- United States

- /

- Commercial Services

- /

- NasdaqGS:CMPR

Cimpress (CMPR): Evaluating Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Cimpress (CMPR) shares have turned higher over the past month, catching some investor attention following steady revenue and solid annual net income growth. As recent business trends come into focus, there is fresh interest in the company’s next move.

See our latest analysis for Cimpress.

Cimpress’s share price has staged a marked rebound recently, rising 7.2% over the last week and bringing its 30-day share price return to 4.5%. Despite this short-term momentum, the stock’s one-year total shareholder return sits at -13.2%. Its impressive 156% total return over three years suggests longer-term holders who stuck with the company have been well rewarded. Recent movement may signal renewed confidence or a shift in risk perception as investors weigh the company’s strategic execution against its prior setbacks.

If you’re looking for more ideas beyond Cimpress, now’s a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Cimpress shares still trading well below analyst price targets despite the company’s recent gains, the key question becomes clear: is this an undervalued opportunity, or is the market already factoring in the next phase of growth?

Most Popular Narrative: 15.7% Undervalued

Compared to Cimpress’s last closing price of $70.39, the most widely followed narrative puts fair value at $83.50, hinting at considerable upside if its growth story plays out as expected.

Strategic investments in proprietary production technology, customer experience, and manufacturing, well above maintenance levels, are expected to deliver $70 to $80 million in incremental annualized adjusted EBITDA improvements by FY '27, setting the stage for significant margin expansion and higher operating income in future years.

Want to crack the logic behind this bullish price target? The fair value projection hinges on bold assumptions about how fast margins and earnings will scale with new product investments. Even a small change in these forecasts could shake up the math. What’s the driver that’s turning heads among analysts? See how the narrative builds its high-stakes case for upside.

Result: Fair Value of $83.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in legacy products or elevated capital expenditures could undermine Cimpress’s margin expansion if promised growth in new segments does not occur.

Find out about the key risks to this Cimpress narrative.

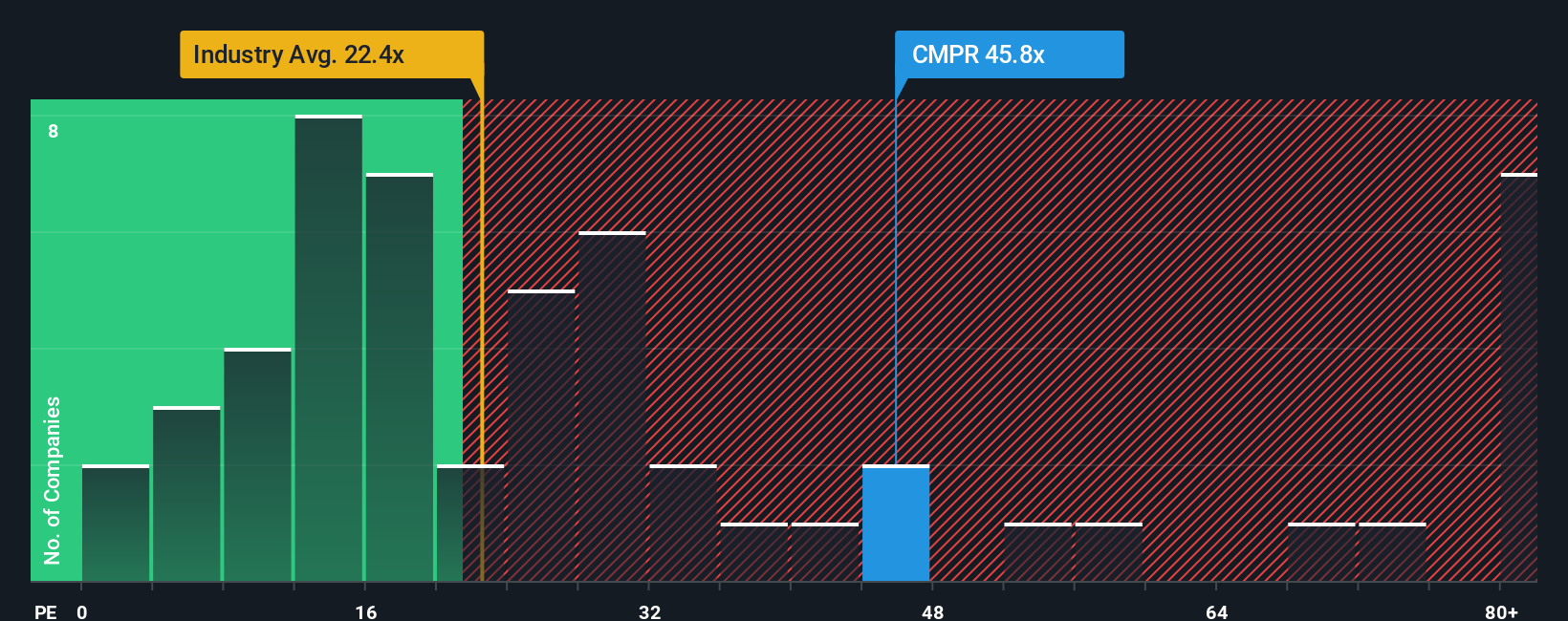

Another View: Multiples Show a Different Picture

While the fair value estimate points to significant upside, comparing Cimpress’s price-to-earnings ratio with peers offers a more cautious perspective. Currently, Cimpress trades at 49.4x earnings, well above the industry’s 21.9x and the peer average of 13.8x. The fair ratio of 25.2x suggests that the market could correct toward a lower level, increasing valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cimpress Narrative

If you want to see where your own analysis leads, it only takes a few minutes to dive into the data and shape your own perspective. Do it your way

A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Spot Tomorrow’s Winners: Handpicked Investment Opportunities Await

Step ahead of the crowd and set your sights on high-potential stocks handpicked for smart investors. Powerful insights are just a click away. Don’t let these opportunities pass you by.

- Uncover strong yields and steady income with these 14 dividend stocks with yields > 3% offering reliable dividends above 3% in today’s volatile market.

- Accelerate your portfolio with these 26 AI penny stocks delivering breakthroughs in artificial intelligence and reshaping entire industries.

- Capture tomorrow’s surges by targeting these 924 undervalued stocks based on cash flows primed for upside based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMPR

Cimpress

Provides various mass customization of printing and related products in North America, Europe, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success