- United States

- /

- Professional Services

- /

- NasdaqGS:CNXC

The Bull Case For Concentrix (CNXC) Could Change Following Launch of AI-Enhanced iX Hero Platform

Reviewed by Simply Wall St

- Concentrix Corporation recently launched an upgraded version of its iX Hero product, introducing new AI-powered features, Harmony for improved speech clarity and Clarity for background noise suppression, to enhance customer experience delivery across global teams.

- This release, already used by industry leader PODS, quantifiably improved client communication metrics and arrives as Concentrix increases visibility with investor conference participation.

- We'll examine how iX Hero's advanced AI integration and communication enhancements could reinforce Concentrix's investment narrative and growth outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Concentrix Investment Narrative Recap

To own Concentrix stock, an investor typically needs to believe that AI-driven product innovations can drive higher client satisfaction and accelerate earnings growth, despite operational and margin pressures. The recent iX Hero launch adds advanced AI features with proven improvements to customer metrics, which could support the pivotal catalyst of increasing AI solution adoption; however, the company’s current low revenue growth rate remains a key short-term concern, and the product update’s impact on this may not be immediately material.

Of recent announcements, the introduction of iX Hero in May set the foundation for this July upgrade, showing ongoing efforts to deeply embed AI into Concentrix’s offerings. These advancements directly relate to the primary catalyst of monetizing next-generation platforms, potentially strengthening the company’s position as clients seek more technology-driven customer support solutions.

Yet, even as new AI features roll out, investors should be aware that low top-line revenue growth could still...

Read the full narrative on Concentrix (it's free!)

Concentrix's narrative projects $10.6 billion revenue and $509.6 million earnings by 2028. This requires 3.2% yearly revenue growth and a $275.3 million earnings increase from $234.3 million today.

Uncover how Concentrix's forecasts yield a $67.67 fair value, a 44% upside to its current price.

Exploring Other Perspectives

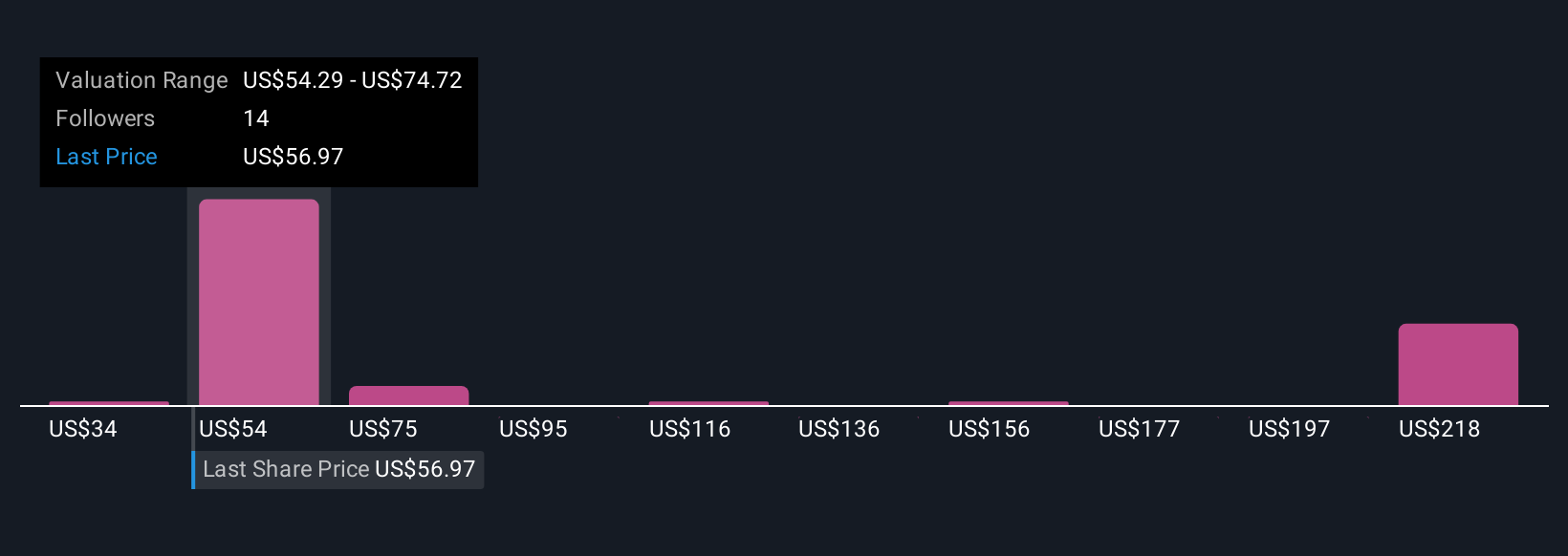

Seven fair value estimates from the Simply Wall St Community span a wide US$33.87 to US$223.57 range. While AI adoption is a major earnings growth driver, expectations for future revenue growth remain modest, so consider multiple viewpoints before making a call.

Explore 7 other fair value estimates on Concentrix - why the stock might be worth 28% less than the current price!

Build Your Own Concentrix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Concentrix research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Concentrix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Concentrix's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXC

Concentrix

Designs, builds, and runs integrated customer experience (CX) solutions worldwide.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives