- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Does Copart’s Stock Drop Signal Opportunity After Used Car Market Shifts?

Reviewed by Bailey Pemberton

- Wondering if Copart might be trading at a bargain or already priced for perfection? You are not alone, and the numbers might surprise you.

- While Copart’s stock has rebounded 1.4% in the past week, it is still down over 27% both year-to-date and over the past year. This shows a sharp shift after years of solid long-term gains.

- Much of this volatility links back to recent headlines about shifting dynamics in the used car market, including fluctuations in vehicle prices and supply chain adjustments that have rippled through the industry. There is also fresh attention on Copart's expansion efforts and partnerships with major insurers, which add new factors for investors to consider.

- On our valuation checks, Copart scores a 4 out of 6, suggesting there are still some attractive aspects to its current price. We will dig into different valuation approaches next, but stick around for a smarter, more holistic way to think about Copart’s true worth at the end of this article.

Find out why Copart's -27.5% return over the last year is lagging behind its peers.

Approach 1: Copart Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to estimate a company’s true worth by projecting its future cash flows and discounting them back to today’s value. This method relies on expected operational performance to calculate how much those future cash flows are worth in current terms.

For Copart, the most recent Free Cash Flow stands at $1.22 Billion. Analysts forecast steady growth, with projections reaching $1.98 Billion by 2028. Beyond the five-year mark, further Free Cash Flow estimates are extrapolated, with 2035’s projection landing near $3.21 Billion. All figures are in US Dollars.

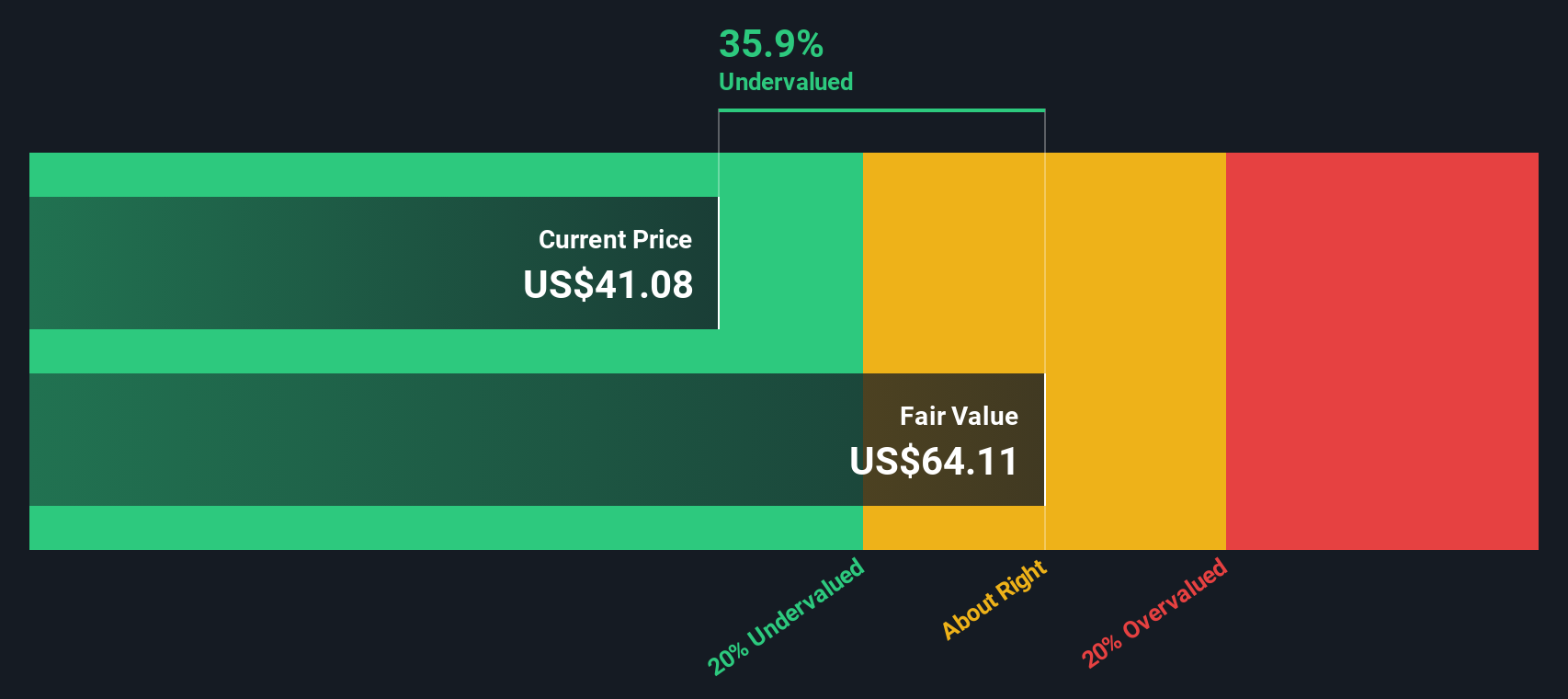

Based on these assumptions and long-term expectations, the DCF model estimates Copart’s intrinsic value at $64.11 per share. With a 35.9% discount to its current trading price, this suggests Copart shares are undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Copart is undervalued by 35.9%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Copart Price vs Earnings

For profitable companies like Copart, the Price-to-Earnings (PE) ratio is a widely-used and meaningful metric for valuation. It indicates how much investors are willing to pay for each dollar of a company’s earnings, making it especially useful when the business has a solid profit track record.

A company’s PE ratio is significantly influenced by its growth expectations and risk profile. Companies with stronger earnings growth prospects or lower perceived risk can usually support higher PE ratios, while slower expected growth or greater uncertainties typically justify a lower number.

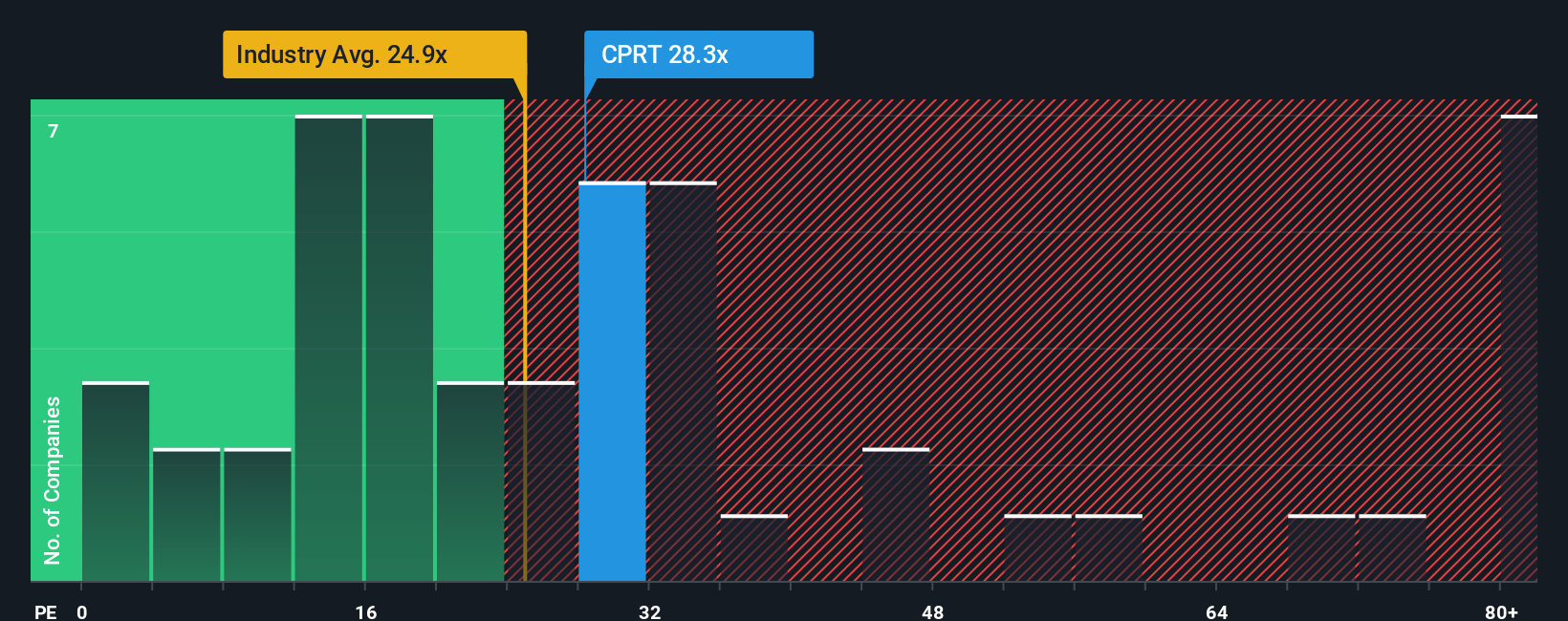

Currently, Copart trades at a PE of 25x. This figure is above the industry average of 24x for Commercial Services, yet below the average for peer companies, which sits at 34x. Comparing Copart’s valuation to these benchmarks offers useful context but does not tell the whole story.

This is where Simply Wall St's Fair Ratio comes in. Unlike simple peer or industry averages, the Fair Ratio incorporates a company’s unique growth outlook, profit margins, overall market size, and risk levels. For Copart, that proprietary Fair Ratio stands at 28x, slightly above its current PE.

Because Copart’s PE ratio is so close to its Fair Ratio, the stock’s valuation appears to be ABOUT RIGHT based on earnings multiples at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Copart Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story or perspective about a company, your view of its future prospects, challenges, and opportunities, expressed through assumptions about growth rates, profit margins, and fair value.

Narratives go beyond just looking at the numbers, as they connect Copart’s growth drivers and risks directly to a set of financial forecasts and an estimate of fair value. This gives you a framework to support your investment decisions with reasoning that reflects your view of the business.

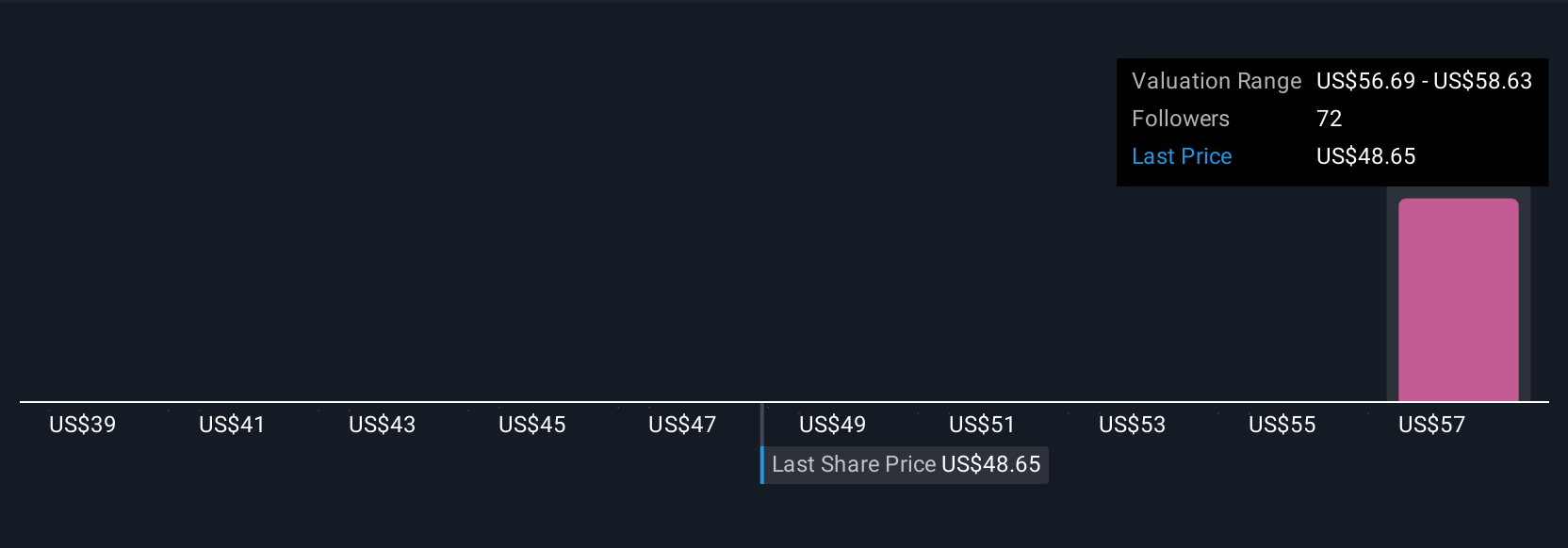

This easy-to-use feature is available to all investors in the Simply Wall St Community page and is already used by millions. Narratives help you decide when to buy or sell by comparing your Fair Value estimate with the current share price. They update dynamically as soon as new news, financial results, or market data is released, so your thesis stays relevant without having to recalculate everything yourself.

For example, some investors see Copart’s international expansion and digitization as reasons to maintain a high fair value near $65, while others worry about industry competition and assign a much lower value around $46. Narratives empower you to see the full range of perspectives and support your own conviction, making investment analysis more personal, robust, and adaptive than ever before.

Do you think there's more to the story for Copart? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, the United Kingdom, Germany, Brazil, Canada, the United Arab Emirates, Spain, Finland, Oman, the Republic of Ireland, and Bahrain.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives