- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

CECO Environmental (CECO): Assessing Valuation as Q3 2025 Earnings and Upward Forecasts Drive Investor Interest

Reviewed by Simply Wall St

CECO Environmental (CECO) is gearing up to report its third quarter 2025 earnings, and the market is watching closely. Expectations are high for a sizable revenue jump compared to last year, which would mark a pivot from recent declines.

See our latest analysis for CECO Environmental.

After a blockbuster quarter that saw CECO Environmental beat revenue and earnings estimates, the stock's momentum has been impossible to ignore. Shares have soared by 8% in the past month and climbed more than 32% over the last 90 days. The total shareholder return hit an impressive 103% in the past year, easily outpacing the broader market. This surge reflects growing confidence in the company’s turnaround and optimism about sustained growth following a string of upward earnings revisions.

If CECO’s strong streak has sparked your curiosity, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the company’s stock hovering near recent highs and another strong earnings report expected, investors face a key question: does CECO Environmental still offer compelling value, or is the market already pricing in next year’s growth?

Most Popular Narrative: 1% Overvalued

With analysts setting a fair value of $53 and CECO Environmental’s last close at $53.36, the narrative signals a market price just above intrinsic value. This setup draws focus to the company’s robust recent performance and revised outlook underpinning current pricing.

Record-high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions. This supports topline revenue growth over the next 18 to 24 months. CECO's ongoing expansion into high-growth international markets such as the Middle East, Southeast Asia, and India, supported by new offices and recent acquisitions, positions the company to benefit from rapid industrialization in these regions. This approach further diversifies revenue streams and reduces reliance on North America.

Want to uncover the bold projections driving this narrative? The calculation mixes multi-year revenue gains with an earnings trajectory rarely seen in the sector. The big surprise? Just one number, hidden in the fine print, completely refashions what investors should expect for future profits. Find out what it is when you read on.

Result: Fair Value of $53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated spending and rising debt levels mean that any slowdown in revenue growth or execution missteps could quickly challenge this optimistic narrative.

Find out about the key risks to this CECO Environmental narrative.

Another View: Discounted Cash Flow Suggests Upside

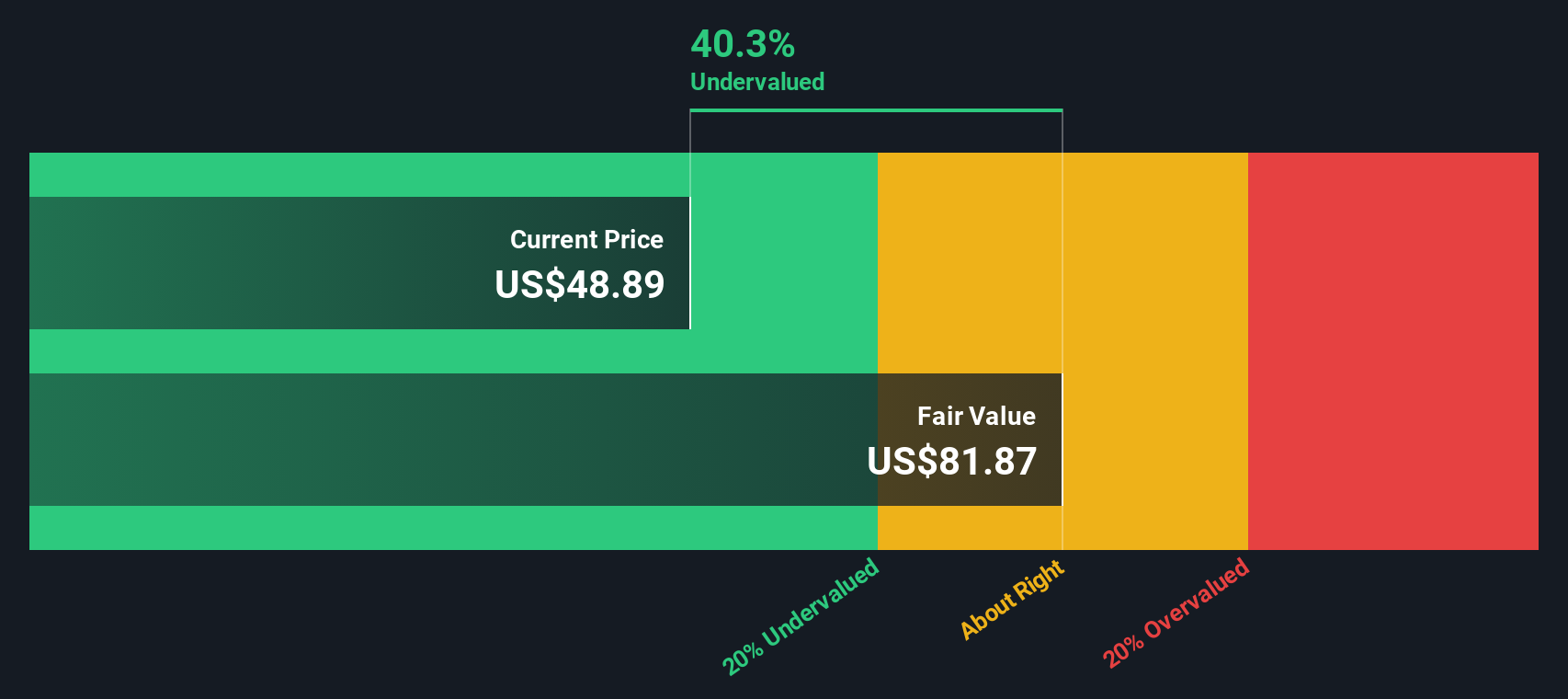

While the market's current price puts CECO Environmental just above analysts' fair value, our DCF model paints a different picture. It estimates the company's fair value at $81.85, which may indicate shares are trading at a significant discount. Does this suggest a hidden opportunity, or is the market wary for a reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CECO Environmental Narrative

If you want to dig into the details or form your own perspective, you can assemble your own data-driven narrative in under three minutes, and Do it your way

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Ways to Level Up Your Portfolio?

Smart investing is about staying a step ahead. Use these hand-picked ideas to spot fresh opportunities you’ll be glad you didn’t miss.

- Get ahead of industry transformation by reviewing these 27 AI penny stocks and see which companies are gaining the most momentum from rapid advances in artificial intelligence.

- Amplify your passive income streams by checking out these 19 dividend stocks with yields > 3%, which showcases established businesses offering yields above 3% for steady returns.

- Capitalize on mispriced opportunities by browsing these 870 undervalued stocks based on cash flows, supported by strong cash flows, and pinpoint hidden gems the market has overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives