- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

Is Now the Right Time to Consider CECO Environmental After 66% Share Price Rally in 2025?

Reviewed by Bailey Pemberton

If you’ve been eyeing CECO Environmental and wondering whether it’s time to get in, stay patient, or take wins off the table, you’re not alone. This stock has been quietly (and not so quietly) rewarding attentive investors with some eye-popping returns. Just check out the numbers: up 6.7% over the past week, 5.9% in the last month, and an astonishing 66.1% so far this year. Zoom out further, and the gains are even more impressive: nearly 95% for the past year and a staggering 637% over the last five years. Those kinds of results don’t happen by accident, so what’s driving the action?

Recent buzz hasn’t just been about performance. CECO Environmental is riding a wave of renewed interest thanks to its ongoing expansion into industrial air quality and emissions solutions, a move that’s won attention as industries accelerate decarbonization efforts worldwide. The market’s view of risk around environmental regulations may be shifting, making CECO’s offerings feel even more essential to future growth. Sure, there’s always the usual day-to-day volatility, but the bigger story lately is about companies positioning themselves to meet stricter standards, with investors recognizing that shift.

Of course, great price gains invite the question: is CECO still undervalued, or are you chasing the rally? On a classic valuation score, CECO’s checks come in at 3 out of 6. That’s a positive start, but no reason for blind confidence. We’re about to dig into how CECO stacks up on key valuation metrics, and at the end, we’ll explore a smarter way to judge value that goes beyond the usual formulas.

Approach 1: CECO Environmental Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model gauges a company’s value by projecting its future cash flows and discounting them back to the present, giving investors an idea of what the company is really worth today. For CECO Environmental, the DCF uses a 2 Stage Free Cash Flow to Equity model, relying on historical performance and analyst estimates to make educated predictions.

CECO’s most recent reported Free Cash Flow (FCF) stands at -$14.9 Million. Looking ahead, analysts forecast impressive FCF growth, with projected figures reaching $86.7 Million by the end of 2027. Ten years out, extrapolated estimates push future FCF to about $160 Million in 2035. These rising numbers suggest the core business is expected to generate more cash, providing a strong basis for value calculations.

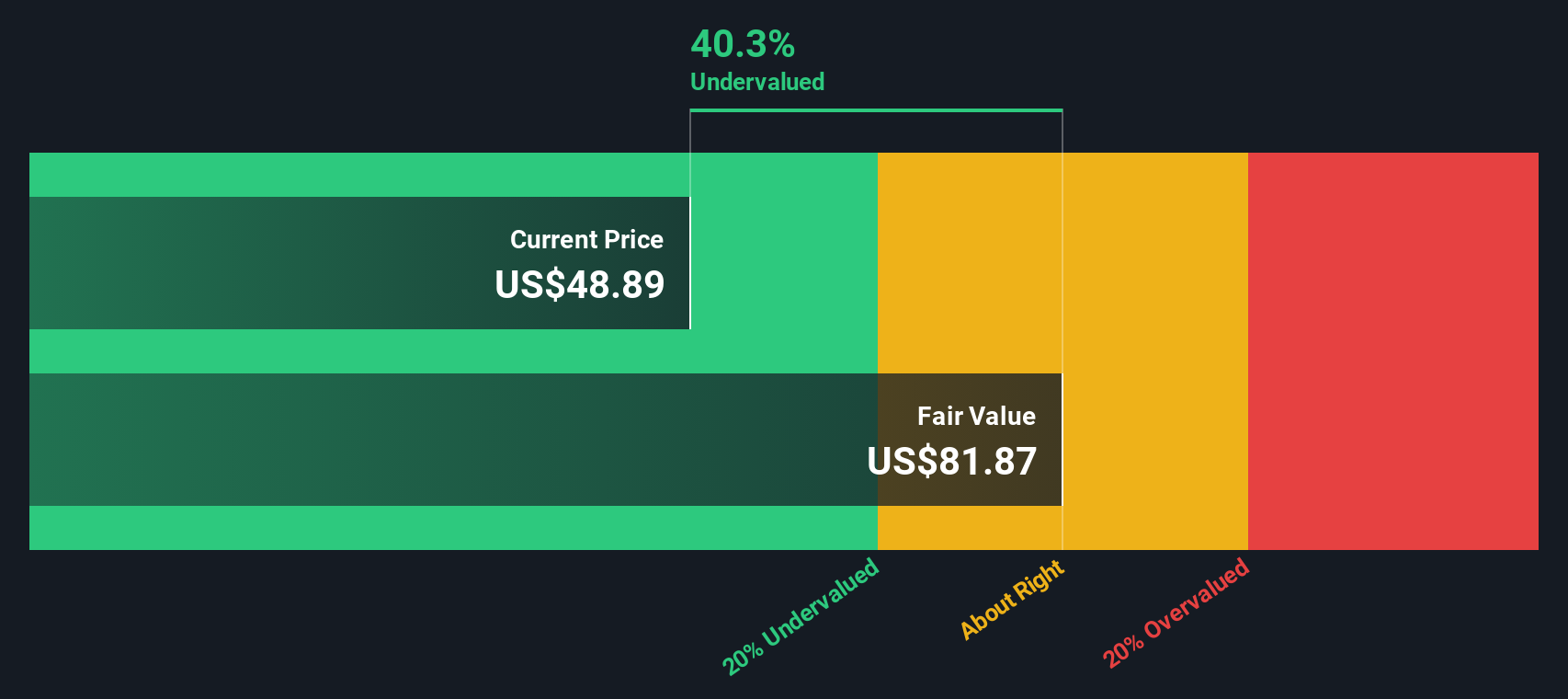

Taking all these projections into account, the DCF model calculates an estimated intrinsic value of $81.85 per share. Compared to the current share price, this implies a 36.3% discount. In other words, CECO Environmental is trading well below what the DCF suggests it could be worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CECO Environmental is undervalued by 36.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CECO Environmental Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true metric for valuing profitable companies, as it directly relates a company’s stock price to its earnings. It is especially relevant for CECO Environmental, given the company’s positive earnings trajectory and long-term growth outlook.

When evaluating what a “normal” PE ratio should look like, it is important to consider both how quickly the company is expected to grow and the risks it faces. Higher expected growth often justifies a higher PE, while increased risks or lower profitability usually pull the ratio down. This makes comparisons between CECO’s PE and several benchmarks informative.

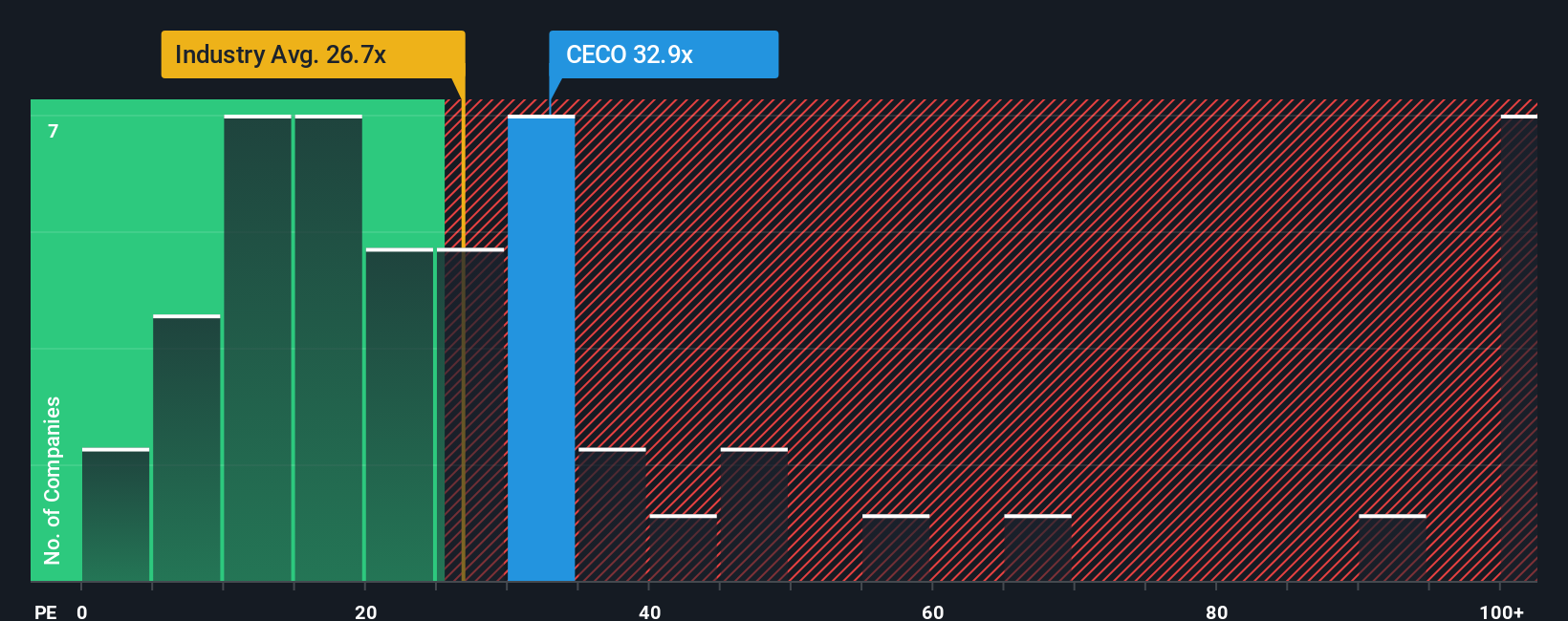

Currently, CECO’s PE ratio sits at 35.1x. This is higher than the Commercial Services industry average of 27.1x and above the peer average of 52.2x. However, rather than relying solely on peer and industry comparisons, Simply Wall St uses a proprietary Fair Ratio, which is a tailored benchmark that factors in CECO’s unique growth prospects, risk profile, market cap, and profit margins. In CECO’s case, the Fair Ratio stands at 18.2x.

The Fair Ratio provides a more comprehensive assessment than industry averages alone because it delivers a valuation precisely calibrated for the company’s own fundamentals and outlook. When comparing CECO’s current PE of 35.1x to its Fair Ratio of 18.2x, it suggests the shares are trading at a premium to what its fundamentals would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CECO Environmental Narrative

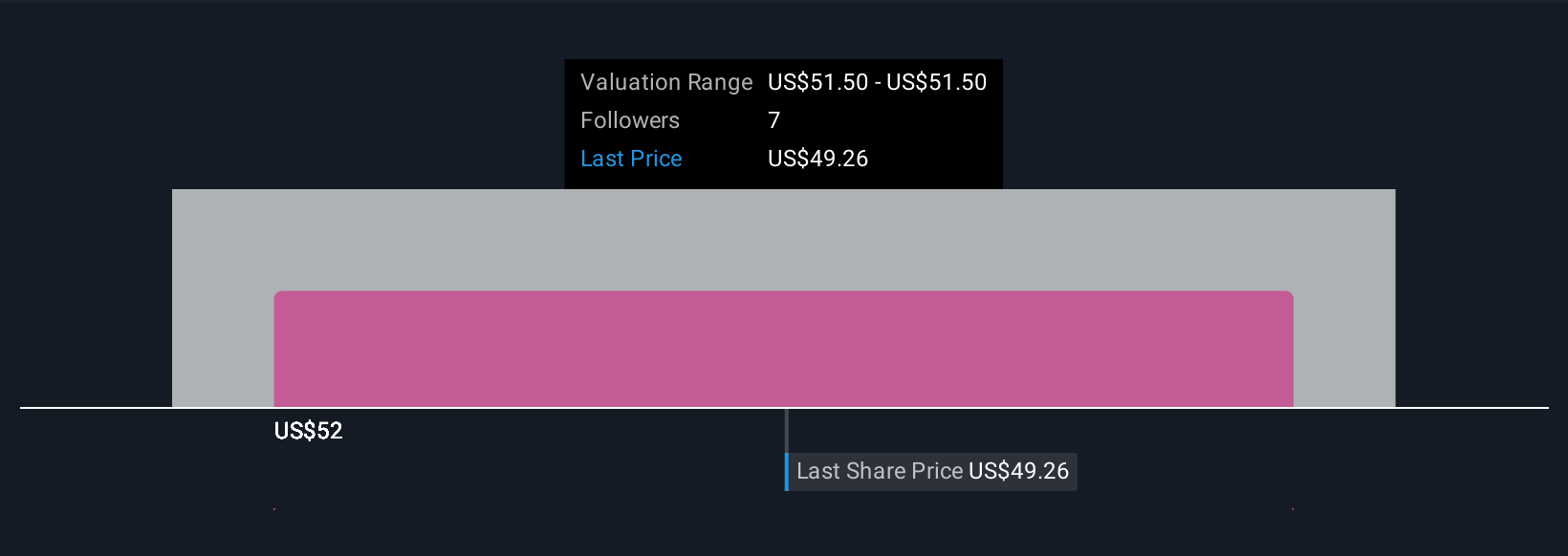

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal take on a company’s future, letting you connect your view of CECO Environmental’s business story with specific numbers like future revenue, earnings, and margins. This approach links the company's story and your assumptions to a clear fair value estimate, turning the hard numbers into a living, breathing outlook.

Narratives let you create or explore simple financial forecasts, so you can compare your fair value directly to the current price and decide if you think CECO is a buy or a sell. They are easy and accessible, available to millions of investors right now on Simply Wall St’s Community page. Narratives update automatically when new data, news, or earnings are released, so your valuation stays current as facts change.

For example, when looking at CECO Environmental, one investor might expect aggressive international expansion and record-high backlogs to drive rapid growth, and so might use a bullish Narrative with a price target as high as $60. Another investor might focus on rising costs and potential industry headwinds and build a more cautious Narrative, resulting in a price target near $46. Narratives let you easily see, compare, and update these differing perspectives over time to align your decisions with your beliefs.

Do you think there's more to the story for CECO Environmental? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives