- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

Can CECO Environmental (CECO) Sustain Its Profitability Edge Amid Rising Market Share and Sector Outperformance?

Reviewed by Sasha Jovanovic

- Earlier this week, CECO Environmental was highlighted for its strong operational performance, with recent analysis showing robust annual revenue growth, rising market share, and gains in profitability and efficiency.

- A unique detail is that CECO's returns on equity and competitive valuation metrics have supported its resilience and helped it outperform the S&P 500 over three and five years.

- Now, we will examine how CECO's improved profitability and sector outperformance impact the company’s overall investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

CECO Environmental Investment Narrative Recap

To be a CECO Environmental shareholder, you need to believe that sustained demand for cleaner industrial solutions, ongoing international expansion, and operational improvements can drive consistent growth despite rising debt and investment costs. This week’s recognition of CECO’s profitability and efficiency supports near-term optimism, but does not significantly change the main short-term catalyst: upcoming Q3 results. The most important risk, pressure on net margins if revenue slows against elevated expenses and leverage, remains unchanged.

Among recent developments, CECO’s raised 2025 revenue guidance stands out most, with management now projecting US$725 million to US$775 million. This revised outlook underlines confidence in demand trends ahead of the Q3 earnings announcement, which is widely seen as the next catalyst for the stock.

However, investors should also be alert to the risk that persistently higher operating costs and growing debt may weigh on profitability if revenue momentum does not hold up…

Read the full narrative on CECO Environmental (it's free!)

CECO Environmental's outlook anticipates $977.2 million in revenue and $54.5 million in earnings by 2028. This scenario is based on a forecast 14.2% annual revenue growth rate and a $2.0 million earnings increase from the current $52.5 million.

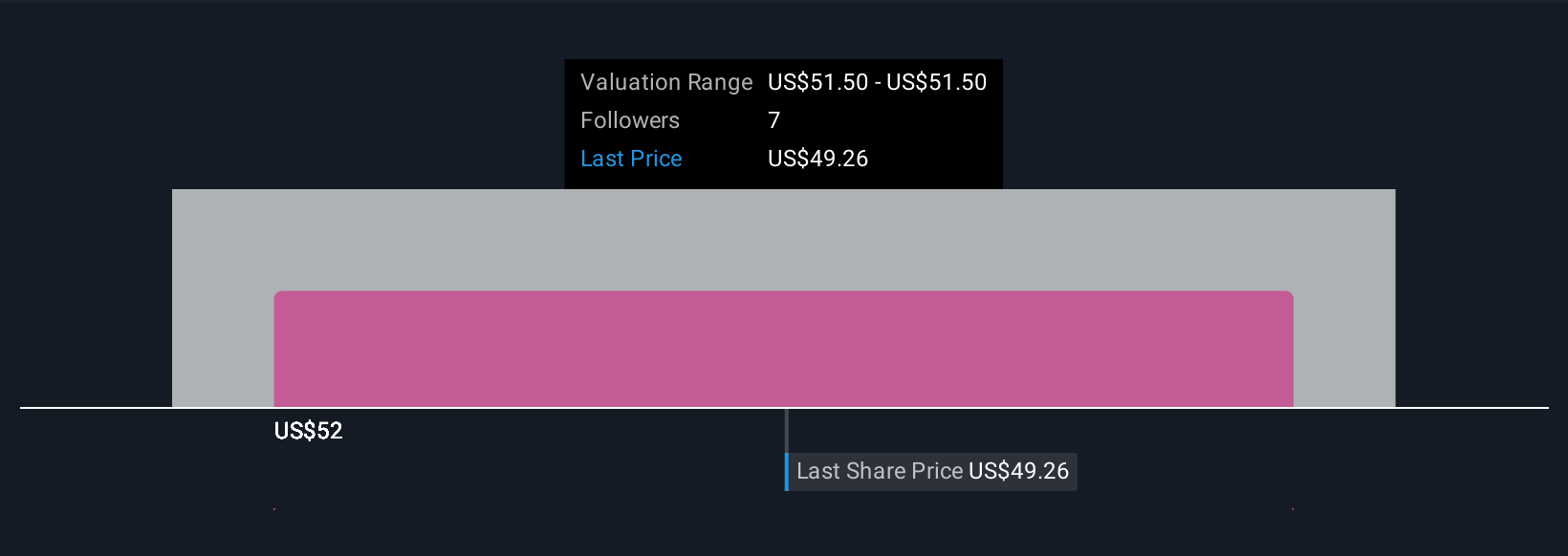

Uncover how CECO Environmental's forecasts yield a $53.00 fair value, in line with its current price.

Exploring Other Perspectives

All fair value estimates from the Simply Wall St Community stand at US$53, based on one contributor. While many are optimistic about a large backlog supporting future growth, views on the impact of expense management differ, see how other investors interpret these catalysts and risks.

Explore another fair value estimate on CECO Environmental - why the stock might be worth just $53.00!

Build Your Own CECO Environmental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CECO Environmental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CECO Environmental's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives