- United States

- /

- Professional Services

- /

- NasdaqGS:BBSI

Some Confidence Is Lacking In Barrett Business Services, Inc.'s (NASDAQ:BBSI) P/E

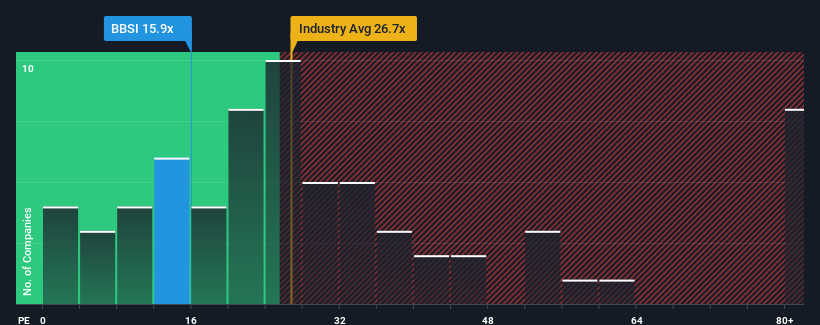

With a median price-to-earnings (or "P/E") ratio of close to 16x in the United States, you could be forgiven for feeling indifferent about Barrett Business Services, Inc.'s (NASDAQ:BBSI) P/E ratio of 15.9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Barrett Business Services as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Barrett Business Services

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Barrett Business Services' to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. The latest three year period has also seen an excellent 72% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 1.8% as estimated by the four analysts watching the company. With the market predicted to deliver 12% growth , the company is positioned for a weaker earnings result.

In light of this, it's curious that Barrett Business Services' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Barrett Business Services' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Barrett Business Services' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Barrett Business Services with six simple checks.

If you're unsure about the strength of Barrett Business Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Barrett Business Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BBSI

Barrett Business Services

Provides business management solutions for small and mid-sized companies in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives