauge how much they are paying for each dollar of earnings, turning a company’s profitability into a quick comparative metric.

What counts as a “fair” PE ratio depends on factors like how quickly a company is expected to grow, its profit margins, and the risks it faces. Companies with stronger growth prospects and lower risk often command higher PE multiples than their peers.

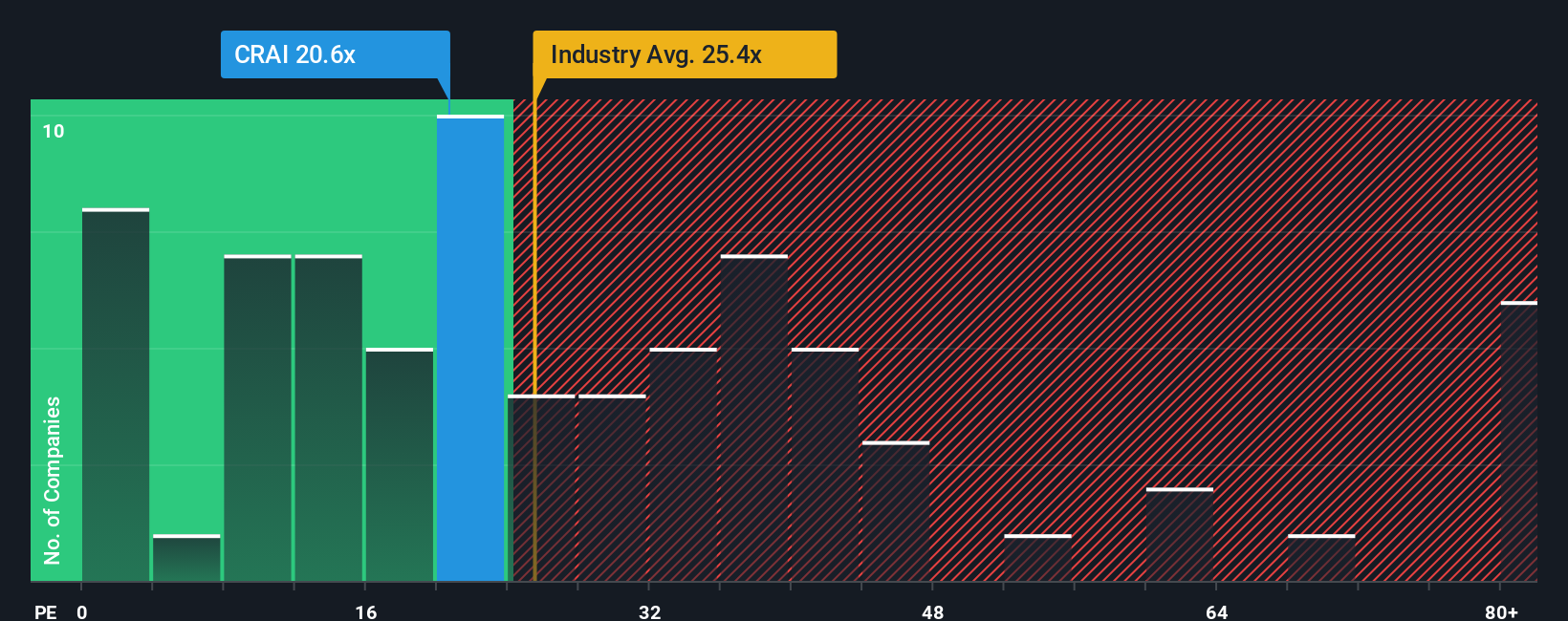

Looking at CRA International, the current PE ratio sits at 21.9x. By comparison, the average PE for the Professional Services industry comes in at 25.1x. Direct peers are trading at a much higher average of 39.0x. This suggests that CRA International is priced below both its industry and peer group.

However, just comparing to industry or peer averages does not always tell the full story because it ignores differences in growth, profitability, and company size. That is where the Simply Wall St Fair Ratio comes in. The Fair Ratio for CRA International is 18.5x, a proprietary benchmark that builds in extra detail such as growth rates, profit margins, and risk factors unique to the business.

Since CRA International’s actual PE (21.9x) is only modestly above the calculated Fair Ratio (18.5x), its shares look reasonably priced on earnings. The difference is not pronounced enough to signal overvaluation or undervaluation in a meaningful way.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CRA International Narrative

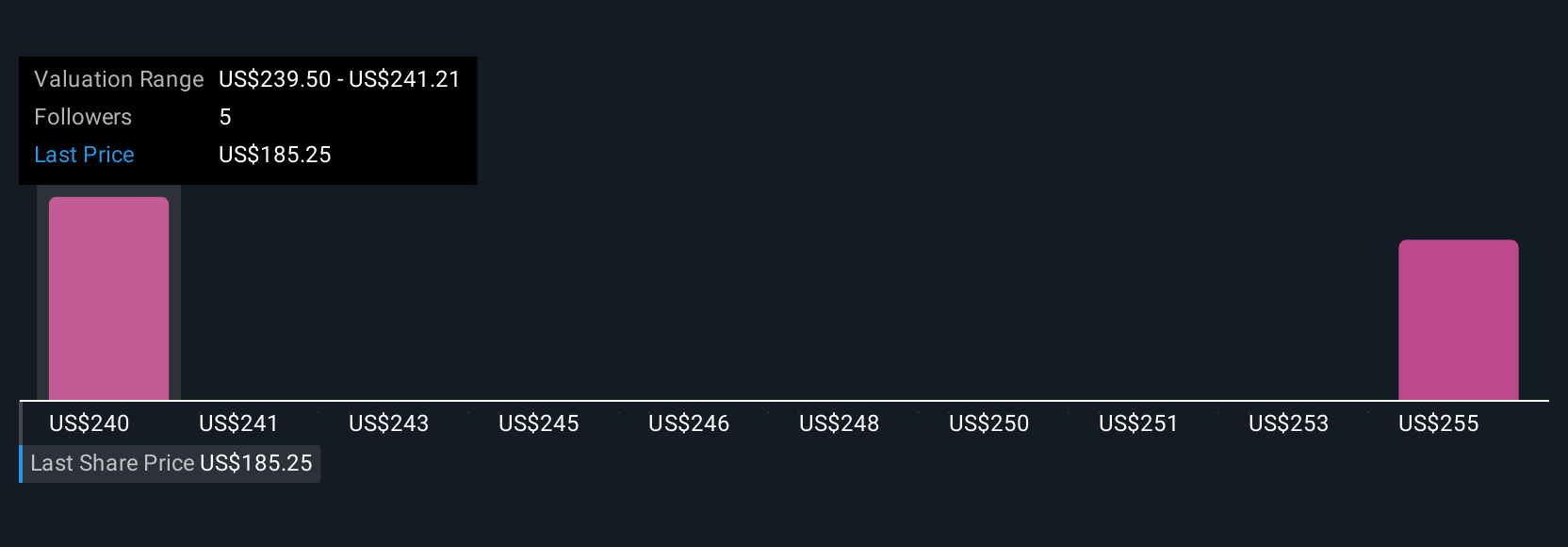

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story, the “why” behind the numbers, where you define your assumptions about future revenue, earnings, and margins to calculate your own fair value for a company like CRA International.

Narratives let you connect a company’s business outlook to detailed forecasts, then tie those directly to fair value estimates, moving beyond simplistic ratios and single-point analysis. With Simply Wall St’s easy-to-use platform, millions of investors use the Narratives tool, found on the Community page, to capture and share their perspectives.

By comparing your Narrative’s fair value to today’s share price, you can decide when to buy or sell based on what you believe is likely, not just what the market or analysts project. Plus, Narratives are automatically updated as soon as new news or earnings data become available, so your view stays current.

For example, some investors may build a bullish Narrative for CRA International by focusing on surging global M&A activity, strong pricing power, and robust growth in antitrust advisory, which could result in higher future earnings and a fair value over $249.50 per share. Others might emphasize risks like talent retention, heavy reliance on key segments, or client fee pressure, which could lead to a more cautious Narrative and a lower fair value. Narratives make it easy to see how your investment thesis stacks up against others in real time.

Do you think there's more to the story for CRA International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRAI

CRA International

Provides economic, financial, and management consulting services worldwide.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives