- United States

- /

- Professional Services

- /

- NasdaqGS:BBSI

Will BBSI’s Dallas Expansion Reveal the True Strength of Its Hands-On Growth Strategy?

Reviewed by Simply Wall St

- Barrett Business Services recently opened a new physical branch location in Dallas, TX, reinforcing its commitment to serve the North Texas business community with payroll, HR, and risk management services.

- This move signals the company’s intention to enhance its hands-on support model by establishing a direct, local presence in a high-growth region.

- We’ll examine how the launch of a Dallas branch shapes the narrative around BBSI’s ongoing market expansion and growth strategy.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Barrett Business Services Investment Narrative Recap

To be a Barrett Business Services shareholder, you need to believe in the ongoing expansion of its physical and asset-light branch model as a driver for scalable growth, especially as the company works to boost its presence in high-potential regions like Dallas-Fort Worth. The Dallas branch opening aligns directly with BBSI’s market expansion catalyst but is unlikely to materially shift the most pressing short-term risk: margin pressure from continued softness in workers’ compensation pricing and regional billings disparities. Investors watching closely for updates on regional performance and risk pricing may find limited immediate impact from this event, but it could set the stage for longer-term growth.

Among recent announcements, BBSI’s guidance for 7% to 9% gross billings growth in 2025 stands out as particularly relevant to the Dallas launch and broader expansion efforts. This growth outlook is tied to the company’s ability to successfully execute local support initiatives, like the new Dallas office, despite existing risks in regional performance and margin pressures that could affect the pace or stability of those gains.

However, while new market entries offer a growth narrative, investors should be aware that persistent downward pricing in workers’ compensation rates presents...

Read the full narrative on Barrett Business Services (it's free!)

Barrett Business Services' narrative projects $1.4 billion revenue and $71.7 million earnings by 2028. This requires 7.0% yearly revenue growth and a $19.6 million earnings increase from $52.1 million today.

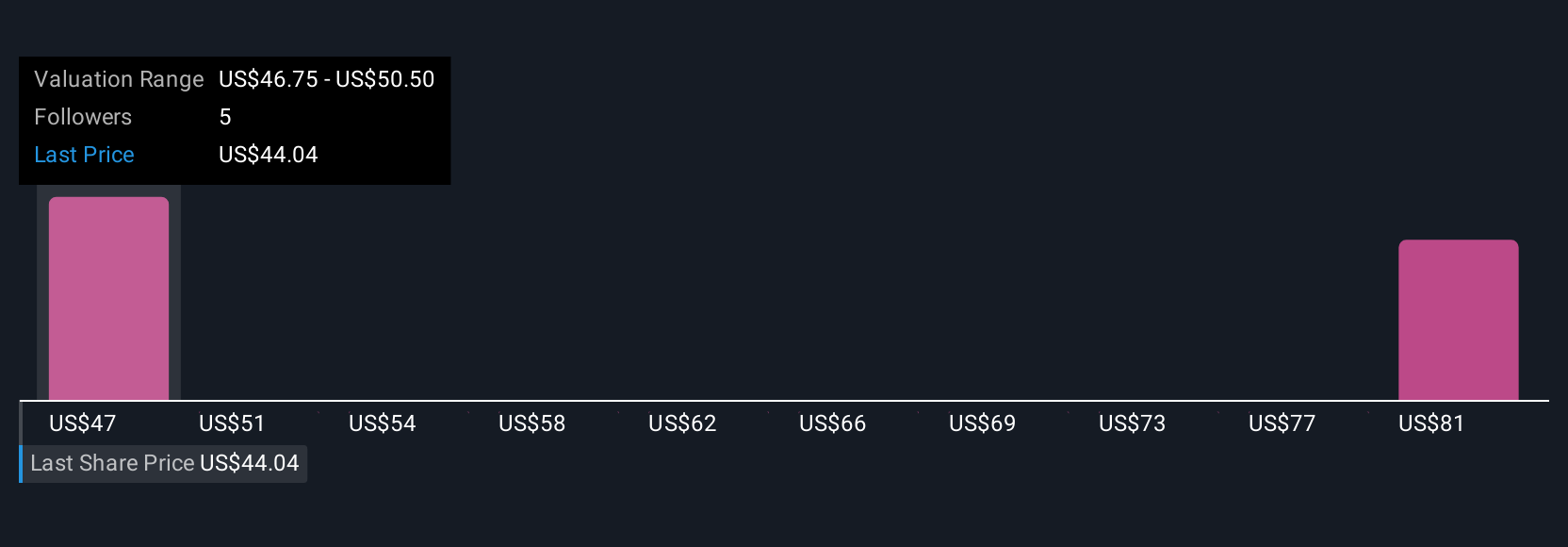

Uncover how Barrett Business Services' forecasts yield a $46.75 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community users estimate fair value for BBSI between US$46.75 and US$83.23 based on 2 analyses. While expansion in Dallas aligns with growth catalysts, softness in regional billings remains a focus for many investors seeking alternative viewpoints.

Explore 2 other fair value estimates on Barrett Business Services - why the stock might be worth just $46.75!

Build Your Own Barrett Business Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barrett Business Services research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Barrett Business Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barrett Business Services' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrett Business Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBSI

Barrett Business Services

Provides business management solutions for small and mid-sized companies in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives